North Africa’s cement industry facing great challenges

Summary: The cement industry in North Africa is being considerably affected by the current political upheavals in the region. However, in Tunisia at least the expected slump in cement sales did not yet occur in the first quarter of 2011. In Egypt, plant stoppages caused a loss of about two production weeks. In Libya, production has come to a total standstill since the beginning of the civil war. The situation in Morocco and Algeria is also regarded as tense. The coming months will be marked by hope and fear and the cement industry naturally wants the situation to return to normality as quickly as possible. The following report deals with the situation of the cement industry in the North African countries and describes the prospects up to the year 2012.

Historical changes generally occur infrequently. It is therefore really remarkable that such an upheaval is currently taking place in a part of the world where the political and social situation had up to now been regarded as relatively stable. Triggered by protest movements in Tunisia, an entire region has been gripped by demands for more democracy, freedom and economic reforms. In Tunisia and Egypt the long-established governments were swept away by the peoples’ protests. Heads of state, like Egypt’s President Mubarak, who had previously been courted by western nations, are now...

Historical changes generally occur infrequently. It is therefore really remarkable that such an upheaval is currently taking place in a part of the world where the political and social situation had up to now been regarded as relatively stable. Triggered by protest movements in Tunisia, an entire region has been gripped by demands for more democracy, freedom and economic reforms. In Tunisia and Egypt the long-established governments were swept away by the peoples’ protests. Heads of state, like Egypt’s President Mubarak, who had previously been courted by western nations, are now in custody facing charges of corruption and embezzlement of state funds. In Libya the protest movement developed into a civil war and the international community found itself obliged to intervene. In the other North African countries of Morocco and Algeria the situation is also regarded as tense.

This happened after the North African governments had come through the global economic crisis with flying colours, judging by the yardstick of economic growth in recent years. In 2010, for example, the economic growth in Tunisia was 3.7 %, in Egypt 5.1 % and in Libya 4.2 %. Particularly in Libya, the economy was expected to show positive development and the construction sector was set to expand after the increase in oil prices. Nevertheless, the dissatisfaction of the predominantly young population of these countries and the increasing divide between rich and poor shows that the economic statistics did not reflect the reality of poverty, unemployment and lack of perspective. Peoples’ hopes now rest on the interim governments and on the promised elections and economic reforms. However, it cannot be expected that the new governments will achieve quick success. The road to democracy and economic reforms will be a long and difficult one.

Anyone who thought that cement production in Tunisia and Egypt would collapse due to the political crisis has been positively surprised. In Tunisia 1.61 million tonnes (Mt) were produced in the first quarter of the year, after 1.59 Mt in the 1st quarter of 2010. This is an increase of 1.5 %. In Egypt the events in January and February caused about two weeks’ loss of production. However, stocks of cement were high and distribution was quickly resumed. The situation in Libya is different. The civil war has put a stop to cement production. All the country’s cement factories have been closed down since the middle of February. The Austrian Asamer Group, which owns shares in three factories, has temporarily evacuated all non-Libyan employees from the country. However, a total loss of the factories, which seemed likely in March, has very probably been averted thanks to the increasing dominance of the western forces.

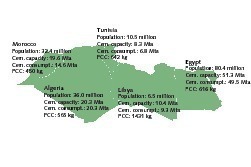

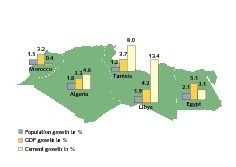

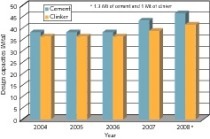

The countries Morocco, Algeria, Tunisia, Libya and Egypt currently have a total population of 165.8 million (Fig. 1). Their cement production capacity is 110 million tonnes per year (Mta). In 2010, cement consumption was 100.4 Mta, corresponding to an average per capita cement consumption (PCC) of 606 kg after 445 kg in 2006 [1]. By comparison, Western Europe has a PCC of only about 440 kg (2010). The highest PCCs in North Africa are in Libya (1431 kg), Tunisia (642 kg) and Egypt (616 kg), while the lowest are in Morocco (450 kg) and Algeria (565 kg). The figures for population growth, economic growth and increase in cement consumption for 2010 also show an uneven picture (Fig. 2). Egypt and Libya have the largest growth in both population and economy, while Libya and Tunisia have the highest growth in cement consumption. The lowest growth in cement consumption was registered in Morocco.

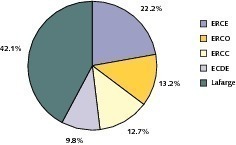

The economic and political situation in the country is tense. Algeria started privatizing the cement industry a few years ago, having established a holding company (GICA = Group Industriel de Ciments d’Algérie) for this purpose. This now holds all four state-owned cement producers. Of the country’s total of 14 cement factories, with their total capacity of 20.3 Mta (Fig. 3), GICA is currently the majority shareholder in 12 cement factories with a total cement production capacity of 11.7 Mta. The remaining capacity of 8.6 Mta at two factories (Fig. 4) is owned by Lafarge, due to their takeover of Orascom. Of the state-owned companies, ERCE owns a capacity of 4.5 Mta at 5 factories in Ain El Kebira, Ain Touta, Hamma Bouzaine, Hadjar Soud and El Maa El Abyad (Tebessa). Then come ERCO with 2.7 Mta at 3 factories in Saida, Beni Saf and Zahana, ERCC with 2.5 Mta at 3 factories in Rais Hamidou, Sour El Ghozlane and Meftah and ECDE with a capacity of 2.0 Mta at the factory in Chlef.

Up to now, 4 minority shareholdings have been granted. 35 % of the shares in the Beni Saf cement factory were sold to the Saudi-Arabian company Pharaon Commercial Investment. Lafarge purchased 35 % of the shares in the Meftah factory and simultaneously took over management of the factory under a 10-year contract. Buzzi Unicem took over 35 % in each of the two factories Sour el Ghozlane (Fig. 5) and Hadjar Soud and thus influences a cement production capacity of 2.1 Mta. ASEC Cement (Citadel Capital) took a 35 % shareholding in Zahana Cement. The new plant that ASEC is planning in Djelfa for an ultimate cement production capacity of 3.2 Mta is the most important planned capacity expansion. The first stage of the plant is due to commence operations in 2012. ASEC also plans to extend the Zahana factory from its present 1.2 Mta to 2.8 Mta. In 2011, Lafarge is going to expand its grinding capacity by 0.5 Mta. The capacities of the state-owned factories in Chlef, Ain El Kebira and Beni Saf are to be increased by 6.0 Mta.

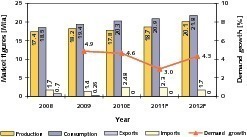

As regards growth in cement consumption, Algeria has a midfield ranking compared to the other North African countries, with a latest figure of 4.6 %. In 2010, Algeria’s cement consumption was 20.3 Mta, of which approx. 2.5 Mta or 12.2 % was imported (Fig. 6). Exports were reduced to practically zero. Cement output came to 17.8 Mta, which - with an installed capacity of 20.4 Mta – corresponds to a plant capacity utilisation of over 87 %. For the next two years a further significant growth has been forecast. However, in 2011 the increase will probably be only 3 %, which is lower than in recent years. No new production capacity will become available before the end of the year, so that the only way to cover the cement demand – at least until the end of 2012 – will be a relatively high import rate. No significant exports are expected until after 2013.

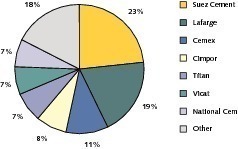

Egypt’s economy is going in the right direction, even if the IMF forecasts an economic growth of only 1.0 % for 2011. 16 cement companies are currently responsible for a production capacity of 51.3 Mta, of which 1.1 Mta is white cement. The market is practically controlled by 8 international cement companies, who influence 41.8 Mta or approx. 81 % of the cement production capacity. Figure 7 presents an overview of the market shares of the most important companies. The market leader Suez Cement (Italcementi) has a controlling interest in Tourah and Helwan Cement (Fig. 8) and has a cement production capacity of 12.0 Mta at 5 plants. Lafarge, number 2 in the ranking, is the sole shareholder of ECC = Egyptian Cement Company (Fig. 9) after taking over Orascom. The ECC plant consists of 5 identical cement production lines with a capacity of 2.0 Mta each. Assuit Cement (Cemex) is in 3rd place with one plant with a capacity of 5.4 Mta.

The subsequent places are taken by Cimpor (3 plants from Ameriah Cement, 4.0 Mta), Titan (2 plants from Alexandria Portland and Beni Suef Cement, 3.8 Mta, Fig. 10), Vicat (Sinai Cement, 3.6 Mta) and National Cement (1 plant, 3.5 Mta). The other cement producers include Arabian Cement (span. Cement la Union), Misr Beni Suef Cement, South Valley Cement, Misr Qena Cement (28 % equity interest in ASEC), Medcon and the white cement manufacturer Sinai White Cement (a Cementir company). In the next few years a number of capacity expansion measures will be implemented. If all the projects currently in hand are actually completed, around 14.5 Mta of new capacity will be created by 2014. In addition, up to 12 further licenses are to be granted.

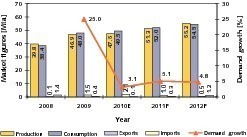

In 2009, cement consumption leapt by 25 % to 48.0 Mta (Fig. 11). 1.5 Mta had to be imported in order to cover the demand for cement. Exports, which were still at a level of 1.4 Mta in 2008, were drastically reduced to 0.4 Mta. This was enforced by an export ban. The growth in demand slowed down noticeably in 2010 and the consumption of 49.5 Mta meant that the rate of increase was only 3.1 %. Imports increased to 2.1 Mta. The latest figure for the cement output rate was 47.5 Mta with the production capacity of 51.3 Mta; this corresponds to a capacity utilization of 93 %. For 2011 and 2012 a rapid increase in output rate to 51.3 and 55.2 Mta is forecast. This growth will be carried by new cement production capacities. The import rate will decline again. The per capita cement consumption is expected to rise to 650 kg by 2012.

Thanks to a building boom, Libya’s cement industry enjoyed a rapid growth in recent years, but present events have put a stop to that. Practically all the construction projects have been put on ice. There is great uncertainty regarding their future, particularly with respect to the project financing. At the moment there is no sign of an end to the civil war and a return to normality. Up to now, three cement producers have been present on the market. The existing 8 cement factories have a total capacity of 10.4 Mta. Ahlia Cement Company (AhCC) has a capacity of 4.4 Mta at its four plants in Maghreb, Lebda, Suk Elkhamis and Zliten. In 2009, a new kiln line for 3200 tpd was brought on line in Zliten (Fig. 12). The AhCC plants are located in the western part of the country, close to Tripoli. With a capacity of 3.2 Mta the Arab Union Contracting Company (AUCC) takes 2nd place in the ranking. The AUCC cement production lines in Burj, to the east of Tripoli, were put into operation in 2005 and 2010.

The Libyan Cement Company (LCC) was formed in 2008 from a joint venture of the Asamer Group and the Libyan Social and Economic Development Fund (ESDF). LCC owns the three cement factories Benghazi, Al-Hawari (Fig. 13) and El-Fataiah, which have a total capacity of 2.8 Mta. These factories are located in Benghazi and 300 km east of Benghazi. The Asamer Group had planned to expand the plants to a capacity of 4.8 Mta by 2012. The amount invested would have been around € 90 million. Other investors were also attracted by the building boom. Al Hadena Cement ordered a new 4600 tpd cement plant from FLSmidth. ESDF contracted the Chinese company CNBM to build a new 3000 tpd plant. A short time later, CNBM were awarded an order for a second plant with 4600 tpd. And in 2008 Italcementi announced that it was entering into a joint venture for a 4.0 Mta plant. But Italcementi at least seemed to have lost interest in Libya even before the civil war.

In 2009 and 2010 the country’s cement consumption showed a double-figure growth rate (Fig. 14). Local cement factories were not able to cover this demand and so about 2.1 Mta had to be imported, which corresponds to 22.5 % of the cement demand of 9.3 Mta. Capacity planning was based on the assumption that Libya could produce about 11 Mta of cement in 2011 and around 13 Mta in 2012. Such scenarios no longer have any meaning. Market experts believe that even if a political solution is quickly found, no more than 45 % of the cement quantity consumed in 2010 will be needed in 2011. Looking further ahead, it is forecast that the 2012 consumption figure will be hardly more than 55 % of the 2010 level. One way in which the Libyan cement producers could cut their losses would be to raise exports. Libyan cement would be very competitive and its purchase by Western countries would also provide real economic assistance for the ill-fated country.

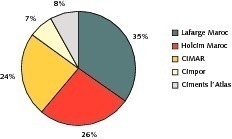

The economic development of Morocco is closely linked with that of the European Union and particularly with that of Spain and France, with which it has close trading relationships. For this reason, Morocco’s economic growth of 3.2 % in 2010 was comparatively low and the construction sector started faltering. The cement industry had substantially expanded its production capacities in recent years because of the good economic development of the country [2]. In 2010 Morocco had 11 cement factories and three separate grinding plants with a total capacity of 19.6 Mta and only five cement producers (Fig. 15). The market leader is Lafarge Maroc with a capacity of 6.8 Mta from three cement plants in Bouskoura, Meknès and Tetouan (Fig. 16) and one grinding plant in Tangiers. Lafarge and its long-established partner SNI (National Investment Company) each own 50 % of the Lafarge Maroc shares.

The next two places in the ranking are taken by Holcim Maroc and Ciments du Maroc (Cimar) with capacities of 5.2 and 4.7 Mta respectively. Cimar is a member of the Italcementi Group. Holcim owns plants in Fez, Oujda and Settat (Fig. 17), as well as a grinding plant in Nador. Cimar owns three cement plants in Safi, Marrakech and Ait Baha. When the Ait Baha plant was commissioned, the plant in Agadir was shut down. Cimar also operates a grinding plant in Laayoune. Newcomer Ciments de l’Atlas with its new 1.6 Mta plant in Ben Ahmed (Fig. 18) near Settat is in 4th place in the ranking, before Asment de Témara (Cimpor), who have a capacity of 1.33 Mta. Ciments de l’Atlas will shortly be commissioning a second, structurally identical plant with a capacity of 1.6 Mta at Beni Mellal. Further new plants are being planned by Ynna Asment (2.2 Mta) and the Spanish firm Essentium (2.2 Mta).The new production capacities have intensified the competitive situation in the country. The clear market definition that was to be found some years ago no longer exists.

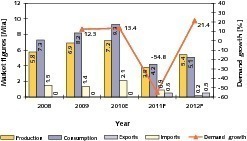

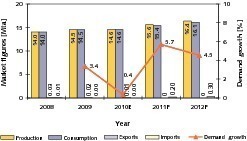

In 2010, Morocco’s cement consumption stagnated. After a growth of 3.4 % in the preceding year, the country only managed an increase of 0.4 % or 0.05 Mta (Fig. 19). Cement production increased from 14.5 to 14.6 Mta. The import and export rates are negligible. Forecasts for 2011 predict a small increase in demand, raising the per capita cement consumption from 450 kg to 468 kg. Correspondingly, the national cement consumption figure is expected to reach 15.4 Mta in 2011 and 16.1 Mta in 2012. This amounts to a growth of 5.7 % and 4.5 %. Exports will remain very small. The main export destination will presumably be Algeria. However, in view of the new cement production capacities and the relatively low production rates, capacity utilization can be expected to worsen [2].

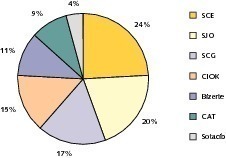

Tunisia’s latest statistics put economic growth at 3.7 %, but available forecasts anticipate a substantial slow-down. This will have a severe effect on the construction and cement industries. Currently, the cement production capacity is 8.3 Mta at a total of seven factories [3]. As shown in Fig. 20, the market leader is SCE (Sociéte des Ciments d’Enfidha), owned by the Spanish Uniland Group/Cementos Portland Valderrivas. The plant in d’Enfidha (Fig. 21) has a production capacity of 2.0 Mta. The two following places are taken by SJO/Cimpor (Les Ciments de Jebel Oust) and SCG/Secil (Les Ciments de Gabès) with 1.7 Mta and 1.4 Mta respectively. These are also Iberian-owned companies. CIOK (Société des Ciments d’Oum El Kelil) is still 100 % state-owned and has a production capacity of 1.2 Mta. Ciments de Bizerte has a capacity of 0.9 Mta, while CAT (Ciments Artificiels Tunesiens), in which the Italian firm Colacem has a stake, has 0.75 Mta. The list of companies is completed by the white cement manufacturer SOTICIB with a capacity of 0.35 Mta (Fig. 22). Cementos Molins has a 65 % stake in SOTICIB.

Since Tunisia began privatization in 1998, capacity expansions have remained within narrow limits and relatively high capacity utilisation figures have been achieved over the years. In December 2010, Ciments de Bizerte contracted Polysius to upgrade one of their two existing kiln lines. However, due to political developments this contract has not yet been put into force. In 2012, a newcomer – Carthage Cement – was expected to enter the market with a new plant in Djebel Ressas with a capacity of 2.3 Mta. Whether FLSmidth can continue building the plant as planned appears unresolved at present. Belhassen Trabesi, a brother-in-law of the deposed president Ben Ali held a 15 % stake in this venture. At the moment, his 15 % share has been frozen. It will presumably either be transferred to the Tunisian state or offered to a foreign investor.

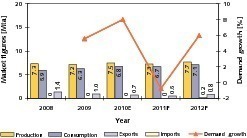

In 2010 the country’s cement consumption rose by 8.0 % to 6.8 Mta (Fig. 23). Production output was 7.5 Mta [3]. Approx. 0.7 Mta were exported, mainly to Libya and Algeria. It should be noted in this connection that in the last three years exports have continuously fallen from the figure of 1.35 Mta. Cautious estimations expect that cement consumption will increase by 3.0 % to 7.0 Mta in 2011. Due to political developments in Libya it can be expected that their importation of Tunisian cement will decrease. It is not clear whether the Tunisian manufacturers can compensate for this by exporting elsewhere. For 2012, a healthy increase in cement demand can again be expected. Forecasts anticipate a rise of 5.8 % to a level of approx. 7.4 Mta. In 2012 the per capita cement consumption will exceed the figure of 642 kg achieved in 2010.

North Africa’s cement industry hopes that the national economies will quickly return to normality and that the construction sector will not go through a lengthy lean period. Smaller local companies would be harder hit by such a lean period than the big international players, who can compensate for losses in North Africa with profits in other regions. When one considers the relatively high stake held by international players from Europe in cement production capacities in North Africa, it becomes clear that the Mediterranean region is increasingly regarded as a common market. Cement companies from Portugal, Spain, Italy, France and Greece have made a particularly high commitment to North Africa. With Cemex (Egypt), a further global player has joined the scene. The Egyptian company ASEC could succeed Orascom in becoming one of the region’s most important competitors. In Algeria, the progressive opening of the market will bring increasing privatization.

Überschrift Bezahlschranke (EN)

tab ZKG KOMBI EN

This is a trial offer for programming testing only. It does not entitle you to a valid subscription and is intended purely for testing purposes. Please do not follow this process.

This is a trial offer for programming testing only. It does not entitle you to a valid subscription and is intended purely for testing purposes. Please do not follow this process.

tab ZKG KOMBI Study test

This is a trial offer for programming testing only. It does not entitle you to a valid subscription and is intended purely for testing purposes. Please do not follow this process.

This is a trial offer for programming testing only. It does not entitle you to a valid subscription and is intended purely for testing purposes. Please do not follow this process.