Trends in cement dispatch

Traditional ways of dispatching cement are changing and cement producers are paying more attention to process improvements. This article provides an overview about the latest trends, the needs of the producers and how they are met by the equipment manufacturers.

1 Introduction

In recent years cement dispatch has become a cost driver for producers. In emerging markets transportation is about 65 % of the distribution costs, packing makes up 15 % and others (taxes, clearing, forwarding costs etc.) make up the final 20 %. But rather than reduce efforts to lower costs and improve efficiency in the supply chain, investment in the network of distribution terminals and bagged cement delivery warehouses is needed to face growing competition. The more strategically these dispatch facilities are located, i.e. close to urban centers and major areas of...

1 Introduction

In recent years cement dispatch has become a cost driver for producers. In emerging markets transportation is about 65 % of the distribution costs, packing makes up 15 % and others (taxes, clearing, forwarding costs etc.) make up the final 20 %. But rather than reduce efforts to lower costs and improve efficiency in the supply chain, investment in the network of distribution terminals and bagged cement delivery warehouses is needed to face growing competition. The more strategically these dispatch facilities are located, i.e. close to urban centers and major areas of construction, the better the market access. In mature markets all micro-markets are mainly served by bulk cement, as a result of research into market segments, products and customers, while in emerging markets the focus is mainly on urban centers and the market is served by bagged cement via dealers and retailers.

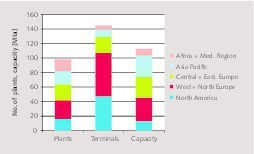

When the number of dispatch facilities of the major players in the industry is reviewed it becomes clear that in developed markets the number of terminals is larger than in emerging markets, where warehouses for bagged cement dominate. For example HeidelbergCement has 98 integrated and cement grinding plants with a combined capacity of 112.6 million tons per year (Mta) as well as 147 additional cement terminals (Fig. 1). The mature markets in North America and Europe combine 73 % of the company’s cement terminals and cement depots but only 4 0% of the capacity and 43 % of the cement plants. Cemex has 13 cement plants and 42 cement terminals in the USA and 15 cement plants and 78 cement terminals in Mexico, which is, for Cemex, also a “mature” market, while for example in Colombia Cemex has 5 cement plants and only 8 land distribution cen-ters or in the Philippines it has 2 cement plants and 4 marine terminals.

Increasing the cement dispatch network follows trend [1]. Other major trends are illustrated in Figure 2, which gives an indication of how cement transport distances have changed in the last few years as well as how the mode of transportation has changed. Although in the last 15 years more cement plants have become operational and the global cement plant density has increased, the average cement transport distance has increased from 160 km to about 190 km. The share of cement distributed by trucks has decreased from 86 % to 82 %, while the share of rail and ship transports slightly increased. Here it has to be noted that rail and ship transports are only used for the primary transportation from the cement plant to the cement terminals, while truck transports are used for both, the primary and secondary transportation to the depots and final customers. Furthermore, the share of bagged cement declined by 5 %, while bulk cement gained a 4 % market share and big bags gained a 1 % market share.

In the following chapters background information is given about how the cement companies face these challenges, how their requirements for cement equipment manufacturers have changed and how the equipment manufacturers try to fulfill these trends. The major topics to be discussed are:

EPC requirements

Rail cement distribution

Cement types and silo conversions

Dispatch flexibility

Automation requirements

2 Challenges and fulfillment of challenges

2.1 EPC requirements

Large and more complex new cement terminal projects are increasingly based on maximum performance, reliability and a given budget. For such projects cement producers are interested in selecting a turnkey supplier that will be able to meet the budget and fulfill specific project requirements. This can include a true turnkey concept, where the supplier will install the terminal for a lump sum within a given schedule on the basis of an EPC-contract (Engineering, Procurement and Construction). In this case all deliveries are the responsibility of the turnkey contractor, including his sub-suppliers. Alternatively packages by other contractors for steel and concrete construction or plant automation are possible. In these cases the turnkey supplier has to provide the equipment, the structural analysis and corresponding workshop drawings for the steel and concrete structures with the appropriate guarantees, to the investor.

Examples of such complex projects are large multi-compartment cement distribution silos or dispatch silos, where ship-unloading, packing, cement blending (mixing) and the integration into existing plants becomes necessary. Cementa AB, a group company of HeidelbergCement, decided to build a new cement distribution terminal (Fig. 3) at Norra Hamnen (Northern Port) in Malmö/Sweden. The new multi-chamber 30 000 t capacity silo was designed to fully cover future needs in terms of storage capacity and cement types and to keep Malmö as an important cement hub in the Swe-dish distribution chain with more than 10 terminals. The new cement terminal is ultra-modern and fully automated, and allows feeding of the silo by trucks as well as Cementa’s own cement carriers. Cement distribution in the first phase is by trucks but can later be expanded to rail transports.

2.2 Rail cement distribution

Rail transportation is known to have several advantages over traditional truck transports, including the ability to move larger cement volumes over longer distances at lower costs. The average transport costs for cement are about 3-4 US$ for every 100 km by rail, while they are at least 12-15 US$ by road. Health & safety, energy efficiency and lower environmental impact are all factors taken into account in investment decisions. Railway projects are known to have high capital investment costs in the beginning but relatively low operational costs. To implement a rail concept, rail cars and locomotives have to be purchased and the terminals have to be adapted for rail distribution.

GCC (Grupo Cementos de Chihuahua) has a strong market presence in the Midwest region of the USA. The cement dispatch concept is based on a number of rail terminals including one distribution terminal in Pueblo. This strategically located terminal comprises four 10 000 t storage silos (Fig. 4), which allow for bulk reloading on four lanes with a combined maximum rate of 2700 t/h, one of the highest rates ever achieved in the industry. The customers are mainly ready-mixed concrete producers as well as concrete block manufacturers, pavers and precasters. Another example is Holcim Schweiz (a member of Lafarge-Holcim), who use rail transport (Fig. 5) for cement and raw materials to and from their rail-linked cement plants Eclépenz, Siggenthal and Untervaz whenever possible. The concept reduces road traffic and the subsequent carbon emissions and also improves safety levels.

2.3 Cement types and silo conversions

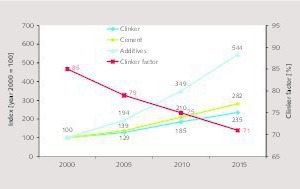

The clinker factor which describes the ratio of clinker used in cement is significantly decreasing globally. In India, for example the clinker factor has decreased from 85 % in 2000 to 71 % in 2015 (Fig. 6). This has several impacts. Not only is the cement capacity growing quicker than the clinker capacity, but also the storage capacities for additives such as fly ash or granulated ground blast furnace slag (GGBFS) are increasing, and the storage capacities for the different types of cement have to be adjusted. In many cement plants and distribution terminals the existing storage facilities can not cover the new demand. Accordingly cement producers are looking for solutions to adequately cover how the new demand can be met. One option, beside new-builds, is to upgrade old unused storage capacities using efficient silo extraction technologies. Another option is to convert large capacity silos into multi-compartment silos.

One such project was undertaken by the Hanover cement plant of HeidelbergCement [2] in Germany. The company decided to reduce the clinker content in its cement mainly for ecological reasons to reduce CO2 emissions. The product portfolio of the plant consists of nine different types of cement, including four different Portland cements and five different slag cements with the content of GGBFS varying from 10 % to 70 %. A new multi-chamber silo for storing cements and GGBFS with integral mixing plant for producing slag cements was installed, and existing cement silos and transport routes had to be upgraded. In total the Hanover plant now has a cement storage capacity of about 27 000 t, split up into 22 different silos (Fig. 7) or silo chambers, including two silo chambers for the storage of GGBF slag. Two small silos are allocated to the mix of bypass dust and clinker cooler dust. Two other small silos are used for special products.

2.4 Dispatch flexibility

High dispatch flexibility has become a major issue for cement producers in the last few years. Not only are cement types on the market constantly changing but sometimes excess capacity can only be exported in bulk form, while the local demand is for bagged cement. In urban centers, in emerging markets, there is often a shift from bagged to bulk cement largely due to increasing RMC (ready-mixed concrete) capacities or other large cement consumers. New requirements also come up when customers require palletized cement bags. This does not necessarily justify an investment in the installation of large and sophisticated plants. Additionally new investors have to supply the market from import terminals, before they enter the market with their own cement production capacity. In situations where demand fluctuates and there are short-term requirements the cement producers have to be careful. Often a short installation time for the new equipment and a low investment cost approach is the main issue.

When Cementos Argos decided to install a new kiln line in the Cartagena plant (Fig. 8) in Colombia a decision was also made to build a new dispatching center, adjacent to the dry process plant. The project required a US$ 35 m investment to take advantage of cement distribution from a free trade zone. Excess capacity which cannot be supplied to the local market is exported to the USA and other markets. Up to 1.3 Mta can be distributed in bagged form and up to 1.0 Mta in bulk form. The dispatching center comprises a system for automatically loading trucks with 1800 bags/h. Palletized bags can also be stored in a warehouse (Fig. 9) with 6900 t capacity. Furthermore bulk loading of trucks is possible via 2 steel silos with 2500 t capacity each.

2.5 Automation requirements

Over the last few years cement producers started paying more attention to the cement dispatch process. The requirement by the cement producers is to achieve a reliable and just-in-time delivery, to reduce loading and waiting times for trucks, to equip trucks with GPS-systems for better location and finally to automate all billing and other commercial issues in accordance with the company’s ERP system. Accordingly dispatch automation systems are required which identify trucks at the plant entrance, complete registration and weighing and guide them to the loading or parking positions. At the loading stations and warehouses the trucks have to be loaded and filled with the appropriate product. Before the trucks leave the plant, they are weighed at the exit gate and a delivery note is printed. Often chipcard systems are used to make the process easier to handle and more reliable.

3 Equipment supplier trends

3.1 Supplier overview

There is a handful of international equipment suppliers, who can handle cement dispatch requirements and are also able to supply all necessary equipment from a single source, within the company group. These suppliers include FLSmidth/Ventomatic, Haver & Boecker Group/IBAU Hamburg/Newtec, Beumer Group/Enexco, Claudius Peters and Moellers. Additionally in the last few years Chinese equipment suppliers have tried to break up this integrated supply chain and then there are a number of suppliers who are capable of supplying single products, such as the storage and dispatch silos, the bulk loading equipment, packers and palletizers and bag loading equipment. Here we concentrate on developments by the main equipment suppliers, who also have their own dispatch automation solutions.

3.2 Silo technology

Concrete silos for large storage capacities of up to 20 000 t and more as well as steel silos for small and midsize capacities up to 5000 t have become the preferred types in cement dispatch. Dome systems and flat storage facilities are not so frequently used. However, for all storage types pneumatic extraction is used. IBAU Hamburg is one of the leading suppliers in the sector. About 10 000 central cone silos (Fig. 10) have been supplied so far to the cement industry, either as single-compartment or multi-compartment silos [3]. For multi-compartment requirements honeycomb designs can be provided. The company also supplies prefabricated steel silos, flat storage facilities (Fig. 11) and extraction systems for dome silos. Two of the major concerns today are the optimization of energy requirements and the elimination of wear in downstream equipment. With the IBAU discharge system up to 25 % of the energy can be saved in material extraction and download transport [4]. Another leading supplier is Claudius Peters Technologies, who provide several designs. The EC-silo (Expansion Chamber) with one central outlet (Fig. 12) is still the preferred solution.

3.3 Bulk dispatch facilities

Bulk cement dispatch by all major suppliers is mostly regarded as state-of-the-art, environmentally friendly technology with little opportunity for improvement. But this is not true when there are rising requirements for larger loading capacities, shorter loading times and the separation of different products that have to be loaded. The requirements for larger capacities and shorter loading times come mainly from the increased rail loading demand and the requirement to load a complete train with 60 rail cars in less than 1 hour. The new Hofuf rail terminal (Fig. 13) at the Saudi Cement Company (SCC) is such an example. Here prefabricated steel silos are used. By using eight silos, two trains can be loaded in parallel with 16 x 250 t/h loading capacity. The net loading time for a train with 60 rail cars is just 20 minutes and about 1 hour when the time for the railway yard and chute positioning is taken into account. If different blended cements have to be handled, then an adequate material separation in the transport lines becomes necessary to avoid product impurities.

3.4 Cement packing and palletizing

With the acquisitions of EEL by FLSmidth, Enexco by Beumer and Newtec by Haver & Boecker, the leading suppliers in the sector have been able to improve their market position and scope of supply [5]. Packer capacities have increased considerably from 4 to 12 and 16 rotating filling spouts (Fig. 14). Seal technologies and packing into plastic bags (PE) are widely increasing due to environmental aspects and a number of other advantages. Palletizers (Fig. 15) also have to cope with larger capacities. However, there is not just a trend to bigger and cleaner. With the focus on cost optimization Ventomatic have very successfully introduced the Ventocompact concept (Fig. 16) to the market. The Ventocompact is a complete production line composed of a rotary packer with supporting structure, automatic bag applicator, bag treating and sorting unit with electronic check weigher as well as a palletizer. The concept allows capacities up to 3000 bags/h.

3.5 Bagged cement dispatch

Manual and semi-automatic bag loading on trucks or railcars is being replaced more and more by automatic bag loading. Automatic bag loaders are an economical solution for the simultaneous loading and palletizing of cement. Beumer and Ventomatic are the leading suppliers. Machine capacities include 2400 and 3000 bags/h. In recent years the Beumer Autopac (Fig. 17) has gained a significant market share in the Sub-Sahara region because of its proven design and excellent investment ratio. North Africa, Latin America and most of Asia are still dominated by the Caricamat technology from Ventomatic. Ventomatic has also successfully introduced the Caricatech autoloader (Fig. 18) and FFL concept (Flying-Fork-Lift), while Haver & Boecker achieved success with the high-performance, palletless SpeedRoad-system (Fig. 19), which is for capacities of up to 3000 bags/h with the ability to handle many different truck types, bags, and loading patterns.

3.6 Dispatch automation

Cement dispatch automation solutions are offered beside the major equipment suppliers by large process automation suppliers such as ABB, Siemens and Rockwell Automation as well as specialist companies. In many cases automation processes have been adapted from other industries. The product family VAS by Fritz & Macziol is one of the market leaders in logistics and dispatch automation systems. More than 160 systems have been delivered to the cement industry so far, including major producers such as Lafarge, Holcim, HeidelbergCement and Cemex. The Java-based application software spans the entire process chain from delivery to dispatch, loading and delivery [6]. As a link between ERP systems and technical systems, VAS represents a key function for efficient process sequences (Fig. 20). In addition, the system supports reporting functions and supplies real-time information to other systems, for example for production, sales or controlling. All external technical systems such as the weighing, silo extraction or metering technology are completely integrated into the process.

4 Outlook

Cement producer expectations for the dispatch sector are increasing. This leads to new and more sophisticated products from the equipment suppliers. However, investments are more carefully considered and cost efficiency has become the major issue. On the one hand this leads to more EPC contracts, especially when the projects become larger and more complicated with the necessity for customer-oriented solutions. On the other hand there is a dramatic increase in demand for standardized and compact machines and equipment, which are easy to operate and require a minimum of maintenance. Process transparency is provided by IT-systems.

Überschrift Bezahlschranke (EN)

tab ZKG KOMBI EN

This is a trial offer for programming testing only. It does not entitle you to a valid subscription and is intended purely for testing purposes. Please do not follow this process.

This is a trial offer for programming testing only. It does not entitle you to a valid subscription and is intended purely for testing purposes. Please do not follow this process.

tab ZKG KOMBI Study test

This is a trial offer for programming testing only. It does not entitle you to a valid subscription and is intended purely for testing purposes. Please do not follow this process.

This is a trial offer for programming testing only. It does not entitle you to a valid subscription and is intended purely for testing purposes. Please do not follow this process.