The cement industry in Egypt

Summary: The cement industry in Egypt started in the twentieth century. Since the establishment of the Tourah Portland Cement Company in 1927 the Egyptian cement industry has witnessed a steady growth. And also a future look at the developments shows that huge expansions are to be expected. By establishing new or expanding existing production lines or by establishing new cement companies during the next three years Egypt aims to cope with the increasing consumption of the local market. It is estimated that around 16 Mt of clinker will be added, pushing the design capacity to 54.8 Mt of clinker. As for cement, it is expected that about 18 Mt will be added to the design capacity, which will increase from 46.6 Mt in 2008 to around 61.8 Mt in 2010. Furthermore, Egypt became one of the main exporting countries, with exports reaching their peak in 2004 at about 12.1 Mt of cement.

The cement industry in Egypt started in the twentieth century. In 1927, the Tourah Portland Cement Company was established, followed by the Helwan Cement Company south of Cairo; then, in 1949, the Alexandria Cement Company was incorporated. The prevalent production method at the time was the wet process. Those companies were owned by foreign companies under the private sector regime, and this state continued until the 1952 revolution, which established the first national company with Egyptian capital in 1956. In 1962, all these companies were nationalized and were then owned by...

The cement industry in Egypt started in the twentieth century. In 1927, the Tourah Portland Cement Company was established, followed by the Helwan Cement Company south of Cairo; then, in 1949, the Alexandria Cement Company was incorporated. The prevalent production method at the time was the wet process. Those companies were owned by foreign companies under the private sector regime, and this state continued until the 1952 revolution, which established the first national company with Egyptian capital in 1956. In 1962, all these companies were nationalized and were then owned by the public sector. During that period, total production in Egypt did not exceed 3.5 Mt until 1980, when the dry process was adopted.

The Suez Cement Company was founded in 1977 and it started production in 1983. In 1985, the Assiut Cement Company started production, and then the Amriyah Cement Company, in the Alexandria Governorate, started production in 1987. In 1994, the Beni Suef Cement Company was commissioned. Thus, there were then seven factories owned by public sector, while one, namely the Suez Cement Company, was working in accordance with the private sector law, until the beginning of the 1990s.

At the beginning of the 1990s, the government started a new course for economic reform, and in 1991 Law No. 203 was passed with a view to liberating the public sector and transforming it into a public-works sector, and to cancelling the cement pricing system. Prices became subject to market mechanisms and supply and demand requirements. Some shareholdings of the public works sector were issued in the stock market to widen ownership. At the end of the 1990s, and specifically in 1996, the Egyptian Cement Company was established and it started production in 1999, followed by the Sinai Cement Company which started production in 2001, then the Misr Cement Company (Qena), which began production in 2002, and finally the Misr Beni-

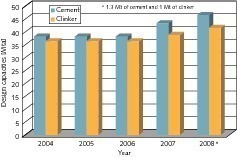

Suwayf Cement Company that started production in 2003. Up to now, Egypt embraces thirteen cement producing companies with all types of grey and white cement, whose total design capacity in 2008 was 41.6 Mta of clinker and 46.6 Mta of cement (Figs. 1–3, Table 1). By the beginning of 1999, the Beni Suef Cement Company and the Assiut Cement Company were sold to their controlling investors, namely Lafarge and Cemex respectively.

In 2000, the Alexandria Cement Company was sold to Blue Circle and the Amriyah Cement Company to Cimpor. Furthermore, the Suez Cement Company acquired 66 % of the Tourah Portland Cement Company, and Ciments Français bought 25 % of the Suez Cement Company. In 2005, Italcementi and other investors acquired 80 % of the Suez Cement Company, and in the same year, Italcementi acquired the Helwan Cement Company.

In 1970, design capacities reached 2.5 Mt of cement, and since that date these capacities have jumped at an accelerating pace when new companies started production. At this stage, design capacities recorded 15.9 Mt in 1992 (including 0.3 Mt of white cement). In 2000, the cement industry witnessed an increase of its design capacity, registering 26.8 Mt of clinker, up at 68.55 % on 1992 figures. It increased to 36.4 Mt of clinker in 2004 then to 38.8 Mt in 2007. In 2008, capacities rose to 41.6 Mt of clinker, with the commissioning of the second 1 Mta clinker line of the Sinai Cement Company and with the Arabian Cement Company starting production with a design capacity of 1.8 Mt of clinker. As for cement, its design capacity registered 38.2 Mt in 2004 and increased to 46.6 Mt in 2008, including white cement whose design capacity rose from 0.3 Mt to 0.75 Mta.

In view of the growth of consumption year after year, most companies announced the addition of new production lines. Moreover, new cement companies were introduced, like

the Arabian Cement Company, the Misr Aswan Cement Company and the ASEC Cement Company. All the new production lines and companies are expected to enter the production stage by 2010, and they are envisaged to add around 16 Mta to the 2008 capacity of 41.6 Mta of grey and white cement clinker, to become 54.8 Mta.

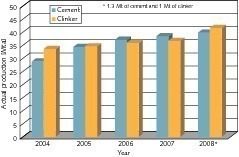

The actual capacities reached during 1990 were 13.2 Mt of clinker and 14.2 Mt of cement; then, they increased to 22.4 Mt of clinker and 24.2 Mt of cement in 2000. Starting in 2005, and with the commissioning of new lines and the entrance of the some greenfield plants into the production phase, actual production reached 34.6 Mt of clinker and 34.3 Mt of cement. Clinker production registered 36.6 Mt and cement production achieved 38.4 Mt in 2007, and in 2008, actual production registered 41.6 Mt of clinker and 39.8 Mt of cement.

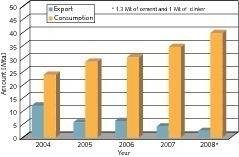

Since the 1970s and up to 2001, imports constituted an important basis to cover the needs of local markets in Egypt, reaching their peak in 1999 to register 6.4 Mt of cement. Then they began to decline to 1 Mt in 2001. However, with the increase of design and production capacities as a result of expansion of this industry and the entrance of new companies, Egypt became one of the main exporting countries (Tab. 1), with exports reaching their peak in 2004, registering 12.1 Mt of cement. Then exports began to decrease to 5.7 Mt in 2005 then to 4.1 Mt in 2007. In 2008, exports declined to 2.5 Mt of cement and clinker due to the increase of demand in the local market.

In 1980, local consumption of cement was 7.6 Mt and increased to 26.6 Mt in 2000 (Tab. 1). From 2005, consumption started to increase with development plans executed by the government as well as housing projects. In 2005, consumption reached 28.8 Mt and increased to 30.5 Mt in 2006 then to 34.4 Mt in 2007 and to 39.8 Mt in 2008. It is expected that consumption will increase to around 41.2 Mt in 2009 and to 43 Mt of cement in 2010.

A future look at the developments in the cement industry would show that cement industry in Egypt is witnessing huge expansions, whether by establishing new production lines or constructing new cement companies that will start production during the next three years, with a view to coping with the increasing consumption of the local market. It is estimated that around 16 Mt of clinker will be added (Table 2), pushing design capacity to 54.8 Mt of clinker. As for cement, it is expected that about 18 Mt will be added to the design capacity, which will increase from 46.6 Mt in 2008 to around 61.8 Mt in 2010.

Überschrift Bezahlschranke (EN)

tab ZKG KOMBI EN

This is a trial offer for programming testing only. It does not entitle you to a valid subscription and is intended purely for testing purposes. Please do not follow this process.

This is a trial offer for programming testing only. It does not entitle you to a valid subscription and is intended purely for testing purposes. Please do not follow this process.

tab ZKG KOMBI Study test

This is a trial offer for programming testing only. It does not entitle you to a valid subscription and is intended purely for testing purposes. Please do not follow this process.

This is a trial offer for programming testing only. It does not entitle you to a valid subscription and is intended purely for testing purposes. Please do not follow this process.