Prospects of the GCC cement industry

The cement demand growth rate in Saudi Arabia declined to 2.4 % in 2014 from 13.2 % in 2013. The country has about a 60 % market share in the GCC. But despite falling oil prices and challenging fiscal budgets in the GCC, the cement industry is expected to revive, due to huge construction investments in the region. The following market review takes a detailed look into the cement industry, reviews the market drivers and gives an outlook to 2019.

1 Introduction

The Gulf Cooperation Council (GCC) consists of the six Islamic monarchies of Bahrain, Kuwait, Kingdom of Saudi Arabia (KSA), Oman, Qatar and the United Arab Emirates (UAE) (Fig. 1). The GCC countries have a combined land area of 2.67 million km², a population of about 51.6 million and a nominal GDP of 1.65 US$ bn, which corresponds to an average of 33 000 US$ per capita, with the highest in Qatar and the lowest in Oman. The GCC economy is largely dependent on its hydrocarbon sector. As a result of the decline in oil prices the countries are experiencing large losses of fiscal...

1 Introduction

The Gulf Cooperation Council (GCC) consists of the six Islamic monarchies of Bahrain, Kuwait, Kingdom of Saudi Arabia (KSA), Oman, Qatar and the United Arab Emirates (UAE) (Fig. 1). The GCC countries have a combined land area of 2.67 million km², a population of about 51.6 million and a nominal GDP of 1.65 US$ bn, which corresponds to an average of 33 000 US$ per capita, with the highest in Qatar and the lowest in Oman. The GCC economy is largely dependent on its hydrocarbon sector. As a result of the decline in oil prices the countries are experiencing large losses of fiscal revenues. Growth forecasts by the IMF for Saudi Arabia have been marked down by 1.5 % to 3.0 % in the latest World Economic Outlook (WEO). The fiscal balance for Saudi Arabia is expected to move into substantial deficit in 2015 and 2016.

Figure 2 shows the GDP development of the GCC countries in the last few years and the IMF projections for 2015 and 2016 according to the April 2015 WEO.

The GDP projections for Saudi Arabia in 2015, 2016 and 2020 are 3.0 %, 2.7 % and 3.3 % respectively. Highest projections are for Qatar with 7.1 %, 6.5 % and 3.9 %, while lowest are for Kuwait with 1.7 %, 1.8 % and 3.2 %. Interestingly, preparations for the FIFA World Cup 2022 in Qatar are expected to have an early impact, while the World Expo 2020 in Dubai/UAE will have its impact later. Anyhow, the infrastructure development planned for the legacy sporting event is expected to position Qatar as the driving force of the GCC construction and cement industry.

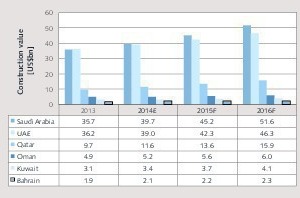

According to a new market report by Dubai-based Alpen Capital the construction sector in the GCC countries will see a double-digit (11.3 %) growth from 2013 until the end of 2016. While the construction spending is still dominated by Saudi Arabia, UAE will closely follow and other countries will make a significant contribution (Fig. 3). Saudi Arabia has planned around 180 US$ bn for transport infrastructure projects between 2015 and 2019. The real estate development fund approved 650 US$ m in new home loans. UAE plans to allocate huge budgets for the development of its infrastructure sector. Also in Qatar, Bahrain and Oman heavy investments in infrastructure and housing will be made.

Political tensions have intensified in the region and violence is on the rise. Central authority has been lost in several countries, extremist and terrorist groups have gained influence, ideological, sectarian and ethnic conflicts are growing. In Syria and Iraq, the Islamic State (IS or ISIS) has erased the borders between the two countries. The Yemen conflict has emerged to a civil war, where a Saudi-led coalition carried out air-strikes. The two leading powers in the region of Saudi Arabia, which is Sunni dominated, and Iran, which is Shiites dominated, are both accused of discriminating against the minority religions in their country. However, despite the destabilization of the region, the GCC countries and especially UAE and Qatar have experienced less turmoil than their neighbors. And post-sanctions Iran might cause further optimism.

2 The cement industry overview

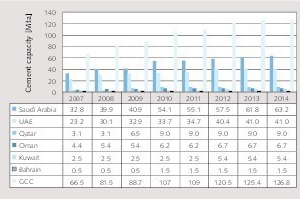

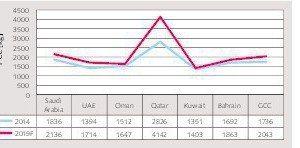

GCC countries have the highest per capita cement consumption (PCC) in the world [1]. In 2014 the figure stood at 1736 kg on an average, highest was in Qatar with 2826 kg and lowest was in Kuwait with 1351 kg. With such a high PCC the cement capacity (Fig. 4) rose from about 66.5 million tons per year (Mta) in 2007 to 126.8 Mta in 2014, which corresponds to a compound annual growth rate (CAGR) of about 9.7 %. 50 % of the cement capacity is located in Saudi Arabia, 33 % in UAE and only 17 % in the other four countries Qatar, Oman, Kuwait and Bahrain. And cement capacity is expected to grow significantly in the coming years. According to OneStone Consulting about 18.1 Mta will come from new facilities which will become operational between 2015 and 2017.

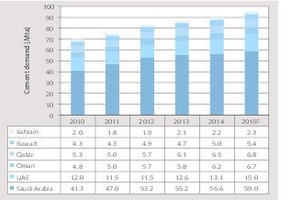

Figure 5 gives an overview of the cement consumption development in the GCC countries with an outlook for this year. In 2007 the consumption was 69.7 Mta, in 2015 about 95.2 Mta are forecasted, which corresponds to a CAGR of 6.4 % over the time period. With the lower CAGR in the cement consumption compared to the cement capacity growth it becomes clear that overcapacity issues have arisen in the last few years. Saudi Arabia will be responsible for about 62 % of the GCC demand, UAE for about 15.8 % and the other four countries for 22.2 %. With these figures it also becomes clear that the largest overcapacities are in the UAE, because of their 33 % share of production capacity and only 15.8 % share of demand.

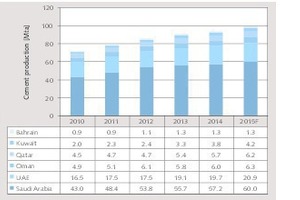

The cement production figures are shown in Figure 6. Cement production in the GCC countries is forecast to increase from 71.7 Mta in 2010 by a CAGR of 6.6 % to 98.9 Mta in 2015. Saudi Arabia will have a share of 60.7 %, UAE of 21.1 % and the other four countries of 18.2 %. The largest growth in cement production is in Kuwait with a CAGR of 16 % over the five years from 2010 to 2015, followed by Bahrain with a CAGR of 7.6 %, Saudi Arabia with 6.9 %, Qatar with 6.6 %, Oman with 5.2 % and finally UAE with the lowest growth rate of 4.8 %. However no new capacity expansion has been announced for UAE and capacity utilization is expected to increase over the time period reviewed.

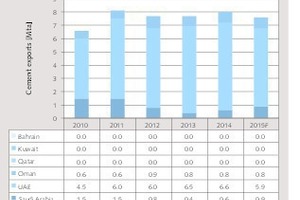

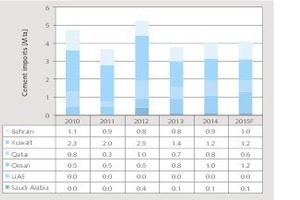

Cement exports and imports in the GCC countries are shown in Figures 7 and 8. Exports were on the rise from 6.6 Mta in 2010 to 8.0 Mta in 2014. For 2015 a slowdown to 7.6 Mta is projected, due to major export reductions by UAE as a result of a growing local demand and more competition from Saudi Arabia. Accordingly UAE will lose market share from 83 % to 78 % of the GCC cement exports. The imports declined from 4.7 Mta in 2010 to 4.0 Mta in 2014. For 2015 slightly increased imports of 4.1 Mta are projected, mainly due to a higher demand from Oman and Bahrain. The only GCC exporters are Saudi Arabia, UAE and Oman, while the main importers are Oman, Kuwait, Qatar and Bahrain. When Iran’s sanctions end, it is estimated that the countries cement exports, will significantly increase.

3 Focus on selected countries

3.1 Kingdom of Saudi Arabia (KSA)

Saudi Arabia’s market is the largest in the region, from population, construction and cement markets. With the large trade surplus from oil revenues that the government has had for a number of years, it has been able to invest substantially in infrastructure and to diversify its economy. The country’s population has quadrupled over the past four decades to reach 30.8 million in 2014. It is expected that it will reach 37.8 million in 2030 and the urbanization rate is as high as 90 %. Residential property owners accounted for only 30 % of the population as of 2014, while the supply of residential units is lagging behind. KSA needs about 200 000 new homes per year from 2015 to 2019 to meet the current demand.

Saudi Arabia’s infrastructure construction sector received a lot of government attention under the tenth plan (2015-2019), despite the declining oil income. Projects that were initiated in the ninth plan are scheduled to be completed by 2018. About US$ 180 bn are to be invested in the transport infrastructure, comprising airports, railways and roads. Of these, projects US$ 85 bn are currently under construction including the Saudi Landbridge rail project and the third phase of the Mecca Metro.

Saudi Arabia overtook the UAE as the largest market in terms of hotel construction projects completed in 2014 due to heavy government investment. The supply is expected to grow as much as 60 % between the years 2015 to 2020. The growth of the tourism industry is also adding to the activity in the country’s retail sector.

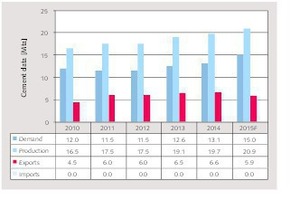

Backed by the heavy infrastructure development Saudi’s cement industry is expected to grow significantly in 2015. Aljazira Capital is expecting an increase of 7.1 %. But in the last few years expectations have often not been met. Figure 9 comprises cement demand, production, imports and exports for the years 2010 to 2014, with an outlook for 2015. Highest demand growth rates were in 2011 and 2012 with 13.8 % and 13.2 % YOY, while in 2013 and 2014 the growth rate was only 3.8 % and 2.4 %. For the first half of 2015 growth came back to 6.2 %, the projection of 59 Mta for 2015 corresponds to a CAGR of 4.3 %. With exports increasing to 0.9 Mta and imports of around 0.1 Mta, cement production is projected to be around 60.0 Mta this year.

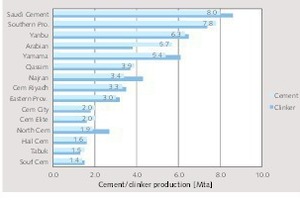

Saudi Arabia’s cement industry consists of 15 producers, with a combined cement capacity of 63.2 Mta and 59.1 Mta clinker. According to the production figures for 2014 (Fig. 10) the main producers were Saudi Cement, Southern Province Cement, Yanbu Cement, Arabian Cement and Yamama Cement with market shares of 9.4 to 14 %. The TOP 5 have a combined market share of 58 %, the TOP 10 which also include Qassim Cement, Najran Cement, Eastern Province Cement (Fig. 11) and City Cement account for 85.3 %. The capacity utilization rates are very high at 90.5 % for cement capacity and 97.5 % for clinker capacity.

Due to the high capacity utilization and the positive market prospects the capacity will largely grow. Al Safwa Cement is a new market entry with a cement production of 2.022 Mta in 2014. The company was originally formed by Orascom and now mainly belongs to LafargeHolcim, who is today the only international cement major in the country. The coming years will see a large number of new projects, including those of Arabian Cement, Eastern Province Cement, Western Province Cement, Qassim and Al Safwa Cement. A new company will enter the market in the 2nd half of 2015, UCIC Cement and another project was announced by Umm Al-Qura Cement (UACC). KSA cement producers continue to enjoy some of the highest margins in the cement industry.

3.2 United Arab Emirates (UAE)

UAE and Qatar are rated by various sources as being of more interest in the construction sector than Saudi Arabia. In the coming years construction spending in UAE is forecast to be the same as in Saudi Arabia. Under its strategic vision 2021, UAE plans to allocate huge budgets to the development of its infrastructure sector. Projects that were stalled during the economic downturn are now revived. Hosting of the Expo 2020 will require upgrades to airports, ports and roadways. Recently the Dubai Government announced a US$ 7.8 bn airport expansion project to cope with the rising passenger flow and to increase the capacity from 60 to 90 million annual passengers by 2018. Other major projects include the Dubai Metro, the Etihad railway network and the Abu Dhabi Metro.

The residential market in Dubai and Abu Dhabi will see an additional 51 000 housing units in Dubai between 2014 and 2020 and in Abu Dhabi alone approximately 5000 new units will be built in 2015. Nearly 50 % of these units are likely to be targeted towards the higher-end of the market. Positive sentiment has also returned to UAE’s retail sector, which in 2014 saw the announcement of several major retail construction projects. Dubai’s retail construction market was undersupplied in the last few years, with little addition to its retail space but by the end of 2015 about 195 000 m² of new space will be added. The hospitality construction sector is also booming again and a large number of new hotel projects are planned or under way.

The cement demand fell by nearly a third from 2009 to 2010, despite large growth expectations. Up to 2012 cement demand further declined or stagnated (Fig. 12). But from 2013 to 2014 a market recovery with growth rates of 9.6 and 4.0 % was registered. For 2015 a double-digit demand growth to about 15 Mta is expected. In 2010 with the abrupt decline in demand, producers began exporting. The exports increased to 6.6 Mta in 2014. With growing local demand and increased competition from Iran and Saudi Arabia in the export markets, exports are projected to decline.

Cement capacity utilization rates in 2014 stood at just 48 % in 2014. For 2015 a slight increase to 51 % is projected.

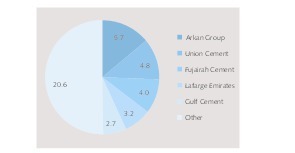

UAE’s cement industry capacity of 40.0 Mta is very fragmented. In total there are 23 cement plants from 22 producers. 12 of these plants are integrated cement plants and the other 11 are separate grinding plants. The grinding plants either import clinker or are supplied with local produced clinker. The main producers comprise the Arkan Group with two cement plants in Abu Dhabi, Union Cement and Gulf Cement (Fig. 13) in Ras Al-Khaimah, Fujairah and Lafarge Emirates in Fujairah (Fig. 14). UAE is the GCC country with the most cement majors owning plants, including Lafarge, Holcim (National Cement, Abu Dhabi), Cemex and Ultratech (Eta Star Cement). For the next few years due to the large over-capacity no new expansion projects are envisaged.

3.3 Qatar

Qatar is forecasted to spend about 150 US$ bn over the medium-term as part of its FIFA World Cup 2022 commitment and the Qatar National Vision 2030 plans. However, investigations over how Qatar was awarded the World Cup tournament as part of the probe into corruption at FIFA is not over yet. The main, envisaged, construction investments are in infrastructure, residential and hospitality sectors. The most recent update on the Qatar Economic Outlook by the Ministry of Development Planning and Statistics (MDPS) Qatar was released in December 2014 and forecasts building and construction activity will contribute 6.3 % and 7 % of nominal GDP in 2015 and 2016 respectively. According to analyst this is likely to act as a catalyst to increase the cement demand in the coming years.

Qatar’s infrastructure is in need of an overhaul to support its rapidly growing economy and population. Big ticket projects in the pipeline include a 40 US$ bn plan for railways, 20 US$ bn for roads and 15.5 US$ bn for airports. The residential sector remained undersupplied, creating a supply shortage of 37.0 % in 2014. The overall demand for units stood at approximately 177 000, whereas the market supply stood at 129 000 units in 2014. Doha is expected to see additional office demand in the short term, as strong economic growth is attracting foreign investors and tenants. The supply of Grade A office space in Doha is expected to grow at a CAGR of 9.7 % between 2014-2017, thereby reaching 3.6 million m² in 2017.

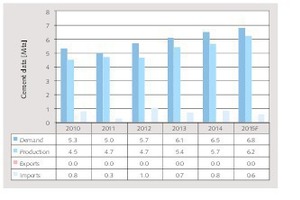

With a cement consumption of 6.5 Mta and a population of 2.3 million Qatar had a PCC of 2826 kg, which is the highest of any country in the world. And the cement demand is expected to increase further (Fig. 15). Since a 5.7 % decline of demand in 2011 to a level of 5.0 Mta the years after showed a steady growth to 6.5 Mta in 2014 and a projected 6.8 Mta in 2015. Cement production increased from 4.5 Mta in 2010 to 5.7 Mta in 2014. All cement is consumed in the domestic market, while the balance is imported. Cement capacity utilization rates in 2014 stood at 63 % in 2014. However, in the coming two years two new cement kiln lines for the leading two cement producers with a combined capacity of 4.5 Mta will become operational. This will only be feasible with significantly increased cement demand.

Cement production is shared between three producers which have a combined cement capacity of 9.0 Mta and clinker capacity of 5.9 Mta. Qatar National Cement Co. (QNCC) has 4 kiln lines (Fig. 16), a fifth is under development. The other two producers are Al-Khalij Cement Co. (AKCC) and Al-Jabor Cement, in which Holcim has a stake. Figure 17 shows how the cement deliveries of the three producers have developed from 2009 to 2014. While the deliveries of QNCC stagnated or declined, AKCC significantly increased deliveries and won market share whilst Al-Jabor was more or less constant over the time.

4 Cement outlook

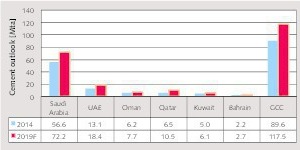

In our outlook it is projected that the cement demand in GCC will grow from 89.6 Mta in 2014 to 117.5 Mta in 2019 (Fig. 18). Saudi Arabia is projected to grow by a CAGR of 5.0 % to 72.2 Mta and UAE will grow by a CAGR of 7.0 % to 18.4 Mta. Largest growth rate of 10 .5 % is projected for Qatar and the smallest growth rates of 4.0 % each are projected for Kuwait and Bahrain, while the projected growth rate for Oman is 4.5 %. The corresponding changes in the PCC are shown in Figure 19. Qatar is expected to increase to a PCC of 4142 kg, which is about the level Qatar had during 2005 to 2008. The increase in the PCC for the other GCC countries is more moderate, but still significant.

5 Conclusion

Our projections show that the cement industry in the GCC countries will return to growth, although the growth rates vary differently from country to country. Nevertheless, overcapacity is still an issue because of some blind investment in the past and unreasonably high export expectations. So in the future, it is recommended that the cement industry carefully considers capacity expansions and also takes the investment decisions of competitors into account. Furthermore reliable market information is not easily available and therefore independent market research is necessary.

Überschrift Bezahlschranke (EN)

tab ZKG KOMBI EN

This is a trial offer for programming testing only. It does not entitle you to a valid subscription and is intended purely for testing purposes. Please do not follow this process.

This is a trial offer for programming testing only. It does not entitle you to a valid subscription and is intended purely for testing purposes. Please do not follow this process.

tab ZKG KOMBI Study test

This is a trial offer for programming testing only. It does not entitle you to a valid subscription and is intended purely for testing purposes. Please do not follow this process.

This is a trial offer for programming testing only. It does not entitle you to a valid subscription and is intended purely for testing purposes. Please do not follow this process.