Russian cement market: current state and development perspectives

The Russian cement industry is actively developing by increasing the production and consumption of cement, in combination with a large-scale modernization. Producers have the necessary reserve capacity to meet the demands of the building industry. By 2020, the country will build new production lines for the production of cement in a total volume of 30-40 Mt to meet the growing demand of the building industry for cement.

1 Introduction

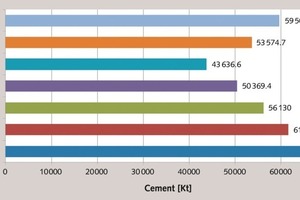

The modern Russian cement industry currently includes 58 cement plants with a total combined capacity of more than 95 Mt. The largest cement companies in the Russian market are the “Euro-cement group”, with a market share of more than 30 %, the Holding Company “Sibirskiy cement” (11 %), “Novoroscement” (more than 8 %). The Russian cement industry is a dynamic field. After the crisis in 2009, a steady increase in the production of cement has been observed (Fig. 1).

During 2012, 61.5 Mt of cement was produced, which was 10.5 % higher than in the previous year. This was the largest...

1 Introduction

The modern Russian cement industry currently includes 58 cement plants with a total combined capacity of more than 95 Mt. The largest cement companies in the Russian market are the “Euro-cement group”, with a market share of more than 30 %, the Holding Company “Sibirskiy cement” (11 %), “Novoroscement” (more than 8 %). The Russian cement industry is a dynamic field. After the crisis in 2009, a steady increase in the production of cement has been observed (Fig. 1).

During 2012, 61.5 Mt of cement was produced, which was 10.5 % higher than in the previous year. This was the largest amount produced in the history of the cement industry in the Russian Federation since 1992. However, the consumption of cement increased more significantly to 65.2 Mt, i.e. 13.2 % more than in 2011. It should also be noted that cement production and consumption levels (Fig. 2) were still lower than that of the Soviet period. For example, 83.1 Mt of cement was produced in Russia in 1990.

In 2013, cement consumption and production reached 69.7 and 66.4 Mt, respectively. However, there was an essential slowdown in growth rates when compared to 2012: consumption fell from 13.2 to 8 % and production from 10.5 to 7.4 %.

2 Modernization

The important major trend in the cement industry is the active building of new energy-efficient production lines for the dry cement production method. Over the past six years, which were not easy for the industry, ten production lines with a total capacity of 23 Mt were put into operation (Table 1). Looking ahead to 2025, more than 21 projects with a total capacity of over 37 Mt can be realized in the Russian Federation.

Today 30 % of all capacities operate with the dry production method in the Russian cement industry that means that this indicator has almost doubled compared to 1992, and by 2025 this percentage can grow by more than 50 %.

The conditions stimulating the active building of new cement production lines are outlined below:

Meeting the growing demand for cement in the construction industry. Housing construction in Russia in 2012 has increased by 5.5 % to 69.4 Mt. Projects for the FIFA World Cup, large transport projects, etc. were implemented.

A steady increase in the cost of energy in Russia. The large number of obsolete and outdated wet process cement plants (about 70 % of the total capacity) dramatically increases the power consumption of the cement industry in Russia, which can result, in the medium term, to a sharp decrease in competitiveness of the cement companies and their exclusion from the market.

The introduction of new modern cement production capacities in 2008-2013 has led to a sharp increase of internal competition in the cement market in the European part of Russia.

3 Customs union

The important factors that will influence the state of the Russian cement market are the integration processes into the framework of the Customs Union of Russia, Belarus and Kazakhstan. Abolition of the internal customs duties will allow the producers of these countries to sell cement freely, thereby creating additional competition with Russian producers and vice versa. In 2013, imports of Belarusian cement increased by 20 % and reached 1.2 Mt.

In the case of Belarus and Kazakhstan, major construction projects of new energy-efficient production lines are being developed. In Belarus three new dry process production lines, with a total capacity of 5.4 Mt, added to the existing capacities in 2012-2013 of 4.8 Mt, which led to a significant surplus of cement in the Belarusian market (over 5 Mt) (Table 2).

A similar situation exists in Kazakhstan. Another 5.3 Mt of capacity could be added to the existing 10.2 Mt of capacity by 2015, with a maximum consumption of cement in Kazakhstan of 7.3 Mt, thus the surplus capacity could reach 8.2 Mt.

It can be expected that by 2015, imports of cement from the Customs Union countries, taking into account the capacity reductions, the growth of the domestic consumption and imports to other countries, could increase from 1 Mt in 2012 to 4-5 Mt in 2015-2017, which is 7.7 % of the consumption of cement in 2012 in Russia. In addition, imports of Russian cement to Kazakhstan, which in 2012 amounted to 767 kt, will stop (Table 3).

Thus, we can say that the Russian market has become an integrated market of the Customs Union countries. The influence of the cement manufacturers from Belarus and Kazakhstan on the Russian cement market, and vice versa, will grow.

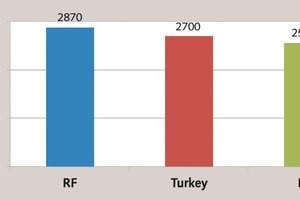

4 Imports

In 2012 the cement market of the Russian Federation had a new trend — a sharp increase in the share of imported cement from foreign countries. In 2012, 4.5 Mt of cement was imported to Russia, that means that the imports increased by almost 80 %. The main supplier countries of cement to Russia were Turkey 1874 kt (doubled), Belarus 981 kt (2.5 times increase) and the Baltics 545 kt (20 % growth). In 2013 the cement market of the Russian Federation remained at the same level and amounted to 5.1 Mt.

This situation was also observed in 2007-2008, but then it was due to a sharp increase in cement consumption in Russia and an acute shortage of capacities to meet demand, which led to an increase in the cement cost in the market, which at peak times reached $200.

The current situation is absolutely different. The country has enough capacities to meet the demands of the building industry.

The main conditions for cement import growth are:

Creation of a Customs Union;

Russia’s accession to the WTO;

Additional cement supply in the world’s market due to the global crisis;

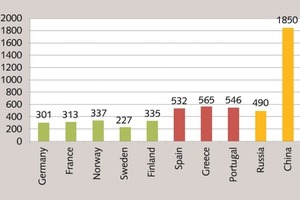

Relative high cement cost in Russia (Fig. 3).

The various reasons for the high cement production cost can be outlined as follows:

Cement companies that have a modernized production are forced to repay the loans, which adds a high investment share to the cost of cement. During the repayment period, these enterprises will be less competitive in the domestic market and the international market;

Cement companies utilizing the worn out production lines of the wet method have high production costs due to high energy consumption; further reducing their competitiveness;

A low level use of alternative fuels and raw materials, which leads to a reduction in the natural fuel costs;

Lack of a developed outsourcing system which optimizes the labor cost.

Thus, the Russian market became open. Any value fluctuations towards the increase will be accompanied by the additional offers of foreign cement. Due to Russia’s accession to the WTO the ability to use the protecting measure is limited.

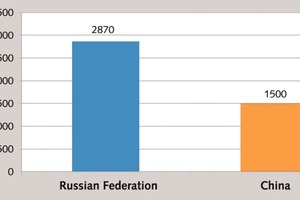

The problem with the import of cement into Russia can negatively influence medium- and longterm perspectives. It is connected to the surplus of cement in the Chinese market. Currently, China produces 2.4 Bt of cement (Fig. 4), which is 1.8 t per capita. The experience of the world leading countries shows that the cement consumption in China will decline steadily (Fig. 5).

In the future, China could become the world’s biggest exporter. Taking into account the relatively low cement cost in China, only $ 50 (Fig. 6), we can assume that it can lead to serious changes in national markets, including the Russian market.

5 Forecast

The 2014 forecast for cement production in Russia is likely to be negative – at best a small growth of between 3–5 % might take place. The main reason for the negative forecast is a general decrease in economic indicators for the Russian economy. In 2014, the import of cement will remain at the same level due to a sharp fall of the ruble.

The highest growth rates are forecast to be in Belarus and Iran. Those countries have a great demand for foreign currency that is the reason why they will increase the supply level by all means, including dumping. In the medium term, there will be a gradual increase in the production of cement in Russia on average of 10 % per year if the world economy remains stable.

Most analysts predict an increase in the volume of cement production in Russia by 2025 to 100 Mt (Table 4), which will require an increase in the production capacity by 30-40 Mt.

In the medium and long-term perspective, there will be a gradual replacement of wet-method plants by dry ones, which will require the construction of additional capacities of approximately 30 Mt.

6 Conclusions:

The Russian cement industry is actively developing the following: increase of the production and consumption of cement; a large-scale modernization of the production; and the producers have the necessary reserve capacity to meet the demands of the building industry.

The Russian cement market, in connection with the creation of the Customs Union and Russia’s accession to the WTO, has become open, which enhances the competitive environment in the market.

It is predicted that by 2020, Russia will build new production lines for the production of cement (dry method) in total volume of 30-40 Mt to meet the growing demand of the building industry for cement. In the long-term prospect it will be necessary to build additional capacity of approximately 30 Mt of lines to replace the wet method with the dry method.

Überschrift Bezahlschranke (EN)

tab ZKG KOMBI EN

This is a trial offer for programming testing only. It does not entitle you to a valid subscription and is intended purely for testing purposes. Please do not follow this process.

This is a trial offer for programming testing only. It does not entitle you to a valid subscription and is intended purely for testing purposes. Please do not follow this process.

tab ZKG KOMBI Study test

This is a trial offer for programming testing only. It does not entitle you to a valid subscription and is intended purely for testing purposes. Please do not follow this process.

This is a trial offer for programming testing only. It does not entitle you to a valid subscription and is intended purely for testing purposes. Please do not follow this process.

![2 Production and consumption of cement in Russia (Mt) [production index (%) compared to the previous year]](https://www.zkg-online.info/imgs/tok_b9786d9f45456a0293304e129c871d91/w300_h200_x400_y203_101519320_7d8f42030c.jpg)

![4 Chinese cement production level [2]](https://www.zkg-online.info/imgs/tok_adaf51af6270b36e8c08f31d3c1d29ea/w300_h200_x400_y196_101519337_83787753a3.jpg)