New developments in Brazil’s cement industry

The growth in demand for cement in Brazil exceeds economic growth, although the rate at which it is growing has lost momentum. However, cement producers are investing heavily in new capacity. This market review highlights the latest developments.

1 Introduction

Over the last decade income inequality in Brazil has dropped significantly. An estimated 40 million people were pulled out of poverty. Fast growth of the middle class now drives private consumption. At about 5 % the unemployment rate is at record lows and real wages are still rising. However, inflation is still almost 6 % in spite of Brazil’s Central Bank (BCB) raising the interest rate from 7.5 % to 10.75 % since May last year. The Real, the local currency, has lost 17 % against the US Dollar since May and the BRL/USD exchange rate is now 2.36. External and fiscal accounts have...

1 Introduction

Over the last decade income inequality in Brazil has dropped significantly. An estimated 40 million people were pulled out of poverty. Fast growth of the middle class now drives private consumption. At about 5 % the unemployment rate is at record lows and real wages are still rising. However, inflation is still almost 6 % in spite of Brazil’s Central Bank (BCB) raising the interest rate from 7.5 % to 10.75 % since May last year. The Real, the local currency, has lost 17 % against the US Dollar since May and the BRL/USD exchange rate is now 2.36. External and fiscal accounts have worsened with the current account deficit reaching 3.7 % of GDP in 2013 and the public sector’s primary budget surplus reaching 1.9 % of GDP, although the country is committed to a surplus of 2.3 %.

Brazil’s economic growth has lost momentum. Figure 1 shows the GDP growth of Brazil in comparison to the world economy, the USA, Euro Zone and Latin America. The outlook for the largest economy in Latin America is still at a low level when the forecast of the International Monetary Fund (IMF) is taken as a base. According to the IMF the GDP is only expected to grow by 2,3 % in 2014 and 2015. The BCB is even more pessimistic with a GDP growth forecast for Brazil of 1.8 % in 2014 and 2.1 % in 2015. The drop in investments and industrial production as well as the deteriorating economic situation in Argentina are regarded as having a major impact on Brazil’s economic growth. On the other hand Brazil is very dependent on its exports of raw materials and other commodities. When the global demand booms, Brazil’s economy will improve.

2 Construction development

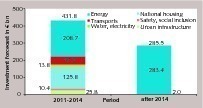

In 2010, the former President of Brazil unveiled an infrastructure investment package worth R$ 1.59 trillion, or about 717 billion Euros. The growth acceleration programme, known as the PAC 2 plan foresees investment of up to R$ 959 billion in areas such as energy, transportation (highways, railways, ports, airports), urban infrastructure, housing, water, sanitation and access to electricity in the period 2010 to 2014 and investments of R$ 632 billion from 2014 onwards. The programme was initiated after the successful PAC 1 plan, which ran from 2007 to 2010 and Brazil’s nomination to host the 2014 FIFA World Cup and 2016 Summer Olympic Games. These two major sporting events will showcase Brazil’s strength and efforts to the rest of the world.

By December 2013 a total of R$ 773.4 billion had been invested under PAC 2, or 76.1 % of the budget, allocated for 2010 to 2014. In the energy sector which predicts major spending (Fig. 2) a new generation capacity of 10 200 MW has been achieved, mainly from the Jirau (3750 MW) and Santo Antonio (3150 MW) hydroelectric projects. Additionally more than 9800 km of transmission lines and 32 new substations were added to the national grid.

In the oil & gas upstream and downstream sectors 26 projects such as seismic assessment, drilling and platform construction were completed. The new refinery in Pernambuco is now 84 % complete, and the petrochemical complex of Rio de Janeiro (Comperj) is 66 % complete.

Investment in the national housing programme “Minha Casa, Minha Vida = MCMV” reached R$ 328.1 billion in 2013. 1.51 million housing units were finished, from which more than 5 million inhabitants could benefit. A further 3.24 million housing units are contracted, of which 2.24 million are part of the PAC 2 plan. As of the 2010 census, Brazil had a housing deficit of 5.8 million. The Government estimates that the current and future demand will increase to 23 million units in the next ten years, so to catch up with demand 2.3 million units have to be completed each year. Figure 3 shows the number of housing units that were financed in the last few years. Most loans are provided under the MCMV-programme by the Brazilian System of Savings and Loans (SBPE) and Redundancy Compensation Fund for Employees (FGTS).

Within the urban infrastructure programme seven major mobility projects were finished by 2013. These projects include the Sao Leopoldo-Novo Hamburgo and the Salvador light rails, the elevated train system in Porto Alegre, the Boulevard bypass in Belo Horizonte and the West and South lines of Fortaleza subway. Work in progress includes 16 rapid bus transit projects among others.

Also in the sector 2877 sanitation projects from PAC 2 and another 3398 urban improvement projects from PAC 1 were completed. About 7.6 million families benefited from the projects. One highlight is the expansion of the sewage system in Baixada Santista (SP), which is used by 400 000 families. Another 4128 sanitation projects have been selected for completion, of which 54 % have been approved and will start early in 2014.

In the transportation sector under PAC 2 about 3080 km of highways were completed throughout the country, while work is in process for another 6915 km, of which 2548 km are extensions and modernisations and 4367 km are roads being built or paved. Additionally, 639 km of railways were finished including the 84 km extension of the Ferronorte line between Rondonopolis and Alto Araguaia.

The ports programme saw the completion of 21 projects, including projects in Port of Recife, Port of Sao Francisco de Sul, Port of Santos and Port of Vitoria. With the completion of 22 airport projects Brazil has increased its passenger handling capacity by 15 million per year. It should be noted that the four airports in Sao Goncalo do Amarente, Guarulhos in Sao Paulo, Campinas and Brasilia have increased their capacity from 49.2 million in 2011 to 81.2 million in 2014.

Brazil’s house prices rose substantially over the last few years, especially in Sao Paulo and Rio de Janeiro, the two major cities. From 2009 to 2012 prices almost tripled and increased by 25 % per year. Also real estate loans have continued to grow fast. At the end of 2012 outstanding loans reached R$ 300 billion, corresponding to 6.9 % of GDP.

3 Cement market developement

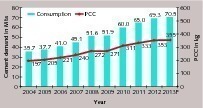

Since 1970 Brazil’s cement industry has undergone periods of rapid expansion, stagnation and decline [1]. In the 1970’s the cement production substantially increased from 9.0 million tons per year (Mta) to 27.2 Mta 1980. In 1985 the production stood at 20.6 Mta and in 1995 a new peak of 28.3 Mta was achieved. The year 2000 saw a new peak with 39.9 Mta, after that the production declined to 35.1 Mta in 2003. 2004 saw a steady increase in the cement production (Fig. 4), except for a decline in 2009, due to the global financial crisis. In 2010 cement production increased by a compound annual growth rate of 14.3 %, but since then annual growth has declined to 1.9 % in 2013.

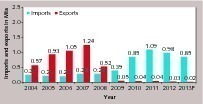

Figure 5 shows the development of cement consumption, which goes almost in line with cement production and nearly doubled from 35.7 Mta in 2007 to 70.5 Mta in 2013, according to the National Union of the Cement Industry (SNIC). Brazil’s per capita cement consumption climbed from 197 kg to 355 kg last year. At the moment Brazil has a population of nearly 200 million, the annual population growth rate is 1.3 %. Cement imports and exports are relatively small (Fig. 6). Until 2008 exports were larger than imports and now exports stand at 0.02 Mta, while imports (incl. white cement) increased to more than 1 Mta in 2009. In 2012 the main imports were from Cuba (0.261 Mta), Turkey (0.188 Mta), Spain, and Vietnam (0.121 Mta, each) and Portugal (0.097 Mta). About 77 % of the imports were made by the North and North East regions.

Interestingly, in Brazil cement dispatch is mainly provided via trucks (96 %), which is in line with the relatively small imports and exports. Rail transports only account for 3 % and ship transports for 1 %. In 2012 67 % of dispatch was in bagged form, while the bulk transports increased to 33 %. It also has to be noted that retail sales still dominate the market with 55 %.

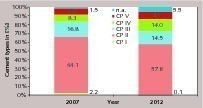

Although there are eight different base cement types there are only five major cement types, similar to the EN 197-1 EU Standard. Ordinary Portland Cements (CP I) are practically negligible with a market share of less than 1 % (Fig. 7). CP II Composite Portland Cements have become the main type with nearly 60 %, while Blast Furnace Portland cements (CP III) lost market shares and CP IV and CP V cement types also gained some market share.

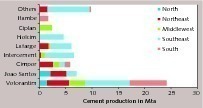

For a more detailed review Brazil is divided into five regions: North, North East, Middle West, South East and South. In 2012 about 48.9 % of the cement was dispatched to the South East, 19.9 % to the North East, 14.6 % to the South, 11.3 % to the Middle East and finally only 5.3 % to the North. Figure 8 shows how the SNIC member companies participated in 2012 with regional dispatch. Votorantim was responsible for 35.4 %, with leading market positions in all regions except the North. Joao Santos ranked second with 10.4 %, followed by Intercem (9.6 %), Lafarge (8.9 %), Cimpor (8.6 %) and Holcim (6.8 %).

4 Cement plants and producers

The first cement plants were established in Brazil in the 1930s. Over the years the capacity development had ups and downs with periods of rapid expansion and large overcapacities [2]. At present there are 15 cement producers in Brazil operating 84 plants, of which 56 are integrated and 28 are separate grinding plants with a combined cement production capacity of 83.2 Mta or almost 1.0 Mta per plant (base 31.12.2013). When taking the 2013 cement production of 70.1 Mta the average utilisation of the capacity has been 84.3 % which in relation to the global average is a high figure.

Table 1 shows a breakdown of plants and capacities of major suppliers. Market leader with a capacity of 31.3 Mta or a 37.6 % share of the installed capacity is Votorantim Cimentos. In Brazil the company operates 17 integrated plants (Fig. 9) and eleven grinding plants together with 110 concrete plants, 28 aggregate plants and eight mortar plants. In 2012 the company made an asset swap related to the 21.21 % stake in Cimpor, which gained Votorantim assets in seven more countries: Spain, India, China, Turkey, Morocco, Tunisia and Peru. With five cement plants and two grinding plants from a former acquisition in Canada and the USA, the company now has 35 integrated cement and 22 grinding plants worldwide, with a combined capacity of 53.2 Mta.

With the positive outlook for housing and infrastructure projects the management of Votorantim decided in 2010 on an investment plan to increase the cement production capacity in Brazil. In 2011 5.2 Mta of new capacity were added with new production plants in Poty Paulista (PE), Sepetiba (RJ), Imbituba (SC), Vidal Ramos (SC) Sao Luis (MA) and in Salto (SP). One of the latest additions in 2013 was the inauguration of the 1.2 Mta cement plant (Fig. 10) in Cuiaba in Mato Grosso (MT). Three other new plants in Rio Branco (PR), Edealina (GO) and Primavera (PA) with a combined capacity of 4.6 Mta will become operational soon. The recent start-ups coupled with an improved distribution network resulted in a sales volume growth of 7 % y-o-y, while the Brazilian cement market increased with less than 2 %.

Second and third in ranking are InterCement and João Santos. The acquisition of Cimpor Cimentos do Brasil by InterCement Holding was agreed in 2012. InterCement now has 17.9 Mta of cement capacity in Brazil from ten integrated plants (Fig. 11) and six grinding plants. Furthermore InterCement has cement assets in Argentina (Loma Negra), Cap Verde, Egypt, Mozambique, Paraguay, Portugal and South Africa, in total 40 plants with a combined capacity of 38 Mta. With the integration of the Cimpor cement trading structure Intercem was able to increase the trading volume by 30 % in 2012. Third in ranking is João Santos Cimentos, which is part of the privately owned Brazilian Nassau Group. The company has a cement capacity of 8.7 Mta from its ten plants and has been a target of cement majors around the world.

Lafarge and Holcim, the leading global cement majors, are Number 3 and 4 by capacity. Lafarge has 7.1 Mta capacity from five integrated (Fig. 12) and three grinding plants. Lafarge began its operations in Brazil in 1959. In 2013 despite the growth in the cement market, Lafarge’s cement dispatch volume decreased by 0.4 %, but because of price and other effects sales value increased by 2.5 %. In general cement prices in Brazil increased by 3 % from 3 Q 2012 to 3 Q 2013. Holcim, the other multinational, has been in Brazil since 1951 and now has a cement capacity of 5.4 Mta from three integrated and two grinding plants which gives them a market share of 6.5 %. In 2007 the cement plant in Sorocaba (SP) was reactivated as a grinding plant after clinker production was terminated in 2002. In 2000 the capacity of the Cantagolo (RJ) plant was upgraded to 1.2 Mta.

The other cement producers in Brazil consist of a number of local companies, including Cimento Itambe, Ciplan, Apodi, Brennand Cimentos, Cimentos Liz (former Soeicom), CSN (Compania Siderurgica National), Cimento Tupi (CP Cimentos), Mizu, SP CIM and Supremo Cimentos. Cimento Itambé operates one plant (Fig. 13) with three kiln lines and a capacity of 2.8 Mta. Ciplan operates one integrated plant in Sobradinho (DF). Cimento Tupi operates three plants, one of which is the integrated cement plant (Fig. 14) in Pedra do Sina (MG). Mizu operates four plants, of which two are grinding plants. A 3000 tpd kiln was installed in 2012 by the Chinese CNBM. CSN entered the market in 2009 with a grinding plant for slag and a clinker plant in Argos (MG), now having 1.8 Mta in capacity.

In January 2014, six cement manufacturers were accused by Brazil’s antitrust watchdog CADE of price fixing from 1986 to 2007. The companies Holcim, Cimpor, Votorantim, Camargo Correa (Intercem), Itabira and Cimento Itambé have been accused of forming a cement cartel and could be fined US$ 1.3 billion and forced to sell assets. More significant than the fine is the proposal that the companies must cut their installed capacity by 22-35 %, which will apply to Votorantim (35 %), Intercement (25 %) and Holcim (22 %). Cimento Itambé would not have to reduce its capacity. In statements, the companies involved said they act accordingly with the law and practice free competition in their markets. Accordingly the companies will fight any decisions by CADE, which could take years.

5 Expansion projects

In Brazil as in most other countries more cement projects are announced than later implemented. However the project list 2014-2016 looks very serious because mostly it covers established cement producers with a few from some newcomers. There are 20 projects with a combined new cement capacity of 24 Mta (Tab. 2). If only 80 % of the projects are implemented, then 19.2 Mta of new capacity will be operational by the end of 2016. Figure 15 shows a breakdown of the capacity additions by year, if fully implemented. Almost 20 Mta or 83 % of the capacity is scheduled to be installed by the 1H 2015. In total there are eight projects for 9.35 Mta of new plants, nine projects for 12.2 Mta for new lines and only three grinding projects with a capacity of 2.45 Mta. Six projects are in the Paraiba State (PB), which could become the second largest cement base after Minas Gerais (MG).

Votorantim has announced five new projects, combining 6.5 Mta, of which one is a new plant and four are new lines in existing plants. InterCement announced five projects with a combined new cement capacity of 4.8 Mta. Two new plants are planned, two new kiln lines and one grinding project. Lafarge announced two projects with a capacity of 2.25 Mta. One is a new kiln line and one is a grinding project. This project was inaugurated in February 2014 with an investment of 70 million GBP. In the first year production will be 0.5 Mta, in the second year 0.75 Mta. Clinker will be supplied from Lafarge’s Cantagalo plant. In total Lafarge will spend about US$ 500 million on its Brazilian cement expansion by 2018.

6 Outlook

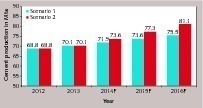

Figure 16 provides an outlook for the cement production until 2016 with a 2.5 % and 5.0 % annual growth scenario. In Scenario 1 the cement production will increase from 70.1 Mta in 2013 to 75.5 Mta in 2016, while in Scenario 2 cement production will increase to 81.1 Mta. When taking 80 % of the new capacity additions into account the cement capacity will increase from 83.2 Mta in 2013 to 102.4 Mta in 2016 (Fig. 17). The figure depicts how cement capacity utilisation will develop with the new capacity from the two production scenarios. Taking Scenario 1 the utilisation will decline from 84.3 % in 2013 to 73.7 % in 2016, in Scenario 2 the utilisation will decline to 77.5 % in 2015 and later increase again to 79.2 % by 2016.

It is not very likely, that CADE will be successful in its attempt to cut the capacities of the major cement producers Votorantim, InterCement and Holcim, unless foreign producers such as Cemex, HeidelbergCement, Italcementi or so are invited to take over Brazilian cement assets. But if this happens, it will definitely be a new development in the global cement industry. So not only are the results of the FIFA world cup and the Olympic Games going to be interesting, but also is the future of the cement industry itself.

Überschrift Bezahlschranke (EN)

tab ZKG KOMBI EN

This is a trial offer for programming testing only. It does not entitle you to a valid subscription and is intended purely for testing purposes. Please do not follow this process.

This is a trial offer for programming testing only. It does not entitle you to a valid subscription and is intended purely for testing purposes. Please do not follow this process.

tab ZKG KOMBI Study test

This is a trial offer for programming testing only. It does not entitle you to a valid subscription and is intended purely for testing purposes. Please do not follow this process.

This is a trial offer for programming testing only. It does not entitle you to a valid subscription and is intended purely for testing purposes. Please do not follow this process.