Unlimited growth potential in Indonesia

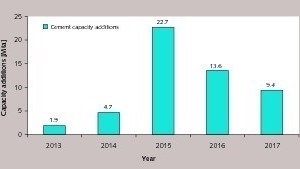

Indonesia is experiencing not only a boom in cement consumption but can also expect a rapid expansion of production capacities, particularly in the years following 2015. This market survey analyzes the cement industry of the country with the fourth largest population in the world and ascertains whether the new cement production capacities are actually needed.

1 Introduction

1 Introduction

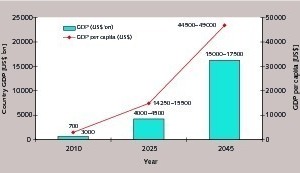

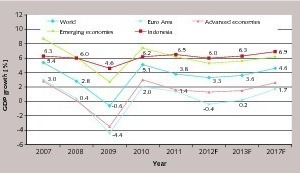

Figure 2 shows Indonesia’s economic growth over recent years compared to other groups of countries, with a view forward until 2017. It is clear that the country has come through the latest global economic crisis relatively unharmed and will also enjoy a stronger upturn as from 2011 than the other emerging countries. However, a growth of 6-7 % (as forecast in the current World Economic Outlook of the IMF) will not be sufficient for Indonesia to achieve the benchmark figures foreseen in the MP3EI master plan. The average annual rate of growth required by the Indonesia master plan from 2010 to 2025 is 12.7 %. Sulawesi is earmarked to achieve the biggest nominal increase in GNP of 13.8 %, while the target for Sumatra is 13.2 %. Indonesia’s main island, Java, has been assigned the slightly above-average figure of 12.8 %.

The master plan focuses on a total of eight sectors, including the steel and textile industries, the foodstuff and beverage industry, the transport industry, the automobile industry and the mining sectors copper, nickel and bauxite. The sectors are split up into a further 22 economic activities, such as the palm oil and rubber industries. No mention is made of the building materials and cement industries. However, the master plan does contain lengthy lists of identified infrastructure projects. A large portion of the expenditure of 205 billion US$ planned for the period 2011 to 2014 is earmarked for the development of the country’s road and rail network, harbours, power stations and other infrastructure projects. It is intended that private investments should account for the massive amount of 75 billion US$.

2 Cement production and consumption

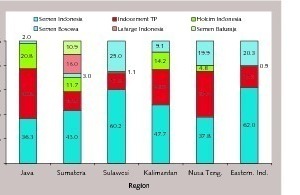

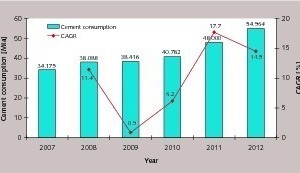

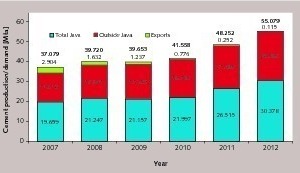

Figure 4 provides information concerning the development of cement production. This rose from 37.079 Mta in 2010 to 55.079 Mta in 2012. Plants on the main island Java produce most of Indonesia’s cement. In 2007, 53 % of the produced cement went to satisfy demand in Java, while 39 % went to the other islands of the Indonesian archipelago and 8 % was exported. In 2012, Java consumed 55 % of the produced cement, while 45 % went to the other islands and exports accounted for a negligible 0.2 %. Cement consumption outside of Java thus increased disproportionately in this period. In 2011 and 2012 the islands of Kalimantan and Sulawesi experienced the highest consumption increases, while Sumatra’s growth rate was below average. The reconstruction of a plant in the province Aceh after the Tsunami of December 2004 meant that 1.0 to 1.6 Mta of cement was imported annually from 2005 to 2011 by one cement company.

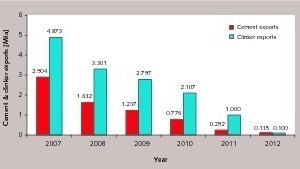

Exports of both cement and clinker have fallen dramatically in recent years (Fig. 5). While cement and clinker exports still amounted to 2.90 Mta and 4.87 Mta respectively in 2007, in 2012 they were only 0.11 Mta and 0.10 Mta respectively. The most important reasons for the declining exports are the increasing domestic consumption rates, the rising capacity utilization, the low demand for import cements, the increasing competition on the main sales markets of Sri Lanka, Bangladesh and Ghana and finally the low revenue achieved with exports. For example, suppliers from China and Vietnam have increasingly taken over clinker exports to Bangladesh, while the main competitors for cement exports are Pakistani producers.

3 Overview of cement producers

Indocement Tunggal Perkasa, a member of the HeidelbergCement Group takes place 2 in the rankings. Indocement has a cement production capacity of 19.1 Mta at its Citeurop (12.9 Mta, Fig. 9), Palimantan/Cirebon (3.8 Mta) and Tarjun (2.4 Mta) plants. In 2011, it increased its cement output by 19.1 % to 15.4 Mta. The achieved plant capacity utilizations were between 76.3 % (Citeurop) and 95.2 % (Palimantan). In 2013, a new cement grinding plant will be put into service at the Citeurop plant, raising its cement production capacity by 1.9 Mta. In 2012, the Samarinda cement terminal on the island of Kalimantan was put into operation.

The number 3 cement producer is Holcim Indonesia with a total capacity of 9.5 Mta at integrated plants in Naragong (4.7 Mta, Fig. 10)and Cilacap (2.9 Mta), as well as two grinding plants in Johor Bahru (1.2 Mta) and Ciwandan (0.7 Mta). For a capital expenditure of over 400 million US$, Holcim is planning a new cement plant in Tuban for a production capacity of 1.7 Mta.

Semen Bosowa Maros currently has a cement production capacity of 3.4 Mta at its integrated plant in Maros (South Sulawesi) and a grinding plant in Batam, 20 km south of Singapore. In 2010, Semen Bosowa concluded an agreement with the CTI Group for supplying the cement plant with clinker from the Middle East. Place 5 in the rankings is taken by Lafarge Indonesia, who reconstructed the Aceh cement plant (Fig. 11) and recommissioned it in 2011 with a production capacity of 1.6 Mta. The two other cement producers in Indonesia are Semen Baturaja (Persero) (1.2 Mta) and Semen Kupang (0.5 Mta). In 2009/2010 it was rumoured that both these companies would be taken over by Semen Gresik. However, Persero is now 100 % state-owned while Kupang was purchased by the Ganda Group of Singapore.

4 Expansion of cement production

capacity and newcomers

However, the expansion plans of practically all these companies, with the exception of Semen Indonesia, Holcim, Indocement and perhaps Semen Bosowa clearly show that the current cement boom in Indonesia was noticed too late, and that the expansion plans of the other competitors were also falsely evaluated. It is also possible that when the two new 8000 t/d kiln lines Tuban IV and Tonasa V of Sesem Indonesia were ordered in 2009, they created uncertainty among other potential investors as to whether the market could actually support such capacities. In 2010, Indocement commissioned a new cement grinding plant at their Palimantan works and were also relatively early in setting a strategic course for a second new grinding plant. Holcim then followed with their Tuban order in July 2011. Semen Bosowa signed contracts for two grinding plants in December 2011.

5 Market shares and expansion strategies

Under these circumstances, all the Indonesian cement producers are focussing on expanding their cement transportation logistics. Semen Indonesia, for example, is planning to add 15 new packing plants to its existing 19 by the year 2015. This situation makes it especially difficult for newcomers to achieve significant market shares in the regional markets of Indonesia. OneStone Consulting has analyzed the strategies involved in the individual new major cement projects in the country. The result shows that, depending on the expansion stage or project phase, the companies have already constructed around five cement terminals and in some cases also separate grinding plants by the time the clinker production line is put into operation. In addition, two cement transport ships are generally required for supplying the cement terminals. Subsequently, as a second expansion stage, further cement terminals are added in order to supply other focus markets.

The problem faced by every individual cement production company is that their competitors’ plans are not exactly transparent, and that there is also a high probability that the competitors are aiming at the same niche markets. In the future, companies will be facing the increasing problem that the niche markets or undersupplied areas that they have identified for their own future activities will previously have been entered and served by their competitors.

6 Prospects

Überschrift Bezahlschranke (EN)

tab ZKG KOMBI EN

This is a trial offer for programming testing only. It does not entitle you to a valid subscription and is intended purely for testing purposes. Please do not follow this process.

This is a trial offer for programming testing only. It does not entitle you to a valid subscription and is intended purely for testing purposes. Please do not follow this process.

tab ZKG KOMBI Study test

This is a trial offer for programming testing only. It does not entitle you to a valid subscription and is intended purely for testing purposes. Please do not follow this process.

This is a trial offer for programming testing only. It does not entitle you to a valid subscription and is intended purely for testing purposes. Please do not follow this process.

![6 Cement producers in 2012 [Mta]](https://www.zkg-online.info/imgs/tok_1820d50bc30d4595d6e478c6de2f0fbe/w221_h200_x110_y128_101535769_6c9e7db507.jpg)