Iran’s cement industry after the sanctions

The lifting of economic sanctions paves the way for an improved economic development in Iran. This article provides an overview of the economic outlook for Iran, the situation of the cement industry and the kind of opportunities that exist for the industry and its suppliers.

1 Iran sanctions after Implementation day

On 16.01.2016, which is called the Implementation day, the European Union, the United States and the United Nations lifted a number of sanctions targeting Iran. While the EU lifted the economical/financial sanctions and most of the restrictions on trade with Iran, the US only lifted the so-called secondary sanctions for non-US financial institutions, which means that the US embargo on Iran and US dollar clearing restrictions remain in place. So, non-US banks may be able to do business in Iran, but will still be unable to be paid in US dollars. However,...

1 Iran sanctions after Implementation day

On 16.01.2016, which is called the Implementation day, the European Union, the United States and the United Nations lifted a number of sanctions targeting Iran. While the EU lifted the economical/financial sanctions and most of the restrictions on trade with Iran, the US only lifted the so-called secondary sanctions for non-US financial institutions, which means that the US embargo on Iran and US dollar clearing restrictions remain in place. So, non-US banks may be able to do business in Iran, but will still be unable to be paid in US dollars. However, where sanctions were lifted prior authorization from national authorities will still be required in order to sell, supply, transfer or export to Iran.

2 Outlook on the economic development

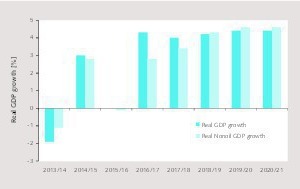

The sanctions relief comes at an important time for Iran. The Iranian economy showed eight quarters of negative growth during the Iranian years 1391 (2012/13) and 1392 (2013/14) with a full recessionary cycle during these two years. In 2014/15, after the presidential elections, the real GDP turned into 3.0 % positive growth and the inflation rate declined sharply from 35 % to 16 %, however with the downturn of oil prices this growth was not sustainable. The International Monetary Fund (IMF) predicted, in its recently published Iran Country Report [1], a bright outlook for Iran as a result of the sanctions relief (Figure 1). After zero growth in 2015/16 and inflation expected to be about 14 %, the real GDP will increase by 4.0 to 4.5 % in 2016/17 and in the years after due to a higher oil production, lower costs for trade and financial transactions and improved access to foreign assets.

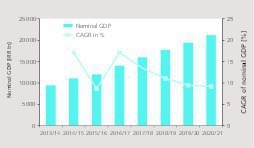

The nominal GDP, at market prices, is projected to grow from below 10 000 trillion IRR (Iranian Rial) in 2013/2014 to more than 21 000 trillion IRR in 2020/21, with the highest growth rate of 17.1 % in 2016/17 slowing down to 9.2 % by 2020/21 (Figure 2). This growth outlook is subject to large uncertainties and depends heavily on Iran’s oil production and exports in the years ahead and if foreign investment and technological expertise can be mobilized. The expected increase in oil supply to pre-sanction levels would put downward pressure on global prices by an estimated 5 to 15 US$/bbl. Figure 3 contains the IMF projections on Iran’s oil export revenues and the annual oil prices, adjusted to the Iranian calendar. However, the projection also depends on the future oil demand and how other OPEC producers will react.

3 Statistics, infrastructure and construction needs

In 2014/15 Iran’s population increased by 1.2 % to 77.8 million, of which 72.5 % lived in urban areas. The total number of households was estimated at 23.8 million, a 4.0 % increase on the year before. Out of the 23.8 million households 17.6 million were residing in urban and 6.2 million in rural areas, showing a 4.5 % and 2.6 % annual growth, respectively. According to the Statistical Center of Iran (SCI) about 23.8 million of the population were employed last year, which is a 0.1 % decrease on the year before. The employment of women decreased by 1.6 %, while the employment of men increased by 0.2 %. In 2014/15 a total of 21.3 million jobs were available, 10.3 million in the service sector, 7.2 million in the industrial sector and 3.8 million in the agricultural sector. Last year the unemployment rate increased by 0.2 % to 11.6 %.

Performance indicators of the construction and housing sector show a continued reduction in 2014/15 and the first half 2015/16 (Figure 4). According to the Central Bank of the Islamic Republic of Iran (CBI) the total construction permits in urban areas declined by 39 % from 191 300 in 2011/12 to 117 300 in 2014/15. Largest decline was in Tehran at almost 69 %, followed by other urban areas with -34 % and other large cities with -28 %. In the same period the floor space approved by construction permits declined by 40 % from 120.8 million m² to 72.2 million m² (Figure 5). The decline in Tehran was 58 %, in other large cities 19 % and in other urban areas 40 %. The figures for the 1 H. 2015/16 indicate another decline in floor space approved of 8 %. Tehran declined by 16 %, while other large cities increased by +4 %.

The private sector investment in new buildings in urban areas has more than doubled since 2011/12 (Figure 6). In 2014/15 the private sector investment increased by 7.5 % to 811 trillion IRR (at current prices), with a growth rate of 12.3 % in Tehran, 10.0 % in other large cities and 1.3 % in other urban areas. However, the private sector investment at constant prices (based on 2011/12) declined by 0.9 % in the last full year. The private sector investment in relation to construction phases indicates a rise of investment in housing starts, semi-finished buildings and completed buildings by 3.6 %, 10.5 % and 4.2 %, respectively, at current prices. Private sector investment in new buildings in urban areas showed a decline of 4.5 % in housing starts, 3.9 % in completed buildings and a 1.9 % increase in semi-finished buildings.

The Iranian infrastructure sector degraded during the many years of western sanctions. Beside the housing sector, investment is needed in power generation, water & wastewater, roads, rail network and transportation. It is planned to build 22 thousand megawatts of new power plants in the country and Iran is projected to spend US$ 20bn on water and wastewater infrastructure over the next five years (including seawater desalination and advanced wastewater treatment). The Ministry of Energy has published a long list of potential projects in various cities and provinces (small scale hydroelectric power stations, dams, irrigation and drainage networks). Iran needs infrastructure investment for more than 55 airports. Out of more than 65 airports only ten have sufficient infrastructure. Furthermore international companies are already looking for office, retail and warehouse space in Iran’s major cities.

The infrastructure investment program will mainly provide opportunities for companies in China, India and Europe. However, during the continued isolation from western markets, China enjoyed a privileged position in trade with Iran. Trade between the two increased four-fold since 2005 to almost US$ 50 bn, while Chinese state-owned enterprises have been investing in Iranian projects for many years. A week after the west lifted the sanctions on Iran, the leaders of China and Iran, optimistically, agreed to raise their bilateral trade to US$ 600 bn in a decade. The two parties agreed on 17 projects, which will deepen the ties on energy and infrastructure and cement China’s position as Iran’s primary ally. Iran is expected to become an important hub on China’s “One Belt One Road” infrastructure program.

Trade with western nations, India and Russia is expected to increase exponentially, given the fact that it is starting out at virtually nil. Italy and France have already signed business contracts with Iran valued at € 17 bn and € 40 bn respectively. A number of businesses have been quick to move into Iran to pursue opportunities. It has been reported that Alstom from France is establishing contracts to work on the expansion of Tehran’s metro, amongst other projects, while Bouygues and Aéroports de Paris are in talks regarding the construction of the second terminal at Tehran’s Iman Khomeni International Airport. Iran has also invited India to invest in infrastructure projects worth US$ 8 bn, including railways, ports, bridges and rail electrification. Several new rail networks linking Iran with Central Asia and Eurasia as well as a gas pipeline from Iran to India are being considered.

4 Development of the cement industry

The cement industry in Iran consists of 71 grey cement plants and nine white cement plants with a capacity of 89.9 million tons per year (Mta) and 1.8 Mta, respectively [2]. The country has 90 grey cement kilns and 11 white cement kilns, of which about 1/3 might not be operational due to technical problems or problems with the fuel supply. In 2015/16 (21.03.2015 to 19.03.2016) 59.5 Mta of grey cement and 0.9 Mta of white cement were produced, resulting in a cement capacity utilization of 66 % for grey and 49 % for white cement. Figure 7 shows the clinker and cement production for grey cement in the last few years. In each year more clinker was produced than cement. In the last two years the production declined to a level of 59.5 Mta for cement and 62.8 Mt for clinker. While the cement production peaked in 2012/13 with 70.3 Mta, clinker production peaked in 2013/14 with 71.9 Mta.

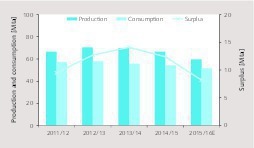

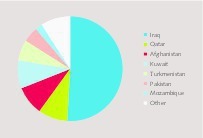

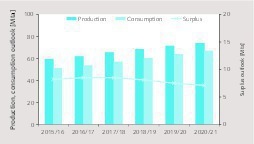

Figure 8 shows the grey cement production, local consumption and surplus. The cement production figures largely exceed the domestic consumption. Consumption was highest in 2012/13 with 57.6 Mta and declined to 51.3 Mta in 2015/16. The surplus, which was exported, was highest in 2013/14 with 14.1 Mta and declined to 8.2 Mta in 2015/16. Cement and clinker exports are illustrated in Figure 9. Exports continuously increased from 10.1 Mta in 2011/12 to 18.8 Mta and 18.9 Mta in 2013/14 and 2014/15, respectively. In 2015/16 exports declined to 15.0 Mta. Over the years the share of the clinker exports increased from 5 to 45 %. The major countries importing from Iran in 2015 are illustrated in Figure 10. More than 50 % of the exports (7.6 Mta clinker and cement) went to Iraq. About 1.4 Mta were exported to Qatar and another 1.4 Mta to Afghanistan. Other countries include Russia, Azerbaijan, Saudi Arabia, Kazakhstan, Yemen, Egypt, Tajikistan, Somalia, UAE and Armenia.

Table 1 shows the grey cement capacity ranking in Iran. There are five cement groups and more than 20 other independent cement producers. Fars & Khuzestan Cement Company (FKCC), which also includes Tamin Cement, has a cement capacity of 26.2 Mta from 16 integrated cement plants. FKCC is listed on the Tehran Stock Exchange (TSE) with a market capitalization of 9.77 bn IRR (06.04.2016). The main shareholder is the SSO (Social Security Organisation) Investment company. FKCC produced 17.1 Mta cement in 2015/16, with an average utilization rate (U-rate) of 65 %. The largest two plants are Abyek Cement with a capacity of 4.3 Mta and Khuzestan Cement with 2.7 Mta. Last year Khuzestan produced 2.659 Mta clinker and 1.457 Mta cement and achieved a clinker capacity utilization of 100 %. FKCC also operates the two white cement plants Saveh and Neyriz White.

In second place in ranking is Tehran Cement with a grey cement capacity of 10.6 Mta from the six plants at Gilan Sabz Cement, Hegmatan Cement, Ilam Cement, Safaeh Cement, Tehran Cement and Nahavad. The market capitalization of 4.93 trillion IRR excludes the group companies Ilam cement and Hegmatan Cement. Hegmatan (Figure 11) is one of the larger plants with two kilns, one with 3200 t/d and one with 3400 t/d. Tehran cement produced 6.8 Mta cement in 2015/16, which resulted in a U‑rate of 64 %. Third place in capacity is held by the Cement Investment and Development Company (CIDCO), which was blacklisted by the EU and US, due to the ownership by Bank Melli. CIDCO has a capacity of 8.4 Mta from the five plants Mazandaran, Shomal (Grey + White), Sarooj Bushehr, Kerman and Firouzkuh Cement. The market capitalization was 5.43 trillion IRR, excluding Shomal, the production was 5.2 Mta, the U-rate 62 %.

Next two places in ranking are held by Ghadir Investment and Espandar Cement. Ghadir Investment, whose major shareholder with 80 % is the Pension & Insurance Fund, operates four plants for grey cement (Shark, Kordestan, Dashdestan and Sepahan. They also have two white cement plants at Shargh White and East Cement. In 2015/16 Ghadir had a grey cement capacity of 7.7 Mta with a production of 4.6 Mta and a U-rate of 60 %.

Espandar Cement Investment Co. (ECIC) operates the five plants Arta Ardebil, Faraz Firouzkuh (Figure 12), Kavir Kashan, Kiasar and Neyzar Qom (Figure 13) and the white cement plant Ekbatan. Their cement capacity was 4.7 Mta, with a production of 3.4 Mta and a U-rate of 72 %. Up to now, ECIC is the only private cement holding in Iran. Until 2010 Holcim had a 49.9 % shareholding in ECIC.

The many independent private grey cement producers in Iran have a capacity of 32.3 Mta, including 0.9 Mta by six independent grinding plants. In 2015/16 the private producers achieved a production of 22.4 Mta, which leads to a U-rate of 69 %. Major independents are Saman Gharb Cement and Hormozgan Cement, each having two production lines and Lamerd Cement, having one production line. Saman Gharb has one plant (Figure 14) in Kermanshah in the west of Iran. Last year the company was leading Iran’s cement and clinker exports with 12.4 %. The plant was nearly fully utilized. Lamerd Cement is with a 3800 t/d kiln the largest cement producing factory (Figure 15) in Fars province, in the south of Iran. Construction of the plant began in 2005, commissioning was in 2010. Hormozgan Cement has two lines, each with 3000 t/d. The plant is at a short distance from the Shahid Rajee and Shahid Bahonar Ports in the south of Iran, close to Bandar Abbas. Hormozgan also belongs to the TOP5 cement & clinker exporters with a market share of 4.7 %.

The white cement capacity in Iran was rapidly increasing in the last few years [3]. Now there are nine plants with a nominal capacity of 1.8 Mta, which is the second largest in the world, after China. The largest two plants, each with a capacity of 0.35 Mta are those of Saveh White and Shargh White. However with the other producers, Benvid White (Figure 16), Neyriz, Urmia, Espandar White, East Cement, Shomal and Larestan there are plenty of suppliers in the market. The capacity utilization for white cement was only 49 %, however some more plants are planned to be converted from grey to white cement. Only 0.2 Mta could be exported and the domestic consumption stagnated at 0.7 Mta.

5 Opportunities and outlook

After several years of decline in infrastructure investments and housing, Iran is the next big construction market in the Middle East. The country has a strong potential to emerge as a one of the few booming markets of the future as it has one of the world’s largest oil and natural gas reserves and a growing population of almost 80 million. The many years of sanctions and embargos opens widespread opportunities, especially with foreign investment from Europe, China and India. However, although there is a large deficit in housing, the housing sector will take time to improve. Any significant positive development in the sector is subject to improvement in the purchasing power of homebuyers, which determines the demand for housing units.

According to our projection the domestic cement demand in Iran will significantly improve. The demand is expected to increase by 30 % from 51.3 Mta in 2015/16 to almost 67.0 Mta in 2020/21 (Figure 17). The annual growth rate for this and the next year will be about 4.3 % and 6.5 %, respectively. By the end of the decade the growth rate is expected to decline to about 5 %. The domestic demand growth will have a positive effect on the production side. However, the surplus for exports will decline, due to the newly installed cement capacities in most of Iran’s major export markets and the growing competition from other export countries. In our projection the surplus will decline from 8.5 Mta to around 7.0 Mta by 2020/21. Accordingly, with the small decline in the cement exports, the grey cement production will increase from nearly 60 Mta in 2015/16 to 74 Mta in 2020/21, an increase of nearly 25 %.

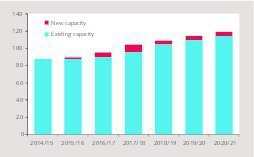

At the moment there are still many started but not yet finished new cement kiln projects and the clinker capacity utilization rates are higher than those for the cement capacity. Nevertheless with fresh money most of the projects will be finished soon and new expansion projects will be on the agenda. Figure 18 shows our projection for the cement capacity by 2020/21. The projection until 2018/19 is mainly derived from estimates by FKCC. According to which about 5.8 Mta of new capacity will be operational in 2016/17, followed by 8.9 Mta in the following Iranian year. Iranian sources expect a cement capacity of 120 Mta by the year 2020. In our projection by the end of 2020/21 about 119.2 Mta will be operational. This will lead to considerable opportunities for cement equipment suppliers.

In the last few years the ownership of some plants changed from one group to another. However, in 2011 with the withdrawal of Holcim from ECIC the last foreign investor disappeared from the market. According to the management of FKCC LafargeHolcim is again interested in Iran and the two companies are negotiating to cooperate, although in statements by LafargeHolcim this was denied. We expect Chinese cement investors to tap into the market, as they have already done in Central Asia as part of their “One Belt One Road” strategy. One other interesting fact is that export agreements were made between cement producers in Iran and Pakistan. The agreement foresees cement exports by Iran to Pakistan as part of a swap deal for re-exports to targeted Asian markets. Some of the exports will be for Pakistan’s domestic consumption and some will be re-exported under Iran’s name to targeted markets throughout Asia.

Überschrift Bezahlschranke (EN)

tab ZKG KOMBI EN

This is a trial offer for programming testing only. It does not entitle you to a valid subscription and is intended purely for testing purposes. Please do not follow this process.

This is a trial offer for programming testing only. It does not entitle you to a valid subscription and is intended purely for testing purposes. Please do not follow this process.

tab ZKG KOMBI Study test

This is a trial offer for programming testing only. It does not entitle you to a valid subscription and is intended purely for testing purposes. Please do not follow this process.

This is a trial offer for programming testing only. It does not entitle you to a valid subscription and is intended purely for testing purposes. Please do not follow this process.