Sub-Saharan upswing continues

At the moment, the increase in cement production on the African continent is predominantly taking place in the Sub-Saharan area. This market report discusses the current developments, presents an overview of production capacity expansions and focusses on the leading countries of Nigeria, South Africa and Ethiopia.

1 Introduction

Within the space of just a few years, cement production capacities in the area have been dramatically expanded. In 2008, its largely obsolete production...

1 Introduction

Within the space of just a few years, cement production capacities in the area have been dramatically expanded. In 2008, its largely obsolete production facilities had a capacity of only 66.3 Mta, but this had been increased by 28.9 Mta to 95.2 Mta by 2011. It is remarkable that despite this rapid capacity expansion the degree of plant utilization is still 75 %, which is a relatively high figure.

2 The Sub-Saharan regions

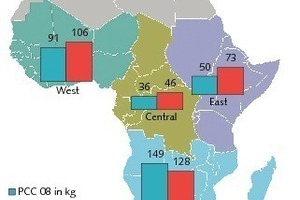

There are also substantial differences in the per-capita cement consumptions (PCC) of the region (Fig. 1). Given the average figure of 92 kg for the entire region of Sub-Saharan Africa, Southern Africa is the clear leader with a PCC figure of 128 kg. West Africa’s PCC of 106 kg is slightly above the average, while East Africa’s 73 kg and Central Africa’s 46 kg are significantly below the average.

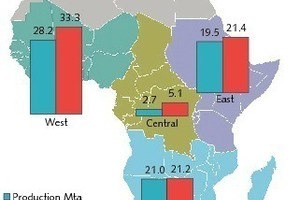

Fig. 2 shows the production and consumption figures for each of the four Sub-Saharan regions. The region of West Africa accounts for 41.1 % of the cement consumption in the Sub-Saharan region with its figure of 33.3 Mta. West Africa also has the highest production output of 28.2 Mta or 39.5 %. East Africa has come up strongly behind Southern Africa in recent years and as regards cement consumption has even taken the lead with 21.4 Mta compared to 21.2 Mta. However, East Africa’s cement production of 19.5 Mta is still 1.5 Mta behind Southern Africa’s figure of 21.0 Mta. In contrast, the consumption and production figures of Central Africa have only changed slightly over recent years with 5.1 Mta and 2.7 Mta respectively. Central Africa’s share in the overall consumption and production figures of the Sub-Saharan region is only 6.3 % and 2.7 % respectively.

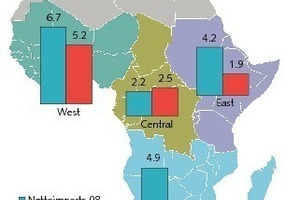

In 2008, the net cement import figure of the Sub-Saharan region was still 17.9 Mta. Subsequently, net imports dropped to only 9.6 Mta by 2011 due to the expansion of production capacity and the consequent rise in local cement output. This represents a decrease of 46.3 % in net imports.

Fig. 3 depicts the changes in net imports during the considered period of time. West Africa is still the leading importer with a figure of 5.2 Mta. In Central Africa, imports have even risen slightly to a quantity of 2.5 Mta. In contrast, the net import quantities of East Africa and Southern Africa have fallen drastically to 1.9 Mta and 0.2 Mta respectively. If the development of production capacity expansion continues, it can be assumed that the Sub-Saharan region will become a net exporter of cement in a few years.

East Africa meanwhile has a cement production capacity of 24.1 Mta at 30 integrated cement plants and five grinding plants. In 2008, the region’s cement production capacity was only 12.1 Mta. The greatest increases in cement production capacity have been achieved by Sudan (from 1.8 Mta to 5.8 Mta) and Ethiopia (from 2.9 Mta to 7.8 Mta). Given East Africa’s cement output of 19.5 Mta in 2011, the plant utilization rate is almost 81 %, which is a relatively high figure. However, there are considerable differences between the individual countries, with Sudan last achieving a capacity utilization rate of only 74 %.

The demand for cement has risen most strongly in Ethiopia (7.7 Mta in 2011), Sudan (4.9), Kenya (3.3) and Tanzania (3.0. Burundi, the Comoros, Djibouti, the Seychelles and Somalia play no significant role for the cement industry. Thanks to the increases in cement production capacity, the region’s net cement import has fallen substantially in the last three years from 4.2 Mta to 1.9 Mta.

The most important cement production projects in the sub-region include the 5000 tpd plants of Berber Cement and 5300 tpd plants of Atbara Cement, which were constructed in Sudan by HCDRI/Sinoma. FLSmidth supplied ASEC’s 1.6 Mta Takamol cement plant in Sudan. Athi River Mining (ARM) has expanded its cement production capacity in Kenya to 1.0 Mta (Fig. 4). In Tanzania, ARM’s 0.75 Mta grinding plant is currently in the commissioning phase. For 2013, a 1.2 Mta clinker production plant and a further 0.75 Mta grinding plant are also planned there. HeidelbergCement has increased its cement production capacities in Tanzania to 1.3 Mta. In Ethiopia, the most impressive projects include Derba Midroc’s 8000 tpd production line and the new 3000 tpd production lines of Messebo Cement and Mugher Cement.

By 2015, cement production capacity in the East African region is set to increase to 40 Mta. To achieve a capacity utilization rate of 80 %, cement production would have to rise from the present 19.5 Mta by 12,5 Mta to 32.0 Mta, although this disregards possible exports.

The most important cement producing country of the region is South Africa, whose 13.2 Mta is 63 % of the total cement production capacity of the region. Significant production figures are also achieved in Angola (3.5 Mta), Zambia (1.4 Mta), Zimbabwe and Mozambique (0.9 Mta each). At present, the largest per-capita cement consumption figure is recorded in Mauritius (538 kg), followed by Botswana (300 kg), South Africa (222 kg) and Angola (219 kg). The lowest per-capita consumptions are registered in Madagascar (19 kg), Malawi (22 kg) and Mozambique (52 kg).

The region’s net imports have decreased dramatically from 4.9 Mta in 2008 to 0.2 Mta in 2011. This shows that the expansion of capacity has kept pace with the region’s demand for cement. However, cement production capacities will continue to increase in coming years, which will probably result in the region becoming a net cement exporter.

The investments in expansion of plant capacities brought years of stagnation to an end. One of the most interesting projects of recent years was the 0.7 Mta Ohorongo cement project (Fig. 5) of the German Schwenk Group in Namibia. Lafarge built a new 0.75 Mta production line in Chilanga/Zambia. CIF Luanda has commissioned a 5000 tpd plant in Angola. Also in Angola, FCKS is set to bring a 1.5 Mta plant on line in September of this year.

Numerous other plants are in the construction or planning stages in Angola, where new capacity was announced to be in the order of 15 Mta. In South Africa, Pretoria Portland Cement (PPC) has commissioned a new 1.0 Mta grinding plant. PPC is also expanding the capacities of two other plants in 2012. Sephaku Cement is planning to start up a new 5100 tpd clinker production plant in 2013. By 2015, the region is expected to have a cement production capacity of around 42 to 45 Mta.

The leading cement production countries in this region are Nigeria (14.0 Mta), Senegal (3.8 Mta), Ghana (3.5 Mta), the Ivory Coast (1.7 Mta) and Togo (1.4 Mta). Countries like Gambia, the Cape Verde Islands and Guinea-Bissau have no production facilities of their own and are totally dependent on imports. The only countries with integrated cement plants are Nigeria, Senegal and Benin, but there are grinding plants in eleven countries including Togo, Ghana (Fig. 6), Mauritania and the Ivory Coast. Ghana, the Ivory Coast, Burkina Faso, Guinea, Mauritania, Liberia, Niger and Sierra Leone have to import all the clinker required for their cement production. In respect of cement imports, West Africa is still one of the biggest net importers of the Sub-Saharan region, which is mainly due to Nigeria’s imports. But West Africa’s cement imports will also rapidly decrease as local production capacities are expanded.

In Nigeria and Senegal there has been a massive expansion of capacities in recent years. In the case of Nigeria, the cement production capacity rose from 11.5 Mta in 2008 to 20.2 Mta in 2010. Alone the Dangote Cement company, which currently has a 70 % market share intends to increase its Nigerian production capacity to 32 Mta by 2015. Also in Nigeria, Lafarge recently brought the 2.5 Mta Ewekoro II plant on line. In Senegal, the production capacity has increased from 3.7 to 6.3 Mta and various expansion projects are planned in Benin. In addition to its activities in Nigeria, Dangote Cement is planning plants in Benin, Ghana, Sierra Leone, Liberia and Senegal. Forecasts for 2015 predict a cement production capacity of 60 to 70 Mta in West Africa, which at utilization rates of around 80 % correspond to a production output of 48 to 56 Mta.

Thanks to their oil incomes, Equatorial Guinea and Gabon have per-capita gross national products comparable with that of Spain while the incomes in the other countries are mostly situated at the bottom end of the scale. The DR Congo is among the poorest countries with an average annual per-capita income of US$ 210 in 2011. However, its gross national products grew at an above-average rate of approx. 7 % in recent years.

At present, Central Africa only has a cement production capacity of 2,9 Mta at five integrated plants and five grinding plants. Since 2008, plant shutdowns have reduced the cement production capacity by 0.2 Mta. No new capacities have reached operational status. Cameroon’s cement production capacity of 1.7 Mta is the biggest in the region, followed by the DR Congo (0.5) and Gabon (0.4). Chad, the Central African Republic, Equatorial Guinea and Sao Tome and Principe have no production facilities of their own and are dependent on imports.

Central Africa is currently the second biggest net import region of the Sub-Saharan region with a figure of 2.5 Mta. Most imports take place via Cameroon, the DR Congo and Equatorial Guinea. In recent years the region was not a focus of capacity expansion projects. HeidelbergCement, who took over three cement plants in the DR Congo from the Forrest Group in 2010, are planning to increase the capacities to 1.4 Mta. In the Republic of the Congo the Spanish company La Union Cement is currently building a 0.5 Mta grinding plant for imported clinker. Dangote has announced plans for a number of cement projects in Central Africa. These include the construction of grinding plants or integrated cement plants in Cameroon, the DR Congo and Gabon.

3 Most important cement producing countries

in the regions

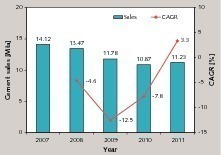

In 2009 and 2010 the country suffered dramatic negative growth with -12.5 and -7.8 % respectively. In 2011 the cement sales returned to positive growth with +3.3 %. In 2007, domestic production facilities could not keep pace with demand for cement and 0.6 Mta had to be imported but in 2011 imports were only at 0.2 Mta – mainly originating from Pakistan – and around 0.3 Mta was exported to other countries in the region of Southern Africa.

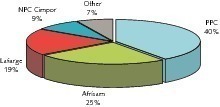

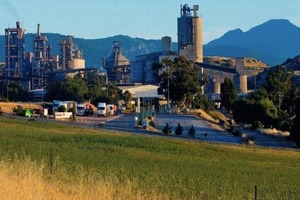

The market leader is Pretoria Portland Cement Company (PPC), with a capacity of 7.4 Mta (Fig. 8) at seven integrated plants and one grinding plant, having a market share of 40 % on a total capacity of 18.5 Mta. PCC owns 13 kiln lines that have an average age of more than 30 years. Recent capacity expansions have been put into service at the Dwaalboom and Hercules plants. Further plant modernizations and capacity expansions are planned for the De Hoek (Fig. 9) and Riebeeck plants. The company’s strategy is also to invest and expand in neighbouring countries and in East Africa.

Second place with a capacity of 4.6 Mta is held by AfriSam, a company formed from Holcim South Africa and the former Alpha Cement. AfriSam currently owns four plants, of which two are pure grinding plants. The next two places are taken by Lafarge with a capacity of 3.6 Mta and NPC Cimpor with a capacity of 1.6 Mta. The remaining producers are Slagment, Ash Resources and Ulula Ash, who primarily operate blending plants for blast furnace slag and fly ash.

At present, there is already a large surplus capacity in the South African industry. Lafarge has brought a new plant online in Lichtenburg (Fig. 10). PPC has postponed a project for a new 2.5 Mta cement plant which was meant to replace an 0.6 Mta line. A newcomer - Sephaku Cement – is set to enter the market by 2013 with a cement production capacity of 2.6 Mta. This project was originally commenced by Orascom Constructions Industries and then discontinued after Orascom Cement was taken over by Lafarge. Later, Dangote Cement took a strategic stake in the project and currently owns a 64 % share. The project comprises an integrated cement plant for 1.2 Mta and a separate grinding plant for 1.4 Mta, which is particularly intended for the production of fly ash cements. Sephaku already owns a 1.2 Mta ash preparation plant. A total of three further projects have been announced by various groups of investors.

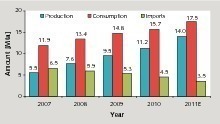

Unfortunately, the country’s cement industry suffers from the problem that all too often artificially high figures for cement demand are published, although the true cement consumption is considerably lower for various reasons. One of the reasons for the discrepancy is a cement price in the order of 200 US$/t, which puts a halt to many construction projects. Another reason is the limited number of import licences that are granted. Fig. 11 shows the current cement development. The steep rise in cement consumption is immediately conspicuous. The figure of 17.5 Mta in 2011 corresponds to a per-capita consumption of 108 kg after 90 kg in 2008. Nigeria is simultaneously moving away from its status as an importing country. Its proportion of imports in 2011 was only 20 % after 44 % in 2008 and 56 % in 2007.

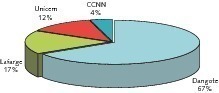

Nigeria’s cement production capacity has increased enormously in recent years and further generous expansions are in the pipeline. At present (end of 2011), Nigeria has a cement production capacity of 20.2 Mta, which would be entirely adequate to satisfy current domestic consumption. The market leader with 67 % or a cement production capacity of 13.3 Mta (Fig. 12) is Dangote Cement with its 10.3 Mta Obajana plant (Fig. 13) and 3.0 Mta Gboke plant. This year, the commissioning of the 6.0 Mta Ibese plant and the expansion of the Gboke plant to 4.0 Mta will bring Dangote up to a production capacity of 21.5 Mta in Nigeria. Lafarge is number 2 in Nigeria with a capacity of 3.5 Mta. Last year its 2.5 Mta Ewekoro II plant commenced production. United Cement (UniCem) has entered the market as a newcomer, having commissioned a 2.5 Mta cement production line. Lafarge and Holcim each own 28 % stakes in UniCem, while Dangote Cement and Floor Mills each have a 22 % shareholding.

Dangote plans to expand its cement production capacities in Nigeria to 32 Mta by 2015. This will be primarily achieved by adding further lines to the Obajana and Ibese plants. It also intends to build a new 3.0 Mta plant in Calabar. Lafarge also plans to undertake a further 2.5 Mta capacity expansion in Lakatabu. The Cement Company of Northern Nigeria (CCNN) also intends to expand production capacity. CCNN belongs to the BUA Group, who recently awarded FLSmidth an order worth US$ 500 million for a 2.0 Mta plant in Edo. Given all these projects, Nigeria could have a cement production capacity of 43.5 Mta in 2015. At a plant utilization factor of 80 % this would mean a production output of 34.8 Mta.

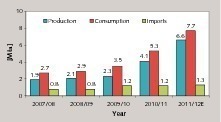

Ethiopia’s cement industry is currently enjoying an enormous boom with annual growth rates in the order of 50 % (Fig. 14). In the business year 2011/12 cement consumption is set to leap to 7.7 Mta, an increase of 45.3 % over the previous year. However, cement imports are remaining practically constant. Domestic cement production is completely covering the increase in cement production.

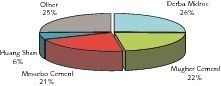

Cement production capacity has developed extremely impressively. Fig. 15 shows the leading producers. Against the 2009 figure of 2.6 Mta capacity at eight integrated plants and two grinding plants, the country meanwhile has a capacity of 7,8 Mta at twelve integrated plants and two grinding plants. The largest new plants put into operation are the two 1.4 Mta plants of Mugher Cement and Messebo Cement. At present, the biggest plant is the 5000 tpd kiln line of Derba Midroc (Fig. 16), which commenced operations in February 2012. Two more larger production lines are due to start up this year: CH Cement, constructed by a group of Chinese Investors, and Ethio Cement.

In Ethiopia, numerous mini-cement plants equipped with shaft kilns have also been installed. However, these have questionable prospects, as the country’s cement output will soon exceed cement consumption. The capacity is expected to reach 12.6 Mta by July, which should result in a cement price slump.

The Ministry for Trade and Industry (MoTI) is no longer granting licences for the construction of new cement plants. Currently, around 15 new projects are undergoing construction or are at the planning stage, including a Dangote Cement project for 2.5 Mta plant and a Lafarge project for a further green-field plant. Besides those, a number of projects by Chinese investors are still pending. The South African company PPC also wants to participate in the Ethiopian market. It is doubtful that the market needs this extra growth in capacity. Already, sales problems are prompting producers to start exporting. However, Ethiopian cement is not really competitive, because the country’s energy and power costs are relatively high and exports involve relatively long transportation by truck.

4 Most important cement producers

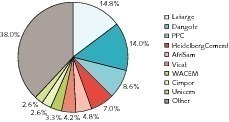

Dangote Cement has reduced Lafarge’s lead and already has a capacity of 13.3 Mta. Third place is held by PPC, a further local African cement manufacturer, with a production capacity of 8.2 Mta. HeidelbergCement has a capacity of 6.7 Mta and therefore a market share of 7.0 %. The company is present in eight countries. In Gabon, Tanzania and the DR Congo it owns integrated plants, but in Benin, Ghana, Liberia, Sierra Leone and Togo it only operates grinding plants.

The subsequent TOP 10 places are occupied both by local companies like AfriSam, WACEM and Unicem and also by such big international firms as Vicat and Cimpor. Having taken over the shares of Holcim South Africa, Afrisam has become the fifth largest producer in the region, with a capacity of 4.6 Mta. Vicat owns plants in Senegal and in Mauritania, which currently give it a capacity of 4.0 Mta and a market share of 4.8 %. Cimpor only has a capacity of 2.5 Mta and a market share of 2.6 %.

At the moment, the signs are that the influence of African and Chinese cement companies will continue to increase. Dangote Cement aims to have a production capacity of 21.5 Mta by the end of this year, which would make it the new No. 1 in the region. In 2015, Dangote aims to have a production capacity of 46.3 Mta in the Sub-Saharan region. It also plans to build new import terminals with a capacity of 4.2 Mta in addition to its existing import capacity in Nigeria. This will allow it to service the markets in Sierra Leone, Liberia, Ghana and the Ivory Coast with cement from Senegal and Nigeria.

PCC, like Dangote Cement, is also pursuing a pan-Sub-Saharan growth strategy. Beside South Africa, Botswana and Zimbabwe, the company is focusing on Zambia, Malawi, the DR Congo, Tanzania, Kenya, South Sudan and Ethiopia. In Ethiopia, PCC recently acquired a ten percent share in Habesha Cement. In the DR Congo the company plans to purchase the Cinat plant, which is urgently in need of modernization.

By comparison, the activities of the international cement companies Lafarge, Holcim, HeidelbergCement, Vicat and Cimpor are rather minor. In contrast, several Chinese companies are already breaking into the market, as shown by the example of Ethiopia. Other countries in East Africa are also on the Chinese “to-do list”.

5 Prospects

Überschrift Bezahlschranke (EN)

tab ZKG KOMBI EN

This is a trial offer for programming testing only. It does not entitle you to a valid subscription and is intended purely for testing purposes. Please do not follow this process.

This is a trial offer for programming testing only. It does not entitle you to a valid subscription and is intended purely for testing purposes. Please do not follow this process.

tab ZKG KOMBI Study test

This is a trial offer for programming testing only. It does not entitle you to a valid subscription and is intended purely for testing purposes. Please do not follow this process.

This is a trial offer for programming testing only. It does not entitle you to a valid subscription and is intended purely for testing purposes. Please do not follow this process.