Optimism in India’s cement industry

In India, the cement supply-demand gap significantly widened due to 55 million t of new capacity in the last three years, together with subdued cement demand and production, with negative growth in 2017. But since this year optimism has come back to the cement industry due to a projected high economic growth and a favorable construction industry development. This market review presents the situation of the cement industry and gives an outlook to 2021.

1 Introduction

Marc Twain noted: “India is the cradle of the human race, the birthplace of human speech, the mother of history, the grandmother of legend, and the great-grandmother of tradition. Our most valuable and most instructive materials in the history of man are treasured up in India only.” At the end of 2020, India will also be the most populous country in the world with a projected 1400 million inhabitants, followed by China with 1397 million. In 2030 India will have a population of 1528 million, while China will have 1418 million. The per capita gross national income (GNI on PPP base)...

1 Introduction

Marc Twain noted: “India is the cradle of the human race, the birthplace of human speech, the mother of history, the grandmother of legend, and the great-grandmother of tradition. Our most valuable and most instructive materials in the history of man are treasured up in India only.” At the end of 2020, India will also be the most populous country in the world with a projected 1400 million inhabitants, followed by China with 1397 million. In 2030 India will have a population of 1528 million, while China will have 1418 million. The per capita gross national income (GNI on PPP base) stood at US$ 15000 in China and only US$ 6400 in India. The percentage of rural population was 57 % in China and 33 % in India (2016 data). So, there is still a long way for India to go, when compared to the development in China.

2 Economic development

The Indian economy has experienced robust growth in the past decade and is expected by the International Monetary Fund (IMF) of the Word Bank in their latest World Economic Outlook (WEO) to be the fastest growing major economy in the coming years (Figure 1). With its recovery from the currency demonetization and the rollout of the GST (Goods and Services Tax), India’s growth is expected to improve to 7.4 % this year, 7.8 % next year and more positive medium-term prospects to 2023 with 8.2 %. Economic growth is expected to gradually rise with continued implementation of structural reforms that raise productivity and boost private investment. India’s projected 2018-19 growth rates are well above China’s 6.6 % and 6.4 % over the same period, and much higher than the average projected growth in the emerging and the advanced countries.

Anil Rai Gupta, Chairman and Managing Director at Indian electricity giant Havells, says India could hit 10 % economic growth if the service sector grows close to 20 %, complemented by 4 % and 8 % growth in its agricultural and industrial sectors. That would not be far short of China in its boom years. But predictions of Chinese-style growth seem over-optimistic in the absence of deeper economic reforms. Doing business in India has become easier in some ways, such as getting permits or bringing in foreign capital. India’s high public debt and recent failure to achieve the budget’s deficit target call for continued fiscal consolidation into the medium term in order to further strengthen fiscal policy credibility will, however, have a negative effect on public spending. Furthermore, over the last couple of years asset quality, especially that of public sector banks, has deteriorated drastically. Accordingly, without a recapitalization of public sector banks, no meaningful and sustainable growth is plausible.

3 Housing, infrastructure and construction needs

India’s construction industry is expected to continue to grow at strong rates over the next decade. The number of Indians living in urban areas will increase from about 460 million in 2017 to about 590 million by 2030. The Housing-for-all-programme (HFA-22), launched in 2015, aims to build 20 million urban homes and 40 million rural houses by 2022. It is the flagship project of Prime Minister Narendra Modi. The programme is expected to bring US$ 1.3 trillion investments to the housing sector by 2025. Figure 2 shows the progress made in Phase I up to FY 2018 (April 2017-March 2018). The affordable housing initiative is aimed at homes with a value of approximately INR 20 lakh (about US$ 30000). Homes in this range are typically located on the outskirts of metros and Tier-I cities. They are aimed at first-time homebuyers in the middle to lower income category.

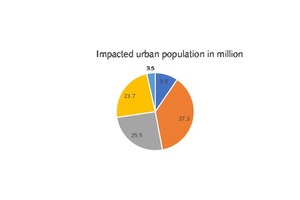

Another initiative is to build 100 smart cities (Smart City Mission) which would reduce the migration of people to metro cities (Tier I). This initiative will further get Tier II and III cities – where India’s tremendous talent pool resides – up to speed with metros bringing these cities into the main stream. Since the initiative’s launch in 2015, great progress has been made. There have been proposals by 99 cities, which impact a population of about 99.5 million (Figure 3). The development of these identified cities will proceed from core infrastructure in order to redevelop slums and other unorganized areas into planned spaces, thus enabling a sustainable life for the citizens. It is estimated that by 2022, the construction and real estate sectors will generate about 75 million jobs and emerge as the largest employer in India.

Up to now, the Indian construction industry accounts for about 8 % of the country’s GDP, employing about 40 million people with a value of US$ 126 billion. Almost 50 % of the demand for construction comes from the infrastructure sector. The Government of India (GOV) is boosting infrastructure by allocating INR 5.97 lakh Crore (US$ 92.22 billion) for the sector. The planned outlay for the road sector is US$ 18.69 billion for national highways across the country, while Indian railways will receive US$ 22.86 billion for capacity creation and redevelopment of 600 railway stations, and another US$ 2.47 billion will be used for the electrification of households in the country. The Airports Authority of India (AAI) has developed and upgraded 23 metro airports in the last five years. By 2020, the AAI aims to bring 250 airports into operation in India. US$ 3.2 billion will be spent to build new terminals and expand existing ones.

At the moment, housing accounts for about 60 % of the cement demand in India (Figure 4). It is estimated that 20 % is for rural housing, 15 % is for urban housing (Tier I) and 25 % is for Tier II and III urban housing. Infrastructure (excl. housing) is responsible for 20 % of the cement demand and the balance of 20 % is for commercial and industrial construction. For the next two years, Nirmal Bang, one of India’s leading institutional equity firms, is projecting a 10.5-12.5 % annual growth in infrastructure spending, while the growth in housing, industrial and commercial spending will remain at 5-6 %. Accordingly, the share of infrastructure in the cement demand will increase from 20 % to 25 %, while the share of housing will decrease from 60 % to 55 %. Cement demand will grow by 7-8 % in the next two years.

4 Cement industry development

4.1 Supply and demand

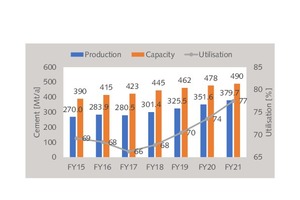

During the last few years, cement demand and subsequently cement production growth in India remained subdued, while cement production capacity increased significantly (Figure 5). Cement production increased from 229.5 Mt/a (million tons per year) in FY2012 to 301.4 Mt/a in FY2018, which corresponds to a CAGR (Compound Annual Growth Rate) of 4.6 %, while cement production capacity increased from 319 Mt/a to 445 Mt/a, which corresponds to a CAGR of 5.7 %. Accordingly, the capacity utilization rate (CUR) declined from 72 % in FY2012 to 68 % in FY2018. In FY2017, production declined by 1.2 % to 280.5 Mt/a, which brought the CUR down to only 66 %. But in FY2018 cement production picked up due to recovery from the demonetization impact and GST implementation.

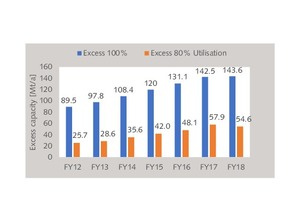

The subdued cement demand and capacity expansion resulted in unfavorable supply-demand dynamics and an increase in the supply gap. Figure 6 shows the development of the total excess capacity at 100 % utilization and the corresponding figure for 80 % capacity utilization. From FY2012 to FY2018 the total excess capacity increased from 89.5 Mt/a to 143.6 Mt/a. In the same period, the excess capacity at 80 % utilization increased from 25.7 Mt/a to 54.6 Mt/a, with a peak of 57.9 Mt/a in FY2017. About 33 %, respectively 147 Mt/a of the cement capacity is located in the South, which comprises Tamil Nadu, Andhra Pradesh and Karnataka. The Southern region has by far the lowest CUR with only about 56 % or an excess capacity of 65.7 Mt/a. The highest CUR in India are in the Central region and Northern region.

4.2. Main cement producers

The cement industry in India is highly fragmented [1, 2]. According to industry sources there are about 65 independent producers, operating 220 large cements plants of which 143 (65 %) are integrated plants and 77 (35 %) are separate grinding plants. The large number of separate grinding plants is mainly a result of the concentration of limestone reserves in only seven cement clusters. Another reason is the production of blended cements which needs large quantities of fly ash, which is mainly produced in coal-fired power plants located close to the markets. Anyhow, for many cement producers it is necessary to have separate grinding plants in order to achieve a good market penetration.

The TOP 10 cement producers combine a cement capacity of about 302.6 Mt/a in FY 2018, which gives them a 68 % market share in terms of capacity (Table 1). The TOP 10 operate 134 cement plants of which 81 are integrated plants and 53 are separate grinding plants. The other producers combine a cement capacity of about 142.4 Mt/a and operate 86 plants of which 62 are integrated plants (Figure 7) and 24 are separate grinding units. The ranking of the TOP 10 has changed significantly in the last few years. The No. 1 is Ultratech with 90.8 Mt/a capacity and 20.4 % market share (excl. 1.5 Mt/a of white cement), after the acquisition of 21.2 Mt/a from Jaypee Cement and the commissioning of 5.7 Mt/a in March 2017. Ultratech, an Aditya Birla company, operates 19 integrated plants and 20 grinding plants in India and two plants with 4.0 Mt/a capacity oversees. In FY2018, the company had a grey cement sales volume of 63.3 Mt/a, which corresponds to a CUR of 70 %.

The No. 2 is LafargeHolcim with 63.1 Mt/a capacity from ACC and Ambuja Cement (ACL) and the sale of Lafarge India to Nirma Cement. ACC (Figure 8) and ACL (Figure 9) operate 13 grinding plants and 16 integrated plants with 21 kiln lines with a clinker capacity of 37.8 Mt/a. In 2017, the group achieved cement sales of 49.8 Mt/a, which results in a CUR of 79 %. ACL proposed setting up a 3.1 Mt/a (9500 t/d) clinkerisation plant at Marwar Mundwa in Rajasthan. The Board of Directors have approved an initial investment of Rs. 1391 Crore towards the first phase of 1.7 Mt/a (5000 t/d) capacity, which is expected to be commissioned in the second half of 2020. LafargeHolcim holds a share of 63.11 % in ACL and 54.53 % in ACC via their ACL share. ACC and ACL decided in February not to pursue a merger at this time. However, they will aim to “maximise synergies” for now and decide later about a merger.

Places 3 to 5 in the ranking are now held by Shree Cement, Dalmia Bharat and Ramco Cement. Shree Cement is rapidly growing and the undisputed no. 3 with a cement capacity of 34.9 Mt/a from four integrated plants and seven separate grinding plants. The RAS plant (Figure 10) has 10 kiln lines with 9.9 Mt/a clinker capacity and is one of the largest in the world. Dalmia Cement Bharat (DCBL) comprises Dalmia Cement, OCL India, Adhunik Cement and Calcom Cement. 85 % of the shares in DCBL are held by Dalmia Bharat and 15 % by the equity investment company KKR. In 2018, DCBL achieved a sales volume of 17 Mt/a of cement, which corresponds to a CUR of 68 %. Ramco Cement operates nine cement plants in Southern India and West Bengal with a total production capacity of 16.45 Mt/a, of which 4 Mt/a are by separate grinding plants (Figure 11).

Places 6-10 in the ranking go to India Cements, Birla Corp, Chettinad Cement, Nirma Cement, and Century Cement (BK Birla). India Cement operates ten cement plants with a capacity of 15.5 Mt/a after the acquisition of Trinera Cement. Birla Corp. (MP Birla Group) acquired the Reliance Cement Company and operates 15.4 Mt/a capacity at ten units, of which the Chanderia Cement Works (Figure 12) is the largest with 4.0 Mt/a. Chettinad Cement has 15.0 Mt/a cement capacity at five integrated plants (incl. subsidiary Anjani Cement). Nirma Cement is a newcomer in India’s cement industry. The company acquired Lafarge India’s cement assets through its wholly-owned subsidiary Nirchem Cement at an enterprise value of about US$ 1.4 billion in October 2016. Century Cement operates 13.1 Mt/a capacity, but this excludes the capacity of the other BK Birla Group companies Kesoram and Mangalam Cement.

The other cement producers comprise a number of well-known names in the cement industry such as HeidelbergCement, JK Cement, My Home Cement, Vicat and Binani Cement. Heidelberg-Cement has a combined capacity of 12.4 Mt/a at four integrated plants and four grinding plants after their takeover of the Italcementi Group, including the Yerraguntla Cement Works (Figure 13). The other major European cement companies in India beside LafargeHolcim and HeidelbergCement are Vicat, which has a capacity of 7.8 Mt/a at two plants and CRH with their partnership in My Home Cement (Figure 14). JK Cement is one of the oldest cement brands in India with 10.5 Mt/a capacity and expansion plans for 18-19 Mt/a in the next few years. Binani Cement has gone bankrupt. Their Indian cement capacity stands at 6.25 Mt/a at the moment.

5 Latest market trends

Despite the increasing gap between cement supply and demand, there has been a price discipline in most of the regional markets, especially those where the large players control the market. According to Kotak Institutional Equities, the plunge in overall cement prices in India in March 2018 indicates that cement producers are chasing market share gains despite increasing input costs. March prices fell by INR 9/50kg bag, offsetting the increases of previous months since December 2017. The decline was led by the Southern region, where prices fell the most with INR17/50kg. Normally, March falls in a seasonally strong quarter. However, April saw a modest rise in cement prices from 322 INR/50kg to 326 INR/50 kg, which is still 6 % below the April prices one year ago. The latest results for May indicate further moderate price increases.

However, the cement price situation and a higher cost pressure because of a sharp rise in energy costs and freight costs due to higher petcoke, coal and diesel prices together with a rise in slag prices and lower sand availability have caused severe problems for a number of cement producers. Accordingly, the pace of consolidation activity in India’s cement industry has picked up. In 2016, Ultratech acquired Jaypee Group’s cement business for US$ 2.38 billion, a deal that added 21.2 Mt/a cement capacity. This year Ultratech will acquire Century Cement from the BK Birla Group, a deal that was already proposed at least in 2015 and comprises 13.1 Mt/a capacity from four plants. Consequently, Ultratech is set to pass the 100 Mt/a capacity mark. Furthermore, Ultratech and its rival Dalmia Bharat are the final bidders for the insolvent Binami Cement.

There have also been a large number of smaller Mergers & Acquisitions (M&A). In 2015 Shree Cement acquired a separate grinding plant in Painipat with 1.5 Mt/a capacity. In 2016, Birla Corp completed the M&A of Reliance Cement with 5.58 Mt/a cement capacity. Orient Cement acquired Bhilai Jaypee Cement and the Nigrie cement grinding unit from Jaypee Group with 4.2 Mt/a combined capacity. HeidelbergCement strengthened its position in India with the acquisition of Italcementi/Zuari Cement. In 2017, JSW Cement increased its stake in Shiva Cement to over 50 %. Furthermore in 2017 the National Company Law Tribunal (NCLT) approved the amalgamation of Trineta Cement by India Cements. Dalmia Bharat Cement is in the process of acquiring two cement plants in Kalyanpur and Murli, which also need approval by the NCLT.

India faces the challenge of disposal of about 150 Mt/a of waste including industrial, biomass and municipal solid waste. Accordingly, many cement producers are looking for solutions to tap this large potential and use the waste as alternative fuels (AF) to save fuel costs and achieve lower CO2 emissions. Consequently, the thermal substitution rate (TSR) increased from only 1 % 7-8 years ago to 4-5 % in 2017. A status paper by the Confederation of the Indian Industry (CII) reported that in 2015 a number of 20 plants had TSRs of larger than 1 %, the average usage by TOP 10 plants was 10 %, the average usage by the TOP 3 was 15 % and the TOP plant had a TSR of 20 % [3]. One of the leaders is LafargeHolcim with ACC and ACL. In 2017 they were co-processing AF in 14 cement plants, 7 of the plants having their own AF pre-treatment facilities, operated by Geocycle. In 2017, about 736 thousand tons of waste were processed, of which almost 80 % was industrial waste.

6 Outlook

The cement market in India is at a turning point. In the last decades, cement demand was growing 1.2 times faster on average than the GDP. If this trend continues, then, given the projected economic growth rates of 7.4-7.8 % in this and the next year and 8.2 % by 2023, the cement industry can be very optimistic. However, in the projection (Figure 15) the considered growth rates in cement production are 7.45 % for this financial year and 8.0 % for the coming years. Accordingly, cement production will increase from 301.4 Mt/a in FY2018 to 379.7 Mt/a in FY 2021. It was calculated that 5-10 Mt/a of the production are going into exports, so the cement demand will be 1.7 % to 2.6 % lower than the cement production, depending on the export/import situation.

Capacity expansion is expected to slow down from a CAGR of 5.7 % in the period 2012 to 2018 to a CAGR of 3.3 % from 2018 to 2021. Accordingly, there is room for an improvement of the cement capacity utilization rates. In the projection with new installed capacity of 45 Mt/a in the coming three years, the CUR will increase from 68 % to 77 %, and consequently the oversupply below 80 % CUR will decline from 54.6 Mt/a to 12.3 Mt/a. Under this scenario the cement prices will significantly increase and the financial performance of the cement producers should improve. Eventually, more newcomers such as Nirma Cement and Emami Cement will be attracted by these conditions and will expand their investments.

//www.onestone.eu" target="_blank" >www.onestone.eu:www.onestone.eu

Überschrift Bezahlschranke (EN)

tab ZKG KOMBI EN

This is a trial offer for programming testing only. It does not entitle you to a valid subscription and is intended purely for testing purposes. Please do not follow this process.

This is a trial offer for programming testing only. It does not entitle you to a valid subscription and is intended purely for testing purposes. Please do not follow this process.

tab ZKG KOMBI Study test

This is a trial offer for programming testing only. It does not entitle you to a valid subscription and is intended purely for testing purposes. Please do not follow this process.

This is a trial offer for programming testing only. It does not entitle you to a valid subscription and is intended purely for testing purposes. Please do not follow this process.