Latest trends in alternative fuels

After some years of small increases or even stagnation due to falling energy prices, the use of alternative fuels as a substitute for conventional fuels in the cement industry is on the rise again. This market review will deal with the major trends, while highlighting country trends, cement producer trends, technical trends, as well as market drivers and barriers.

1 Introduction

Co-processing is the use of waste fuels as a source of energy and raw material [1]. This has already been practiced in the cement industry for a couple of decades. The clinker burning process offers excellent opportunities for the safe and sound recovery of a wide variety of AFR (alternative fuels and raw materials). The typical energy recovery of, for example, fluff is 86 % with 6 % Si, 4 % Ca and 4 % Al+Fe material recovery, and virtually no additional waste is produced. Co-processing saves resources and reduces green gas emissions, but the main advantage is more and more seen...

1 Introduction

Co-processing is the use of waste fuels as a source of energy and raw material [1]. This has already been practiced in the cement industry for a couple of decades. The clinker burning process offers excellent opportunities for the safe and sound recovery of a wide variety of AFR (alternative fuels and raw materials). The typical energy recovery of, for example, fluff is 86 % with 6 % Si, 4 % Ca and 4 % Al+Fe material recovery, and virtually no additional waste is produced. Co-processing saves resources and reduces green gas emissions, but the main advantage is more and more seen in the saving of fossil fuels, because cement processing is so energy intensive. However there are large differences from country to country and plant to plant. While a few plants have achieved alternative fuel use rates of almost 100 %, most of the plants still do not use any, if one looks at it from a global perspective [2].

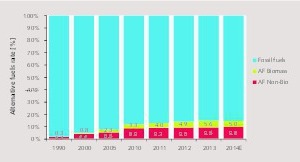

According to the World Business Council for Sustainable Development WBCSD and the “Get The Numbers Right” database of the Cement Sustainability Initiative (CSI) the alternative fuel rate increased on a global scale from about 2 % in 1990 to 5.2 % in 2000, 12.2 % in 2010 to 14.8 % in 2014 (Figure 1). The biomass share increased from 0.3 % to 5.0 % and the non-biomass share from 1.7 % to 9.8 %. These fuel substitution rates are generated from the data of the GNR participants, but these companies only cover 21 % of the global production; nearly 80 % is estimated, as cement producers in China do not report and many Indian cement producers do not provide data to the CSI. So all data apart from that from Europe and North America should be considered as estimations, because there is no accurate data available, yet.

2 Breakdown by regions and selected countries

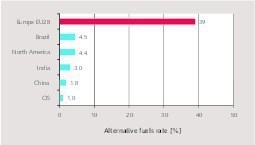

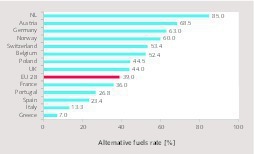

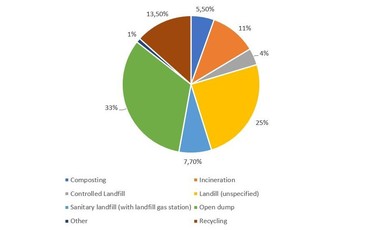

If one looks at the different world regions very large differences in the use of alternative fuels can be seen (Figure 2). Europe is leading with the use of about 39 % alternative fuels (AF), followed by Brazil and North America. China and the CIS countries are at the end of the ranking, both estimated at using less than 2 % of alternative fuels. In the EU the use of alternative fuels varies considerably from country to country (Figure 3). Highest use is in the Netherlands, Austria, Germany and Norway. Lowest is in Southern Europe and countries such as Greece, Italy and Spain. One of the reasons for this is, whether there is a landfill ban on recoverable resources or not. But there are also different behaviours in these countries, including permit practices, the influence of labor associations and a different understanding of the benefits of co-processing.

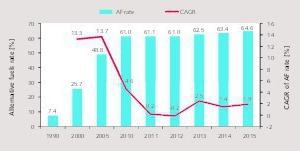

In Germany the thermal substitution rate (TSR) increased from 7.4 % in 1990 to 61.0 % in 2010 and 64.6 % in 2015 (Figure 4). Until 2005 there have been high 2-digit growth rates in the use of alternative fuels. After 2010 the use of alternative fuels plateaued at around 60 %, partly due to economics, partly due to availability and supply of alternative fuels and partly due to technical issues and other reasons. But the increase in the use of alternative fuels is limited and not without problems. In Germany permits for the burning of alternative fuels has not been a big problem. This is different, for example, to Italy, where in 2015 Italcementi operated a total of seven cement plants, but only two had a permit to use alternative fuels. About 0.5 Mta of AF has been exported to cement plants in the EU [3].

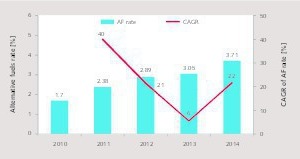

Turkey is the largest cement producer in Europe. In 2015, according to the Turkey Cement Manufacturers Association (TCMB) the installed clinker capacity was 76.5 million t (Mta), the installed cement capacity was 126.1 Mta and the cement production 71.4 Mta, of which 7.4 Mta went into exports. In terms of the alternative fuel rate, Turkey is today at the lower end of the South European countries. In 2010 the alternative fuel rate still stood at 1.7 % (Figure 5). In 2011 and 2012, in Turkey the AF rate saw very impressive annual growth rates. But in 2014 the use of AF still stood at 3.7 %, which is not very much, even when compared to Southern Europe. Of the 49 integrated cement plants in Turkey 20 still used no AF at all in 2014, eleven plants used less than 1 %, ten used between 1 % and 5 %, only seven used more than 10 % and the best in the class only used 26.5 %.

3 Selected cement producer data

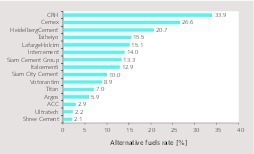

Figure 6 illustrates the AF rates of ten major cement groups in the world. Leading suppliers from China are missing, because they did not report any data. Due to the acquisition of more than 35 Mta capacity disposed of by Lafarge and Holcim, with more than 12 Mta quality assets alone in Western Europe, the Ireland-based CRH is now the world’s leading cement producer in terms of AF use, with a company-wide thermal substitution rate (TSR) of 39 %, followed by Cemex at 26 % and HeidelbergCement at 21 %. LafargeHolcim on the other hand fell to fifth place in ranking and CRH, Cemex, HeidelbergCement and Taiheiyo are now ahead. Leaders from emerging markets are Cemex, Intercement, Siam Cement and Siam City Cement as well as Votorantim.

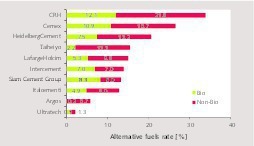

It is interesting to see how the alternative fuel rate of the leading cement producers is split into bio-fuels and non-bio alternative fuels (Figure 7). CRH is also leading in this comparison, with 12.1 % of bio-fuels and 21.8 % non-bio alternative fuels, followed by Cemex with 10.9 % bio-fuels. Generally the cement producers from emerging markets achieve a higher proportion of biofuels, than those from mature markets. Siam Cement Group is leading the biofuels sector in using more biofuels than non-bio alternative fuels. Biomass fuels should be socially-responsible and generated mainly from agricultural waste or other secondary byproducts, rather than being specially cultivated, since they will compete with food crops for land and other resources.

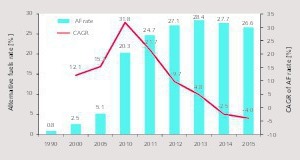

Cemex is the undisputed leader in the use of alternative fuels, when looking at the companies with the most dynamic development. They raised the AF rate aggressively from 0.8 % in 1999 to 20.3 % in 2010 and to 28.4 % in 2013 (Figure 8). But since then the alternative fuel rate has declined and stood at only 26.6 % in 2015. Unfortunately no reasons were given by Cemex for this decline. But it can be assumed it has to do with the availability of the alternative fuels and with the prices in comparison to conventional fuels. Please note that 92 % of all Cemex integrated plants burn alternative fuels. In 2015 eight of them exceeded the 50 % substitution rate.

4 Economic trends, market drivers and barriers

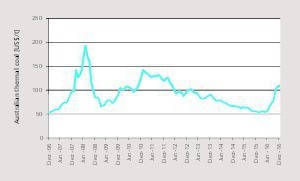

Oil prices are often talked about, but in the cement industry the coal price is much more important and, by the way, the coal price is not tied to the oil price. Following the coal price development from the end of 2006 to the end of 2016, three major peaks and two periods can be seen when the prices massively declined (Figure 9). So from 2010 to the summer of 2016 coal prices heavily declined to just slightly above 50 US$/t. At the end of 2016 with more than 100 US$/t coal contract prices hit their highest level in almost six years and this will have an impact on the alternative fuel use in the cement industry. With increasing coal prices the prices for fuel-grade petcoke also increase and alternative fuels become more competitive.

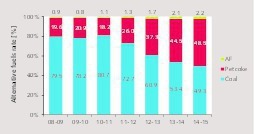

In the last seven years, Ultratech, the largest cement producer in India, increased its AF use from 0.9 to 2.2 % (Figure 10). However, in the same period the use of petcoke increased from 19.6 % to 48.5 %, while the coal fuel rate declined from 79.5 to 49.3 %. Nearly half of the fuels used are now pet-coke and the other half is coal, if alternative fuels are ignored. A different development can be seen at the Monjos Plant of Spanish cement producer Cementos Portland Valderrivas (CPV). The plant started the burning of AF in 2011 and achieved a maximum AF rate in 2012 (Figure 11), while the petcoke rate achieved its maximum in 2016. Fuel-grade pet-coke is always an option, often available with a discount of more than 20 % compared to coal, which makes it very important as a fuel for cement plants.

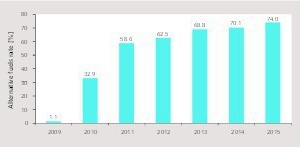

Some countries and some companies achieved a very significant increase in the use of AF in just a few years. In Poland for example the AF rate grew in a record time from less than 20 % in 2007 to more than 50 % in 2015. Since 2013 there has been a landfill ban on separately collected combustible waste and in 2012 the waste-to-energy capacity had a share of less than 0.2 % of the combustible waste. Naturally, the cement industry profited from the situation. Cemex in Latvia is another example. In 2010 they commissioned a new 3500 t/d line. An early decision was made, when the new plant was planned, to use alternative fuels [4]. The results show that AF rates from 0 to 80 % can be achieved in a few years (Figure 12), but this needs the availability of alternative fuels, the acceptance by all the stakeholders and importantly the specific application know-how.

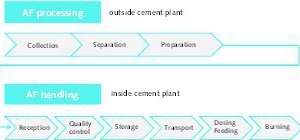

The availability of waste fuels is a very local parameter and without pre-treatment of waste, no high alternative fuel rates can be achieved. Geocycle was established by Holcim in the 1970s and now operates 85 waste pre-treatment facilities in more than 50 countries (2015 data) around the world and has gained an impressive know-how in the use of AF (Figure 13). About 15 million t of waste are treated annually to provide alternative fuels for LafargeHolcim’s cement plants. In Asia, Geocycle has been active in India, Sri Lanka, Singapore, Vietnam, Thailand, the Philippines, Malaysia, Indonesia, Australia and New Zealand. Highest AF rates were achieved by Lafarge Malaysia with 14 % and Holcim’s Siam City Cement with 10 %. Lowest use is in LafargeHolcim’s Indian subsidiaries ACC and Ambuja Cement. This data demonstrates the complexity and difficulty of AF use.

5 Technical trends and observations

The cement industry is using more than 100 different types of alternative fuels. Typical examples are tyres or tyre chips which is also called tyre derived fuel (TDF), other alternative fuels are RDF (refuse derived fuel or residue derived fuel) (Figure 14), SRF (solid recovered fuel), residual oil and solvents, sewage sludge, animal meal and other biofuels such as wood chips, rice husks and other agricultural waste. Oils and TDF have the highest calorific values of about 33-35 and 25-30 MJ/kg respectively, while sewage sludge or dried sewage sludge (DSS) and animal meal have the lowest with about 8-12 and 12-16 MJ/kg, respectively.

However the biggest challenge is to handle such extremely light or very heavy materials with the same equipment. The variation of the material properties can lead to severe problems (compression due to density, stickiness due to moisture, blocking due to particle size, or a combination thereof). Figure 15 gives an idea what kind of technologies are involved. Accordingly due to the complexity of alternative fuels there are many attempts to improve specific equipment or to find even general solutions for key issues. In this review some of the solutions are highlighted. These include the generation of TDR, RDF and SRF, while the focus is on shredding, dosing and processing technology.

5.1 Shredding of TDF and SRF

Tyres are perfect for increasing the calorific value of the alternative fuel mix. Although many attempts are made for the handling, dosing and feeding of complete tyres into the kiln, the trend goes simply to the production of tyre chips, because the material is more homogenious and easier for dosing. When the cement producers cannot buy tyre chips they have the opportunity to install shredders/classifiers, which can achieve the required size reduction and material separation. There are a number of suppliers on the market. The French company Precimeca delivered a fully automatic stationery shredder (Figure 16) to LafargeHolcim, which is able to process tyres of 1200 mm diameter and 500 mm width to supply 50 mm chips. The nominal capacity is 10 t/h and the shredder is driven by 2 x 125 kW motors. The turnkey installation integrates a tyre cleaning device to keep the life-time of the removable knifes at about 2600 h.

For the shredding of giant off-the-road (OTR)-tyres, solutions can be found for example at EcoGreen.

5.2 RDF processing plant

Municipal solid wastes (MSW) are available in a large quantity in almost all countries. If there are no adequate processing plants available, then the concept of the Spanish Grupo SPR can be a solution for cement producers or their waste-pretreatment partners. Such an installation was installed for Cemex Asia in the Philippines in 2014/2015. The installation (Figure 17) is for the treatment of 40 t/h MSW with mainly organic, PET, textile and ferrous metal fractions. The facility comprises screen discs for fine fractions, manual sorting for PET, textile, inert and saleable materials, a primary shredder, a drum for fine rejects, two air drum separators and a secondary shredder. The RDF output is 12-15 t/h with calorific value of 18.8-20.9 MJ/kg, with a humidity of < 20 % and chlorine content of < 0.6 %.

5.3 Handling of alternative fuels

Materials handling specialists for alternative fuels such as FLSmidth, Schenck Process, Aumund, Beumer, Vecoplan, Di Matteo, MHC Engineering, ATS Group/Walter Material Handling offer different technical solutions. The right handling systems requires modular systems which allow the best technical solutions and highest flexibility. Gravimetric dosing screw feeders (Figure 18) and rotary weigh feeders have become the systems of choice. Manufacturers as well as clients claim that both devices are suitable for a variety of alternative fuels. Both offer outstanding reliability and high short- and long-term accuracy. However the feeders are different. In many cases, it can be necessary to reduce the moisture of RDF or other alternative fuels, before dosing and pneumatic conveying. For example the company Di Matteo installed a flash dryer at the Nowiny plant of Buzzi Dyckerhoff in Poland.

5.4 Start-up AF process kit

Customers still require low-cost solutions, compact and robust equipment that needs little maintenance. Plug-and-play solutions are definitely in the trend. An excellent solution consists of start-up kits for alternative fuels as for example offered by Schenck Process for RDF, DSS or other material. Such a system is extremely economical and uses variable concepts. It does not require either structural changes of the plant or reserve silos or an underground pit for the material storage. The alternative fuels are either discharged directly from tractor trailers with “walking floors”, or are delivered in tipping containers. The material is added to the weighfeeder via extraction screws and chain conveyors. The required amount of fuel is fed into the blow-through rotary valve and then conveyed directly to the burner.

6 Outlook on alternative fuels

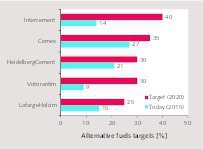

Alternative fuel rate targets set by the cement producers are often linked to targets on greenhouse gas emissions and specifically on the reduction of carbon dioxide.

Figure 19 shows the targets of some selected cement producers and how different the targets are and how far away the companies still are from their targets. The targets by Intercem and Votorantim can be called very ambitious. But Cemex, HeidelbergCement and LafargeHolcim for example are not so far away in their targets and achievements.

Being interested in a global view, a projection to 2030 and even by 2050 given by the Cement Sustainability Initiative is a good discussion base. Western Europe is on a good track to achieve the 60 % goal by 2030, but this means also the countries in Southern Europe have to be fully aware and support the target, otherwise not more than 50 % will be achieved. The developing regions are still far away from this projection. Just think about China, they produce more than 50 % of the global cement, but have only achieved an AF rate of less than 2 %. So anything close to 20 % will be ambitious.

What will be achieved in the future will depend on at least three major issues: Firstly, the development of coal and pet-coke prices. For this year the projections indicate that China will increase coal production and the prices for thermal coal will drop from more than 100 US$/t to 75 US$/t. Second, the regional availability of waste fuels and cement capacity growth. It is clear that when cement markets stagnate or decline, such as in Western Europe, especially with landfill bans, more waste fuels are available per plant when compared to expanding cement markets, without landfill bans and lower availability of waste fuels for new and existing plants. Third and probably the most important, it all depends on enough pre-treatment facilities and the appropriate know-how.

//www.onestone.eu" target="_blank" >www.onestone.eu:www.onestone.eu

Überschrift Bezahlschranke (EN)

tab ZKG KOMBI EN

This is a trial offer for programming testing only. It does not entitle you to a valid subscription and is intended purely for testing purposes. Please do not follow this process.

This is a trial offer for programming testing only. It does not entitle you to a valid subscription and is intended purely for testing purposes. Please do not follow this process.

tab ZKG KOMBI Study test

This is a trial offer for programming testing only. It does not entitle you to a valid subscription and is intended purely for testing purposes. Please do not follow this process.

This is a trial offer for programming testing only. It does not entitle you to a valid subscription and is intended purely for testing purposes. Please do not follow this process.