Focus on Latin American cement markets

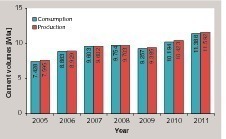

Source/Quelle: SNIC, www.CEMfocus.com

Source/Quelle: SNIC, www.CEMfocus.com

Source/Quelle: SNIC, www.CEMfocus.com

Source/Quelle: SNIC, www.CEMfocus.com

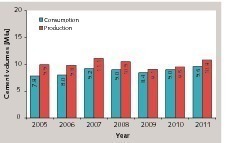

Source/Quelle: Canacem, www.CEMfocus.com

Source/Quelle: Canacem, www.CEMfocus.com

Source/Quelle: www.CEMfocus.com

Source/Quelle: www.CEMfocus.com

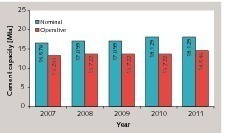

Source/Quelle: AFCP, www.CEMfocus.com

Source/Quelle: AFCP, www.CEMfocus.com

Source/Quelle: AFCP, www.CEMfocus.com

Source/Quelle: AFCP, www.CEMfocus.com

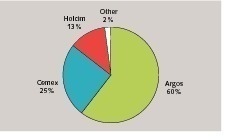

Source/Quelle: ICPC, www.CEMfocus.com

Source/Quelle: ICPC, www.CEMfocus.com

Source/Quelle: www.CEMfocus.com

Source/Quelle: www.CEMfocus.com

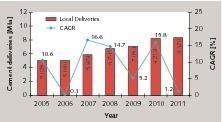

Source/Quelle:asocem, www.CEMfocus.com

Source/Quelle:asocem, www.CEMfocus.com

Source/Quelle: asocem, www.CEMfocus.com

Source/Quelle: asocem, www.CEMfocus.com

Source/Quelle: www.CEMfocus.com

Source/Quelle: www.CEMfocus.com

Many cement markets in Latin America are booming and production capacities are being expanded. This market report identifies the current developments, discusses the focus countries Mexico, Brazil, Argentina, Columbia and Peru and provides an overview of the TOP 10 cement producers in the region.

1 Introduction

1 Introduction

In 2011, Latin America benefited from direct investments of around US$ 153.5 billion. The largest investments went to Brazil (US$ 66.7 bn), Mexico (US$ 19.4 bn), Chile (US$ 17.3 bn), Columbia (US$ 13.2 bn), Peru (US$ 7.7 bn) and Argentina (US$ 7.2 bn). Seen regionally, South America received US$ 121.3 bn of direct investments in 2011, while Mexico and the other Central American countries received US$ 27.7 bn and the Caribbean countries received US$ 4.4 bn. While the 2011 investments in South America and Central Ameri-ca both exceeded the 2010 figure by 36 %, the increase in the amount received by the Caribbean countries only increased by 20 %. All in all, 10 % of worldwide direct investments went to Latin America. The “Economic Commission for Latin America and the Caribbean” (ECLAC) expects a consistently high level of investment for 2012. Many countries will thus be able to compensate their debit balance of payments on current account with their intake of foreign capital.

2 Overview of the cement industry

Table 1 provides an overview of the cement markets in the Latin American region – incl. Caribbean countries – and the TOP 5 cement countries Brazil, Mexico, Argentina, Columbia and Peru. The TOP 5 countries are home to 72 % of the overall population. As regards the cement production and cement consumption of 170 Mta each (figures for 2011), the TOP 5 account for 77 % and 76 % respectively. The Latin American region has a total cement capacity of 240 Mta at 225 cement plants (incl. separate grinding plants), which means that an average plant utilization rate of 71 % is achieved. Exports and imports are approximately equal at 3.9 and 4.3 Mta respectively. However, one conspicuous feature is the relatively high percentage of exports and relatively low percentage of imports accounted for by the TOP 5. Brazil has developed into by far the biggest cement market of the region, followed by Mexico, Argentina, Columbia and Peru. Venezuela has fallen back in comparison to the last market report covering this region [1].

3 Overview of the countries

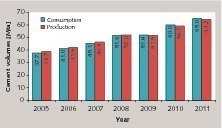

According to the latest data for 2011, there are 14 cement producers in Brazil, who own a total of 82 cement plants, of which around 25 are separate grinding plants. The country’s cement production capacity is currently about 80 Mta, which – at a cement production rate of 64.2 Mta (2011) – corresponds to a high capacity utilization rate of 80 %. It is worth noting in this connection that the monthly fluctuation in production rate is between 4.631 Mta (Jan. 2011) and 5.911 Mta (Oct. 2011), which represents a maximum difference of 27.6 %. Brazil’s cement exports have decreased from 1.2 Mta in 2007 to less than 0.05 Mta in 2011. The country’s imports fell from 1.2 Mta in 2007 to 0.4 Mta by 2009, but have meanwhile risen again to 0.8 Mta. In November 2011 a cartel investigation report that had been pending since 2006 was submitted to the Brazilian Ministry of Justice (SDE). This accused leading cement producers, cement associations and various managers of unfair practices.

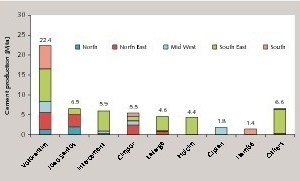

Figure 2 provides the 2010 cement production figures of the leading cement producers by region. Votorantim has a clear market leading position with a market share of 38 %, followed by João Santos with 11 %, Intercement (10 %), Cimpor (9 %), Lafarge (8 %) and Holcim (7 %). Votorantim has its largest market share in the southern region with 69 %, João Santos in der northern region with 60 % and Intercement in the south-eastern region with 17 %. Intercement purchased Cimpor’s Brazilian shares in 2012 and will thus improve its market position, especially in the north-eastern region (+22 %), mid-west (+17 %) and south (+11 %). Compared with its 2010 production figures, the company will thus have a market share of maximum 27 % in the western region. This will still be far lower than Votorantim’s market share, which is 43 % in that region. Votorantim is so far also the only company that is represented in every region. Cimpor is active in 4 regions, João Santos, Intercement and Lafarge in 3 each and the other companies in only 1 region.

Votorantim Cementos owns a total of 17 plants (Fig. 3) in Brazil. The company has a global cement production capacity of 42 Mta at 22 cement plants and separate grinding plants, which was expanded by 15 Mta in 2012 by taking over Cimpor’s assets outside of Brazil. In 2011, Votorantim expanded its production capacity in Brazil by 5.2 Mta. It opened new plants/cement production lines in Poty, Sepetiba, Imbituba, Vidal Ramos, São Luís and Salto/Santa Helena (Fig. 4). In 2012 and 2013, the company is building new facilities and expanding its plants in Cuiaba, Rio Branco, Edealina and Primevera to increase its cement production capacity in Brazil by a further 5.8 Mta. By so doing, Votorantim’s intention is to further improve its market position in Brazil and to shorten the distribution routes to its customers. The company’s medium term aim is to catch up with the 5 global leaders in the building materials business. In 2002, Votorantim already achieved a clinker factor of less than 70 %, but this had again risen to 76 % by 2007. The figure has meanwhile decreased to 74 %.

Other capacity expansion projects are being realized by Cimpor, Holcim, Cementos Liz (Soeicom), the steel producer CSN and newcomer Supremo Cemento. Cimpor has awarded FLSmidth orders for a 1.45 Mta greenfield cement plant in Caxitu and a new production line at the Cezarina plant. Fives FCB is constructing a new 4,500 tpd plant for Holcim in Barroso. Cementos Liz awarded KHD Humboldt Wedag an order for a 5000 tpd production line. CSN is also planning to add two further lines to its Arcos plant. Supremo Cimentos has contracted FLSmidth to construct a further line at the Adrianopolis cement plant. These projects will raise cement production capacity in Brazil to around 90 Mta by 2014. For a capacity utilization rate of 75 %, the cement production rate would have to rise from the present 64.2 Mta to 67.5 Mta, which will be no problem with the present rate of growth. It is even conceivable that a production figure of 72 Mta and a utilization rate of 80 % could be achieved.

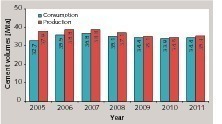

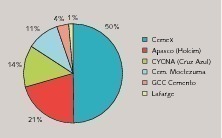

Approximately 1.0 Mta of cement are exported. Of this, only 0.37 Mta go to the USA. Despite the slump in cement production, plant capacities have been greatly expanded in recent years, rising from 50.5 Mta to 58.9 Mta in the period 2007 to 2011. During this space of time, the plant utilization rate decreased from 76 % to the low figure of 60 %. Figure 6 shows the market shares by cement production capacity. The market leader with around 50 % and a capacity of 29.3 Mta is Cemex, followed by Holcim (Apasco), which has a capacity of 12.2 Mta and Cementos Y Concretos Nacionales (CYCNA or Cooperativa La Cruz Azul) with a capacity of 8.0 Mta. The fourth to sixth places are taken by Cementos Moctezuma, the owner of Buzzi Unicem and Cementos Molins with 6.3 Mta, GCC Cemento (Grupo Cementos de Chihuahua) with 2.3 Mta and finally Lafarge with a capacity of only 0.8 Mta. This means that European cement producers have 1/3 of the cement production capacity with their total of 32.8 Mta while Mexican producers have 2/3.

Cemex wholly owns 15 cement plants in Mexico and has a minority share in three others. The company’s main factory and administrative headquarters are located in Monterrey (Fig. 7). The company ran into difficulties due to the global economic crisis and in 2009 had to draw up and sign a financial plan for consolidation and debt reduction together with its creditors. Meanwhile, the company has paid off more than half of its approx. US$ 15 bn debt of that time, is back on an even keel and on course for growth. The cost-cutting measures imposed by the company have also had several positive effects. For instance, the alternative fuel usage rate was increased from 8 % in 2007 to as much as 25 % in 2011. By 2015, the company intends to achieve an alternative fuel rate of 35 %. Moreover, a reduction of the clinker factor, together with other intro-duced measures, has reduced the specific CO2 emission by 23 % since 1990.

The second-ranked company Holcim Apasco owns seven plants (including 1 separate grinding plant). In 2010, a new cement production plant (Fig. 8) with a capacity of 1.5 Mta was put into service at Hermosillo. The equipment supplier was Fives FCB, who have meanwhile established a service centre in Mexico. CYCNA owns four cement factories of which the Hidalgo and Tepezalá plants each have a production capacity of 3.0 Mta. Cementos Moctezuma now operates three cement factories, having commissioned a 1.3 Mta plant in Apazapan in 2010. GCC Cemento also owns three facilities, one of which is a separate grinding plant. Lafarge has built a second plant in Tula for 0.6 Mta, but this has only slightly increased the company’s production capacity. In addition, two independent companies operate slag grinding plants with a total capacity of 1.3 Mta. The cement industry is largely concentrated in the central federal states of Hidalgo, Estado de Mexico and Puebla, where 10 of the currently existent 33 plants are located.

Like the cement consumption, Argentina’s cement production is also concentrated on Buenos Aires and Pampeana, as well as the north-western area of the country. In Patagonia, the far south of the country, there are only two cement plants. At present, there is still a large disparity between the nominal and the operative cement production capacities (Fig. 10). The difference between the two increased from 3.3 Mta in 2007 to 3.6 Mta in 2011. Referred to the operative capacity, the capacity utilization rate is 79 %. The market leader with an operative capacity of 6.3 Mta at a total of 8 cement plants (Fig. 11) is Loma Negra (Camargo Corrêa or Intercement), followed by Cementos Minetti (Holcim) with 4.6 Mta at 5 plants (one of which is a separate grinding plant), Cementos Avellaneda with 2.8 Mta at 2 plants (which belong to Cementos Molins) and the newcomer PCR (Petroquimica) with 0.9 Mta at 2 plants.

The current cement production capacity in Columbia is 16.6 Mta. Based on the 2011 production output of 11.6 Mta, the capacity utilization rate is 70 %. A total of five cement producers are present on the market (Fig. 13). The market leader with an installed capacity of 10.0 Mta at nine integrated cement plants (Fig. 14) and one separate grinding plant is Argos. This company owns four export harbours and a ready-mix concrete production capacity of 3.5 million m3 with 53 plants. In May 2011, Argos took over cement production capacities of 3.2 Mta in the south-east USA from Lafarge North America. In 2009 the company had already taken over cement assets in der Caribbean from Holcim. Cemex ranks second in Columbia with 4.2 Mta at two cement plants, Holcim is in third place with a cement production capacity of 2.1 Mta at the Nobsa plant and the two plants of Cementos Tequendama and Cementos del Oriente with their total of 0.33 Mta.

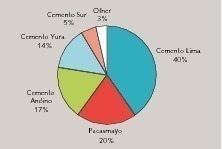

In 2011, the installed clinker capacity was 8.6 Mta and the cement production capacity was 13.0 Mta, which means that a capacity utilization rate of 65 % was achieved. Figure 16 shows the shares of the most important companies in the country’s overall production output. The market leader is Cemento Lima (Fig. 17) with a market share of 40 %, followed by Cemento Pacasmayo and Cemento Andino with 17 %. Cemento Yura and Cemento Sur, which are both members of Grupo Gloria, together achieve a 19 % market share. In July 2012 the shareholders of Cemento Lima and Cemento Andino decided to merge the two companies in October this year under the name Union Andina de Cimentos. This will extend the market leading position to 57 %. FLSmidth has received several orders from the two companies for plant modernizations and the construction of new cement production plants. Cemento Yura is also planning to nearly double its plant capacities by 2016.

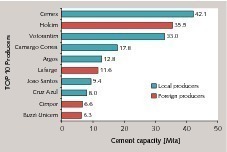

4 TOP 10 cement producers in the region

Cemex, the market leader, owns cement plants in seven Latin American countries, including Mexico, Columbia, Costa Rica, the Dominican Republic, Panama and Puerto Rico. The company also leases a cement plant in Nicaragua. Second-placed Holcim operates cement plants in nine Latin American countries, with the largest capacities in Mexico (12.2 Mta), Ecuador (5.5 Mta), Brazil (5.3 Mta) and Argentina (4.6 Mta.). The further rankings are occupied by the “local players” Votorantim, Intercement and Argos. Lafarge is only active in five countries and has a total cement production capacity of 11.6 Mta at 9 integrated plants and 7 separate grinding plants. Lafarge’s setup typifies the structure of most cement plants in Latin America. Individual plants generally have a capacity not far in excess of 1.0 Mta. However, the three plants of Buzzi Unicem in Mexico are the exception to the rule, having a total capacity of 6.3 Mta.

Votorantim, Intercement and Argos are the companies showing the highest growth rates. For one thing, these firms clearly have a sound financial setup, allowing them to take over other companies like CIMPOR. Secondly, they are established in the countries with the largest current cement growth, such as Brazil, Argentina and Columbia. Thanks to its deal with Intercement and Cimpor, Votorantim has developed into a real global player. However, it remains doubtful whether Votorantim can really climb the rankings to join the TOP 5 cement producers in the medium term, particularly in view of the fact that Chinese companies are also breaking into this league. A lot will depend on the future development of the cement markets in Latin America.

5 Prospects

Überschrift Bezahlschranke (EN)

tab ZKG KOMBI EN

This is a trial offer for programming testing only. It does not entitle you to a valid subscription and is intended purely for testing purposes. Please do not follow this process.

This is a trial offer for programming testing only. It does not entitle you to a valid subscription and is intended purely for testing purposes. Please do not follow this process.

tab ZKG KOMBI Study test

This is a trial offer for programming testing only. It does not entitle you to a valid subscription and is intended purely for testing purposes. Please do not follow this process.

This is a trial offer for programming testing only. It does not entitle you to a valid subscription and is intended purely for testing purposes. Please do not follow this process.