Market trends in marine cement terminals

The amount of cement being handled at cement transshipment terminals all around the world is increasing, although the global seaborne cement trade is declining. The background facts and their significance for the international plant engineering business for import terminals is discussed in this report on the basis of the latest market figures.

1 Introduction

1 Introduction

2 Overview of global cement transportation

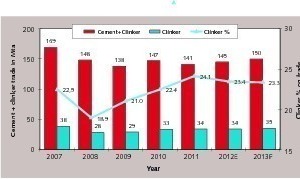

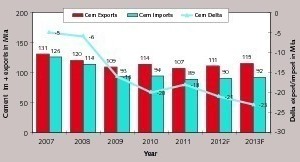

Fig. 2 depicts the cement import and export figures as well as the differences between importation and exportation. That there are differences between the import and export figures is due to the fact that the countries and other bodies publishing data mostly state precise export figures but uncompleted import figures [2]. Cement imports are undertaken not only by cement companies but also by independent importers or companies of the concrete industry for their own requirements. This causes corresponding gaps in the statistical recording. The cement export figures therefore provide more exact information about the actual trade in cement. The graph shows that exports fell from 131 Mta in 2007 to 109 Mta in 2009 (-17 %). Since that time, exports have shown a slight upward trend with figures varying between 107 and 115 Mta. The difference between exports and imports have become bigger and bigger: starting with an original difference of 5 Mta, it has now reached 23 Mta, i.e. in 2013 an imported quantity of approx. 20 % remains unaccounted for.

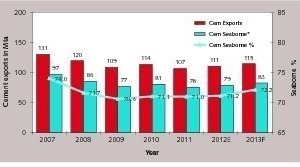

The amount of exported cement transported by ship (incl. the Canadian Great Lakes) in the overall cement export volume is shown in Fig. 3. In 2007, the quantity transported by ship was 97 Mta or 74 %. In subsequent years, this amount declined, mainly as a consequence of the collapse in markets in the USA, Spain and Nigeria, to 70-71 % [3]. Since 2012, a slight increase in maritime transport has been apparent. The market is particularly characterized by surplus cement capacities in the exporting countries, demand for cement and relatively high cement prices in the importing countries, and by the freight charges for maritime transport. There can be large differences between neighbouring countries, such as those currently existing between the United Arab Emirates (UAE) and Saudi Arabia. While cement demand is stagnating in the UAE, where there is also a high surplus capacity, so that prices are in the order of 54.5 US$/t (1st quarter of 2013), Saudi Arabia‘s cement demand rose by 10.7 % in the 1st quarter of 2013 compared to the preceding year, and current cement prices are around 68 US$/t.

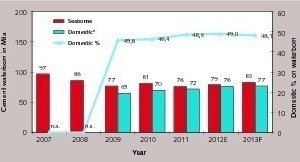

However, the market for marine terminals is influenced not only by cross-border cement exports, but also by the ship transport of the various countries‘ domestic markets. Domestic transportation is not only handled by barges, but also by oceangoing cement ships, for example domestic cement transportation in Japan, South Korea, Taiwan, Australia, Vietnam and Indonesia. Fig. 4 presents data for all cement transportation by ship, including percentage figures for exportation and domestic markets (but not including market data for China). The graph shows that meanwhile the amount of cement transported by ship for domestic markets is almost on the same level as exports. The overall market has grown from 142 Mta in 2009 to 160 Mta with a compound annual growth rate (CAGR) of 3.0 %. At present, domestic markets make up 48-49 % of the overall market quantity.

According to the latest information, around 420 ships are available for maritime transportation of cement. Of these, approx. 315 ships have a capacity larger than 2000 dwt (deadweight tonnage). 22 % of these, i.e. slightly more than 90 ships, are self-unloading cement transport ships, and 330 ships are so-called bulk vessels requiring onshore ship loading equipment for discharging the cement. Most of the self-unloading ships are fully booked by long-term charter, which is partly due to the fact that very few new ships of this type, or conversions, have been built in the last 10 years. For the last two years, however, a slight upward trend has been discernible in the capacities of self-unloading ships.

Bulk vessels are fundamentally classified into 4 size categories: Handy ships with up to 39 999 dwt, Handymax with 40 000-59 999 dwt, Panamax with 60 000- 79 999 dwt and Capesize with 80 000 dwt and more. Handy and Handymax ships are mainly used for cement transportation.

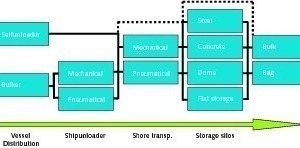

3 Technologies for marine import terminals

Mechanical (continuous) ship unloaders are supplied in a very wide range of sizes. They can therefore be employed for all sizes of terminal and ship and have unloading capacities ranging between 400 and 1500 t/h. Depending on the size of ship, road-mobile mechanical ship unloaders are available for 5000 to 15 000 dwt (Fig. 9), while larger, so-called high-performance ship unloaders (Fig. 10) handle ship sizes of 40 000 dwt and more. The mechanical systems employed for cement are always equipped with screw feeders and screw conveyors that have an energy consumption of 0.5 kWh/t. The technological configuration of all sizes of mechanical ship unloaders is more or less identical. Modern high-performance ship unloaders are usually of modular design, having a lightweight steel structure. To assure a constant material unloading rate, the systems are equipped with speed-controlled extraction screw conveyors [6]. There are also numerous innovations in the technical details.

Conveyance from the ship unloader to the storage silos can also be undertaken by mechanical or pneumatic systems. These involve defined material transfer points, as the ship unloader normally travels along the ship from cargo hatch to cargo hatch. For the transfer points, at which the material is fed to the actual conveyor units, pneumatic troughs have proven particularly effective. The nature of the subsequent conveying equipment mainly depends on the conveying distance, the delivery height and the required throughput. For longer conveying distances of up to 500 m and throughput rates of 400 t/h, screw pumps are generally used. For higher throughput rates the system can be equipped with several parallel screw pumps. Bucket elevators are employed for vertical conveyance, while high-capacity belt conveyors can be used for mainly straight conveying routes.

A total of four well-established storage solutions is to be found at all sizes of terminal, even if one or the other type possesses particular advantages for a certain size of terminal. Usually, steel silos are used for the smallest storage capacities while concrete silos equipped with a central cone handle the largest storage capacities. In between these two extremes, use is made of flat storage halls and dome silos. The fundamental differences and respective selection criteria have been described, for instance, in [7, 8]. In the meantime, pneumatic floor discharge systems are in use for all these types of storage installation. However, mechanical discharge systems are still sometimes employed in flat storage halls and dome silos. Nevertheless, the trend is clearly towards pneumatic discharge systems because these are practically maintenance-free and less susceptible to faults, meaning that they provide more reliable operation. Nowadays, pneumatic systems are also completely encapsulated and dust-tight, thus fulfilling the most stringent environmental regulations.

In recent years, steel silos or batteries of steel silos have been specified in numerous projects with handling capacities of up to 1 000 000 t (Fig. 11). Such silos are relatively simple to erect, and the individual silos can have diameters of 8-12 m and capacities of up to 4000 -5000 t. To assure trouble-free discharge of the cement, the silo bottom is usually cone-shaped and is equipped with an aerated floor. Steel silos also permit a relatively high degree of flexibility with regard to storage of different cement types. Moreover, if the silos are mounted on a substructure, loading lanes can be installed beneath them. Such advantages cannot easily be implemented with dome silos or flat storage halls. Separation of the silo interior into different compartments is pos-sible but not easy to realize. For dispatch purposes, a separate building with suitable intermediate conveyors and dispatch silo feeding system is almost always necessary.

Concrete silos provide the greatest technological capabilities. They can be designed as multi-compartment silos, incorporating all the ancillary equipment into the silo structure. Such silos, which are designed as central cone silos, have become the favoured solution for large storage capacities (Fig. 12). They can include a very broad range of detail solutions, including mechanical mixers, Roto-Packers and several loading lanes located underneath the central cone. Up to now, such cement silos have been constructed with diameters of 30 m and more, and storage capacities of up to 40 000 t. The typical dimensions of storage silos with a storage capacity of 20 000 t are 20 m silo diameter and 60 m silo height. Operation of these silos is very reliable and fully automatable. Nowadays, modern chip card systems that can be operated by the truck drivers are installed in cement dispatch systems with bulk loading facilities.

The greatest innovations of recent years have, without doubt, taken place in flat storage systems. Beginning with no longer up-to-date mechanical discharge systems, the first upgrade stage involved pneumatic trough conveyor systems that enabled complete encapsulation of the storage system. Over the last few years, the non-plus-ultra has become the employment of aeration systems and technologies like that installed for the first time by Golden Bay Cement at the Eastport Terminal in Auckland New Zealand (Fig. 13). There, the entire floor of the flat store is equipped with large-area aeration channels that can be controlled section-by-section [9]. Cement conveyance from the flat store to the dispatch system is handled by screw pumps. Meanwhile, several such systems are either already installed or at the planning stage.

This development has decisively improved the attractiveness of flat storage systems, in recent years, resulting in declining use of dome silos at cement import terminals.

4 Project and contract award trends

5 Conclusions

Überschrift Bezahlschranke (EN)

tab ZKG KOMBI EN

This is a trial offer for programming testing only. It does not entitle you to a valid subscription and is intended purely for testing purposes. Please do not follow this process.

This is a trial offer for programming testing only. It does not entitle you to a valid subscription and is intended purely for testing purposes. Please do not follow this process.

tab ZKG KOMBI Study test

This is a trial offer for programming testing only. It does not entitle you to a valid subscription and is intended purely for testing purposes. Please do not follow this process.

This is a trial offer for programming testing only. It does not entitle you to a valid subscription and is intended purely for testing purposes. Please do not follow this process.

![7 Power consumption for the ship unloading system (FLSmidth [5])](https://www.zkg-online.info/imgs/tok_f3e648eae3665b2f1a1178c18dc68f28/w300_h200_x400_y250_101536620_c4146355ef.jpg)