Latest trends in refractory materials

Today’s focus on cash flow generation in the cement industry leads to an over-simplification of the complexity of cement processes. One example is refractories, which are mostly regarded as commodities. In this article we will look at, what can be wrong with this approach.

1 Introduction

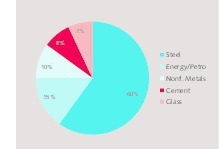

Refractories are indispensable for high temperature industrial processes. Their raw materials are minerals with high melting points, such as magnesite, dolomite and aluminum silicate. The global refractory market exceeds 20 € bn. Roughly 8 %, (1.6 € bn) is used by the cement industry (Figure 1). The largest consumer is the steel industry with 60 % (12 € bn), followed by energy/petrochemical industries with about 15 % (3 € bn) and nonferrous metals with 10 % (2 € bn). The glass industry comes close to the cement industry with 7 % (1.4 € bn). In modern precalciner systems...

1 Introduction

Refractories are indispensable for high temperature industrial processes. Their raw materials are minerals with high melting points, such as magnesite, dolomite and aluminum silicate. The global refractory market exceeds 20 € bn. Roughly 8 %, (1.6 € bn) is used by the cement industry (Figure 1). The largest consumer is the steel industry with 60 % (12 € bn), followed by energy/petrochemical industries with about 15 % (3 € bn) and nonferrous metals with 10 % (2 € bn). The glass industry comes close to the cement industry with 7 % (1.4 € bn). In modern precalciner systems refractories play a critical role in both the rotary kiln lining and the lining of the precalciner, the cooler, kiln hood and burner. Today in the cement industry, refractories are regarded as consumables in a range of 0.65-0.85 kg/t clinker needed for a kiln operation.

From the economic point of view, refractories are responsible for only about 1 % of the operating costs of a cement kiln, but with increasing cost discipline and focus on maximized cash flow, refractories are now classified as a commodity, although process requirements have changed significantly and selection of the right refractory for different temperature and stress zones in the system becomes more and more important. If procurement departments were not judged by the money they saved for a specific refractory volume they bought, but instead judged by the cost of ownership, which should include initial costs, refractory lifetime, energy savings, costs of replacement and unplanned kiln stoppages, caused by the breakdown of refractories, then the selection of refractories will be more carefully made and they will again be regarded as indispensable consumables.

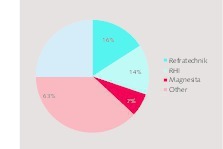

The market for refractories in the cement industry is still very fragmented [1], after numerous takeovers. There are more than 30 important suppliers, worldwide. Figure 2 shows the TOP3 refractory producers for the cement industry with their related 2015 turnover. Refratechnik Cement is the market leader with a turnover of 255 €m in cement and a 16 % global market share, followed by RHI with 14 % and Magnesita with 7 %. Of the TOP3 suppliers Refratechnik Cement is the only one, which is focusing on cement with 69 % of the turnover. RHI achieved 13.0 % of the turnover in cement, while Magnesita achieved 15.8 %. Both companies generate the bulk of their turnover in the steel industry. Refratechnik Cement and RHI are the only two players, which cover the global market in cement, Magnesita is focusing on North and Latin America. Refratechnik Cement and RHI are regarded as the technology leaders within the cement sector.

2 Trends in refractory consumption,

production and prices

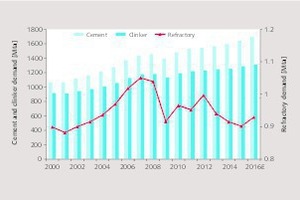

For some years now, with the exception of this year, there has been a decline in the overall refractory consumption in the markets apart from China. Figure 3 shows the development of the global cement and clinker demand outside China and the associated refractories demand, with a forecast for 2016. While the cement production increased from 1065 million tons per year (Mta) in 2000 to about 1700 Mta in 2016, corresponding to a CAGR of 3.2 %, the clinker demand increased from 915 to 1309 Mta, which corresponds to a CAGR of 2.4 %. The reason is that in this period the clinker factor in cement decreased from 0.86 to 0.77 t clinker/t cement. However the specific refractory demand declined from 0.98 kg/t clinker in 2000 to 0.71 kg/t clinker in 2016, so the absolute refractory demand was highest in 2007 with 1.050 Mta and lowest in 2015 with 0.902 Mta over the last 10 years.

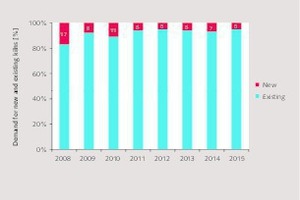

The lifetime of the rotary kiln brick lining generally determines the duration of a kiln operating campaign. The specific demand for refractories decreases with increasing kiln capacity. A new 3000 t/d kiln needs about an initial 2300 t of refractory materials, resulting in 0.77 t/tpd, while a new 5000 t/d kiln plant requires on average 3200 t, resulting in 0.64 t/tpd. In Figure 4 a breakdown of the refractories demand by new kilns and existing kilns is given. In 2008, when 121.7 Mta of new clinker capacity was contracted outside China, the share of refractories for new plants was highest at 17 %. Since then the share for new plants has decreased and is now about 5 %. This percentage in 2015 corresponds to a new contracted kiln capacity of 58.0 Mta [2]. However, a number of other parameters, such as buying behaviour, maintenance spending etc. also have an influence.

Whilst great efforts are made to ensure appropriate refractory materials selection, it is primarily the nature and stability of the subsequent kiln operation and the amount of alternative fuels that influences rotary kiln and preheater lining life. Figure 5 illustrates how the lining concept has changed from 2008 to 2015. In 2008 bricks accounted for about 60 % of the refractory weight and monolithic linings and insulation material for 40 %. By 2015 this had changed to 53 % bricks and 42 % monolithics and 5 % others. The relatively high proportion of high alumina bricks has been reduced from 21 % to only 8 %, while the proportion of fireclay bricks increased from 24 % to 31 %. The concept change from high alumina bricks to alkali-resistant fireclay bricks has been made to achieve a very high resistance to alkali attack in the calciner, cyclones, raw meal ducts, gas ducts, tertiary air duct, inlet chamber and riser duct. Beside alkali attacks there are chloride and sulfate attacks, which mainly result from the ever increasing alternative fuel rates.

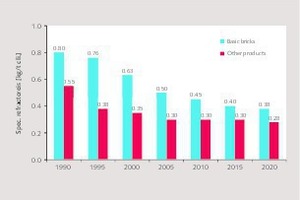

Basic bricks still account for the largest refractory demand, because they are used in the most heavily stressed zone of the rotary kiln and typically need an operational life of one year. A lot of effort has been invested by the refractory industry into improving this figure and consequentially, the specific consumption of basic material has dropped significantly (Figure 6). Instead of 0.8 kg/t clinker in 1990 the average consumption is now 0.40 kg/t. Some new kilns achieve values even lower than 0.3 kg/t. The other lining products also decreased significantly from 0.55 kg/t to 0.3 kg/t. This is partly because kiln plants throughout the world have largely been modernized and wet-process plants, which have high consumption rates, no longer play an important part. The figures indicate that the specific refractory consumption will fall more gradually in the future. The projections for 2020 are 0.38 kg/t for basic bricks and 0.28 kg/t for other products, this will result in a total specific refractory consumption of only 0.66 kg/ t clinker, if appropriate high-quality refractory products and engineering concepts are used.

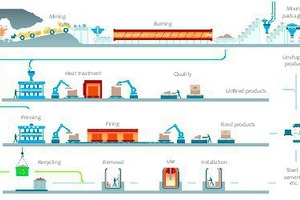

Raw materials account for about 60-65 % of the total production costs of the leading refractory manufacturers. Figure 7 illustrates the production process which starts with raw material mining, burning in rotary kilns, and then producing unshaped products with a mix of other materials, or the pressing of unfired bricks as well as brick pressing and downstream firing in tunnel kilns. Finally the refractories are installed in processes used in the steel, cement and other industries. The lifecycle of the refractory ends with removal and recycling or disposal. The processes today are highly automated (Figure 8). Access to high-quality raw materials and production quality are very decisive because of their influence on refractory product performance. However, it has to be noted that roughly 70 % of the global magnesite deposits are located in China, North Korea and Russia.

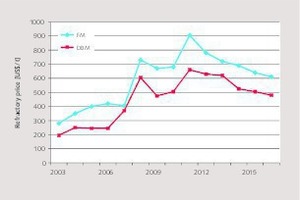

Some years ago top refractory grades were sold at prices of 1000 €/t to over 1300 €/t. With growing competition and decreasing market potential prices dropped. However to be competitive and to gain strategic competitive advantage it has become necessary for refractory manufacturers to have access to their own raw materials. Nevertheless the fluctuation in raw material prices still has a large influence on price formation [3]. Figure 9 shows how prices of fused magnesia (FM) and dead-burned magnesia (DBM) in US$/t have changed over the last few years with a significant decrease, which has been passed on in the product prices of the refractory industry as mentioned before. Currently it seems that the price of the dominating raw materials has bottomed out and it will be interesting to follow the trend over the next few years.

3 Lifecycle aspects

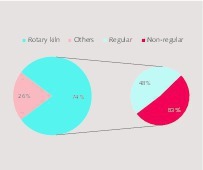

Refractory life is impacted by a number of process parameters including thermal, mechanical, chemical and operational effects (Figure 10). However in an internal investigation of their European-based cement plants by one of the heavy-weight cement producers new facts became evident. The internal analysis (Figure 11) on refractory wear shows that 74 % of the refractories were consumed for the rotary kiln, while 26 % were consumed for the preheater, clinker cooler, kiln hood and burner. However the most interesting fact is that in the rotary kiln only 48 % of the demand was for regular wear, while 52 % was for non-regular wear. Of the non-regular wear of 52 % at least 13 % could be allocated to problems in refractory selection, installation and quality, while the remaining 39 % were caused by unforeseen process parameters and mechanical problems.

3.1 Alternative fuels and measures

against alkali attacks

Today, alternative fuels combined with the loss of refractory knowledge at plant level and consequent poorer buying behavior have the largest impact on refractory performance in the cement industry. Stress to the refractory lining result from thermal, chemical and mechanical influences (Figure 12). Thermal influences result, for example, from the inhomogeneity of the fuels, strong temperature variations, overheating and varying flame position [4]. Chemically there are phenomena such as redox reactions, clinker melting, infiltration of alkali salts and condensation of acids [5]. Also anchor corrosion and corrosion of the steel shell are well-known. And last but not least there are several mechanical problems such as a shift of coating, refractory spalling and shell deformation/non-ovality of the rotary kiln. Figure 13 shows cloggings in the preheater and ring formation in the rotary kiln which resulted from the use of alternative fuels. It is clear that the overlapping of thermal, mechanical and chemical stresses to refractory materials and steel constructions need very close attention to avoid unplanned kiln stops.

The worst damage, due to alkali attacks, occurs in the preheater in the lower cyclone stages and the riser ducts as well as the rotary kiln inlet. Alkali and acid vapours infiltrate the refractory lining and attack the lining phases at temperatures as low as 600-700 °C. The leading refractory suppliers for the cement industry have developed alkali resistant brick and lining solutions to cover these problems, however these solutions are tailor-made and none of them will fit into the commodity approach. One such product which is already widely used is an acidic fireclay material. One of the things that these solutions have in common is that the Al2O3-content in the bricks is reduced to below the conventional 35 %. Other solutions make use of silicon-carbide in SiC-bricks or alkali-silicate impregnation, reaction-sealed fireclay or alumina bricks/castables. These concepts tend to be applicable when the temperature stays above 900 °C which activates the protective sealing effect of the SiC which typically ranges from 5-30 %.

3.2 Energy savings with advanced refractories

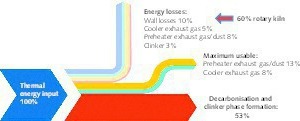

Thermal energy is the highest cost factor in clinker manufacturing, accordingly energy efficiency in cement production has become a major topic. A typical clinker process consumes 53 % of the energy input for decarbonisation and clinker phase formation (Figure 14) [6]. The maximum unusable energy from exhaust gases accounts for 13 % of the preheater and 8 % of the clinker cooler. Combined energy losses account for 26 %, of which 10 % are wall/shell losses, 8 % are preheater exhaust gases, 5 % are cooler exhaust gases and 3 % are from the hot clinker. Of the wall losses alone 60 % are from the rotary kiln and it is clear that the refractory material has a major influence on the wall losses. Accordingly wall temperature measurements have become one tool in the reduction of wall heat losses (Figure 15).

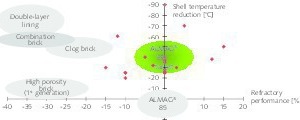

Over the years refractory manufacturers have introduced different concepts to reduce energy losses in rotary kilns such as double layer linings, special clog bricks, combination bricks and so on. The problem with these solutions is, that the gains in wall temperature reductions were only possible with a shorter refractory lifetime. Today, the most promising concept is advanced high porosity brick solutions [7]. Figure 16 shows a new development by Refratechnik Cement. Their ALMAG ES brick is targeting a reduction in wall heat losses of around 15 % for the total kiln and even 40 % in the basic zone of the rotary kilns, without reducing refractory performance, when compared to high-grade bricks such as ALMAG 85 grade.

The German Cement Association VDZ has put this refractory concept to the test in a survey report at a 5000 t/d BAT plant and confirmed the values [8]. The corresponding field application measurements are very promising, although there have been partially overlapping process related fluctuations. However, a reduction of at least 20 °C was achieved and the highest temperature reduction measured at about 90 °C. The refractory performance was clearly within the targeted ±15 %.

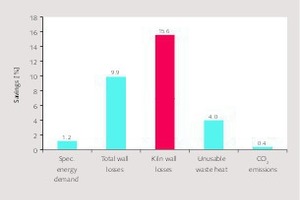

Figure 17 shows a simulation study for the saving potential of the new basic lining concept performed by the German VDZ [8]. Reference case is a 5000 tpd kiln line with 5-stage preheater/calciner with a rotary kiln with L/D = 15 and with a grate cooler. The simulation was carried out for a conventional lining and a thermal optimized lining with ALMAG ES in the lower transition zone of the kiln, the burning zone and upper transition zone. The simulation shows almost 10 % of the system wall losses and almost 16 % of the kiln wall losses can be saved which results in a saving of 2150 t/a coal or 1.2 % of the specific energy demand, 4 % savings in unusable waste heat and 0.4 % in CO2 emissions. In times when the potential to enhance clinker manufacturing efficiency are already exploited to a great extent, this is very significant. The other aspect is, that these savings can be achieved without any large extra investments.

4 Application case studies

Cementos Argos is a Colombian-based cement producer. The company has a cement capacity of more than 20 Mta from 13 integrated cement plants and nine grinding plants in three world regions and 14 countries. In 2008 Cementos Argos started a strategic cooperation project with Refratechnik Cement. At that time the company was operating 19 kilns with a combined nominal clinker capacity of 15 000 Mta. The project aimed at increasing kiln production through lowering time required for repairs, reduction of production loss caused by unforeseen kiln stops coupled with non-availability of refractory materials, reduction of the variety of refractory materials, minimization of inventory levels and last but not least the improvement of the quality of refractory materials and the quality of their installation.

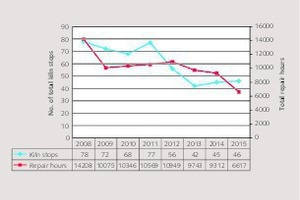

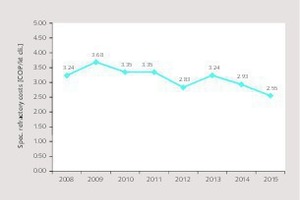

They began with the standardization of refractory shapes, refractory engineering seminars and operator training. The first new refractory installation began in 2011. Results were better than expected [9]. In Colombia from 2009 to 2015 the clinker production could be increased from less than 3.8 Mta to almost 5.1 Mta, which is an improvement of almost 35 %. Figure 18 illustrates how kiln stops and time loss due to refractory repairs have been reduced. In 2008 there were 78 kiln stops which caused 14 208 hours of repair. By 2015 the number of kiln stops had been reduced to 46, which is an improvement of 41 %, while the number of repair hours had been reduced to 6616, which is an improvement of 53 %. What is also significant is that the specific refractory costs have been reduced (Figure 19). In 2009 the specific cost was 3.68 COP/kt, while by 2015 the specific costs were reduced to 2.55 COP/kt clinker.

5 Conclusion

Refractory costs only account for about 1 % of the operating costs of a kiln line. However refractories have a large influence on the plant availability. Small savings in initial refractory costs are more than offset by the costs for unforeseen kiln stoppages and refractory repairs. Accordingly a lifecycle cost approach or cost of ownership approach is suggested here, including the costs of repair and kiln stoppages. Furthermore the commodity approach does not allow for the many advantages, that advanced refractories provide, including significant energy savings and the possibility of using alternative fuels without risking plant availability.

Überschrift Bezahlschranke (EN)

tab ZKG KOMBI EN

This is a trial offer for programming testing only. It does not entitle you to a valid subscription and is intended purely for testing purposes. Please do not follow this process.

This is a trial offer for programming testing only. It does not entitle you to a valid subscription and is intended purely for testing purposes. Please do not follow this process.

tab ZKG KOMBI Study test

This is a trial offer for programming testing only. It does not entitle you to a valid subscription and is intended purely for testing purposes. Please do not follow this process.

This is a trial offer for programming testing only. It does not entitle you to a valid subscription and is intended purely for testing purposes. Please do not follow this process.