Global trends in the gypsum industry

The gypsum industry is in an upswing. The largest growth rates are projected for the wallboard (plasterboard) industry, with up to 2-digit growth rates according to some analysts. This market review will feature an outlook on the wallboard (plasterboard) industry in European, American and Middle East/Asian markets and will also outline the future of synthetic gypsum.

1 Introduction

While natural gypsum has been mined and manufactured for centuries, the processing of synthetic gypsum has been available only in the last few decades. Synthetic gypsum is an industrial by-product composed of calcium sulphate dihydrate and has the same characteristics as natural gypsum. A variety of gypsum by-products are available. The most common is FGD (flue-gas desulphurisation) gypsum, beside citrogypsum, phosphogypsum, fluorogypsum and titanogypsum. Technically, one uses the ability of burned gypsum to absorb water and thereby bind when mixed with water. When heated to...

1 Introduction

While natural gypsum has been mined and manufactured for centuries, the processing of synthetic gypsum has been available only in the last few decades. Synthetic gypsum is an industrial by-product composed of calcium sulphate dihydrate and has the same characteristics as natural gypsum. A variety of gypsum by-products are available. The most common is FGD (flue-gas desulphurisation) gypsum, beside citrogypsum, phosphogypsum, fluorogypsum and titanogypsum. Technically, one uses the ability of burned gypsum to absorb water and thereby bind when mixed with water. When heated to about 110 °C, gypsum is formed, at 130 to 160 °C stucco is formed, and above 290 °C anhydrite, in which the crystallization water is completely burned out. Gypsum and anhydrite are used by the cement industry, in wallboard manufacturing, in stucco and plaster and in agriculture.

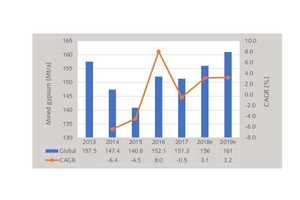

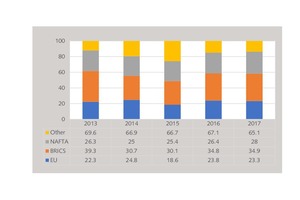

According to the World Mining Data 2019, the amount of mined gypsum and anhydrite stabilized over the last few years after a significant decline in 2015 (Figure 1). For 2018 and 2019 a further increase by about 3 % to more than 160 million annual tons (Mt/a) is projected. The breakdown of the mining output by developed and developing countries is interesting (Figure 2). Normally, it would have been expected that the developing countries would have the largest growth, but the opposite is the case. From 2013 to 2017, developed countries increased their output while in developing countries it was stable and transition countries were also stable. Growth can be mainly attributed to the EU and NAFTA, while the decline mainly affected the BRICS countries (Figure 3), incl. Brazil, Russia, India, China and South Africa.

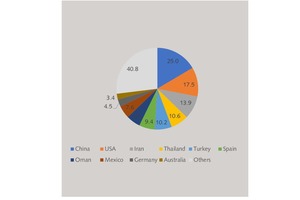

Figure 4 shows the TOP 10 global gypsum mining countries in 2017. China is the leading producer with about 25 Mt/a and 16.5 % market share, followed by the USA and Iran with 11.6 % and 9.2 % market share, respectively. Interestingly, in the TOP10 there are countries such as Thailand, Turkey, Oman, and Mexico, beside countries such as Spain, Germany and Russia. The output of Brazil decreased from 3.4 Mt/a in 2013 to 2.15 Mt/a in 2017. Australia also lost significantly from 4.6 Mt/a to 3.4 Mt/a. However, the country with the largest losses is Iran. After 21.1 Mt/a in 2013, only 13.9 Mt/a were mined in 2017. Oman is the largest-growing mining country with 2.8 Mt/a in 2013 and 8.4 Mt/a in 2017. Saudi Arabia increased its gypsum mining from 1.7 Mt/a to 3.15 Mt/a. The largest growth in 2017 was achieved by India with 2.3 Mt/a in 2016 and 3.0 Mt/a in 2017.

According to a market report by Smithers Apex, the global gypsum market including synthetic gypsum (Figure 5) had a size of 252 Mt/a in 2016. According to a newer research report by the IMARC Group, the market is estimated to be worth US$ 22.4 billion in 2018. For 2024 a growth to US$ 31.7 billion is projected, which corresponds to a CAGR (Compound Annual Growth Rate) of 5.8 % over the forecast period. Nearly all gypsum is used in three main applications, which include building construction (wallboard and plaster), cement (where it is used as a setting retarder) and agriculture (as fertilizer and soil conditioner. Construction will dominate the market in about 10 years with 57 %, followed by cement 40 % and agriculture with about 3 %, according to the gypsum value in these sectors. Other minor applications with less than 1 % include e.g. plaster casts, dentistry and other medical use.

2 The wallboard industry

Gypsum boards/panels are lightweight construction materials that are widely used as walls, partitions and ceilings in interior construction. They are synonymously called drywall, wallboard or plasterboard. Wallboard is easy to install and can be attached to wood, metal framing or other structures. They are recyclable, reasonably priced and provide sound control, versatility, quality and fire resistance. This makes wallboard a preferred construction material and accordingly the market growth of wallboard is amazing. The demand is directly related to the growth of the construction sector and especially the housing sector incl. newbuild, modernisation and repair.

In terms of volume, according to Grand View Research the global wallboard market had a size of about 12.7 billion m2 in 2018, which is projected to grow by a CAGR of 6.3 % to 19.6 billion m2 in 2025. In terms of revenue, the market is expected to grow by 11.4 % in the forecast period. India is expected to be the fastest growing country at a CAGR of 15.6 %. The high demand for residential and commercial construction, together with increasing consumer spending capacity, is driving the gypsum wallboard market growth, due to rapid industrialisation, growing population, increased income levels and improved living standards. However, the growth is limited by natural gypsum production as well as the availability of synthetic gypsum.

According to the Global Gypsum Directory 2019 [1] and own research, there were 440 wallboard plants globally active or temporarily mothballed at the end of 2018. The annual production capacity of these plants is 13.8 billion m2. The largest capacities are in China with 3.0 billion m2 (22 % of the global capacity) and 84 plants or 36 million annual m2 average amount, compared to 31.7 million m2 on a global average amount. When compared to the global wallboard production given by Grand View Research, this would mean a global capacity utilisation of 93.4 %, which from our point of view is too high and unrealistic when the large overcapacities in China and the USA are taken into account.

2.1 European markets

The European gypsum and anhydrite industry had an annual turnover of over € 7.7 billion, of which about 70 % were for wallboard (or plasterboard, the more common name here). More than 150 gypsum quarries as well as 160 gypsum factories (incl. all plants) are operational and more than a million professionals install plasterboard around Europe. Production in Europe is for European markets, to avoid the high transport costs for raw materials and plasterboard and to meet local customer needs.

The total capacity of wallboard plants in Europe, including all Western Europe, Central and Eastern Europe, Russia and the other countries of the Former Soviet Union (FSU), comprises 128 plants and 3.38 billion m2 or 25 % of the global capacity. The largest capacities in Europe are in the UK (405 million m2, eight plants), France (368 million m2, eight plants and Germany (348 million m2, 11 plants). Scandinavia comprises 10 plants with 254 million m2 capacity, Spain, Portugal and Italy comprise 17 plants with 484 million m2. The countries in Central & Eastern Europe combine 15 plants with 411 million m2, the countries in South Eastern Europe comprise 23 plants with 465 million m2 and finally Russia and the other FSU countries comprise 31 plants with 516 million m2.

Europe hosts three of the largest wallboard producers in the world. The new world champion is the Knauf Group after its acquisition of the USG Corporation from the USA. In 2018, Knauf (Figure 6)

generated a turnover of € 7.1 billion and had more than 28000 employees. In 2018, the company produced more than 1.5 billion m2 of wallboard plus gypsum fibre board, gypsum wall panels and about 4 Mt/a of plasters and filling compounds. Knauf operates more than 220 gypsum factories worldwide. In Europe this includes a wallboard capacity of about 1.37 billion m2, excluding gypsum fibre plants. In Knauf’s European plants, the major gypsum resource is synthetic gypsum with almost 60 %. Over the years, natural gypsum as a resource in wallboard production has decreased to less than 40 %, while recycled gypsum still makes up less than 5 %.

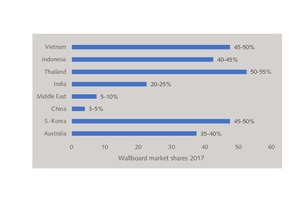

In April 2019, Knauf finalized the acquisition of the USG Corporation, the largest gypsum wallboard manufacturer in North America. USG has 6800 employees and 51 plant locations. In 2017 the company achieved US$ 3.2 billion turnover. These figures do not include USG’s joint-venture with Boral, which has 3200 employees, 49 plant locations (including 18 wallboard plants) and US$ 1.2 billion sales in 2017. Figure 7 shows USG Boral’s wallboard market shares in Asia and Australia. It has strong market shares with 50-65 % in countries such as Thailand, the Philippines and Malaysia/Singapore. Its smallest market shares are in China with 3-5 % and the Middle East with 5-10 %. Knauf agreed to buy USG in mid-2018 for US$ 7 billion. The Australian Competition and Consumer Commission approved the deal in late March 2019 subject to asset divestments relating to the Boral-USG joint venture.

Saint Gobain is the no. 2 in Europe with a gypsum wallboard capacity of about 1.08 billion m2. The company has wallboard assets in more than 20 countries in Europe, the main assets being in the UK/Ireland, France and Germany (lead picture), including brands such as British Gypsum, Placo, Gyproc and Rigips. In Western Europe, Saint Gobain is bigger than Knauf. The Saint Gobain Group had € 41.8 billion sales in 2018 with more than 180000 employees and operates in 67 countries. The construction products sector which includes gypsum, mortars, insulation, exterior products and pipes had a turnover of about € 12 billion. No. 3 in Europe is the Etex Group with a gypsum wallboard capacity of about 523 million m2. Their main wallboard capacity in Europe is in the UK/Ireland, France and Spain. All the other producers in Europe have a combined capacity of less than 500 million m2.

2.2 American markets

The gypsum industry and wallboard markets in the Americas are dominated by the USA. According to the US Geological Survey (USGS), domestic production of natural (crude) gypsum was estimated to be 21.4 Mt/a with a value of US$ 168 million in 2018. 16 Mt/a of synthetic gypsum were used and 5.2 Mt/a gypsum and anhydrite were imported, mainly from Canada, Mexico and Spain, leading to a gypsum consumption of 42.5 Mt/a, which is 0.9 Mt/a more than in the year before. Total wallboard sales were estimated to be 25.5 billion square feet, while the production capacity of operating wallboard plants at the beginning of 2018 was stated to be 33.4 billion square feet. This leads to a capacity utilisation of 76.4 %. The wallboard capacity conversion to m2 results in 3.2 million m2, which is even lower than the figure of 3.63 million m2, published in [1], and which will mean a capacity utilisation of 65.3 %.

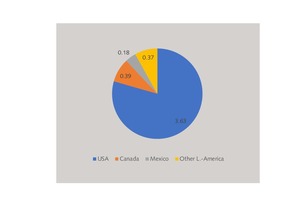

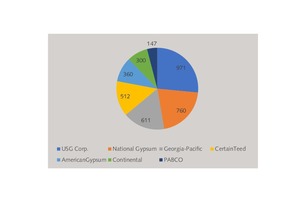

Figure 8 shows the breakdown of the gypsum wallboard capacities in the Americas for the year 2018 [1]. The USA accounts almost for 80 % of the capacities with 3.66 billion m2, Canada for 8.5 %, Mexico for almost 4 % and the other Latin American countries for 8.1 %. In total there are 101 wallboard plants. The USA has 62 wallboard plants operational, Canada has 12, Mexico has seven and in the other Latin America there are 20 at the moment. There are only seven wallboard producers in the USA (Figure 9), after 11 companies in 2008. The capacity is still 14 % below the prior peak level. USG Corporation has the lead with 971 million m2 capacity or 26.5 % of the total US capacity of about 3.66 billion m2. USG operates 15 wallboard (Figure 10) and other gypsum product facilities in the USA, two in Canada, four in Mexico and two more in Other Latin America. In joining the Knauf Group, USG thinks to be even better positioned to meet customers’ needs.

Places no. 2 and 3 in the US market are held by National Gypsum and Georgia-Pacific with 20.8 % and 16.7 % market share, respectively. National Gypsum has 17 operative gypsum board plant locations located in strategic markets nationwide. Four of the plants exclusively produce wallboard using by-product gypsum from nearby coal-fired powerplants. Georgia-Pacific Gypsum, which is part of the Koch Group, operates 12 wallboard plants, of which three are in Texas and one each in Arkansas, California, Georgia, Indiana, Iowa, Nevada, New Hampshire, Oklahoma and Tennessee. In two of the plants only one of two lines is operating, while the other is still idled. CertainTeed, which is part of Saint Gobain, is the no. 4 in the market with about 14.0 % market share by capacity. The company operates eight drywall plants.

The three smaller producers in the USA are American Gypsum, Continental Building Products (CBP), and PABCO Gypsum with 9.8 %, 8.2 % and 4.0 % market share, respectively. American Gypsum, which is part of Eagle Materials, operates five gypsum wallboard plants. The Duke plant is one of the largest in the USA with 1300 million square feet design capacity. The gypsum wallboard production of American Gypsum totalled about 250 million m2 in fiscal 2019. CBP owns three drywall manufacturing facilities in Florida, Kentucky (Figure 10) and New York with about 300 million m2 and two joint compound facilities. The company improved its wallboard volume output of the three plants from 247 million m2 in 2017 to 254 million m2 in 2018. PABCO Gypsum just operates two plants.

In Canada, Certain Teed (Saint Gobain) has the largest market share, with 35.5 % of the capacity from six plants, followed by CGC (former Canadian Gypsum Company, which is now part of the USG Corporation) with 29.7 % and Georgia-Pacific with 16.8 %, both from two plants and two others with 18 % from two plants. Accordingly, the market in Canada is dominated by producers which are also leading companies in the USA. In Mexico, the leading producer is Panel Rey with 86 million m2 capacity from three plants and a market share of 48.3 %, followed by USG with 37.1 % market share from three plants and Knauf with 14.6 % from one plant. After the acquisition of USG by Knauf, it will be only two suppliers in the Mexican market and Knauf will be the market leader with 51.7 %, if no other capacity is added.

The markets in the other Latin American Countries are dominated by Knauf, Etex and Saint Gobain, which have a combined market share of almost 90 %. Knauf is the market leader with seven plants in Argentina, Brazil (2), Chile, Colombia (2) and Honduras with 141 million m2 capacity and 35.9 % market share. The capacity of its Coloma plant in Honduras is going to be upgraded from 5 to 30 million m2. Etex has a market share of 32.8 % from its six plants in Argentina, Brazil (2), Chile, Colombia and Peru (Figure 11). Saint Gobain has a market share of 20.6 % from four plants in Brazil (2), Chile and Peru. The other three producers Ecuagypsum in Ecuador, Trevo Industrial de Gesso in Brazil and Immsa in Nicaragua operate only small plants and have a combined market share of only 10.7 %.

2.3 Middle East and Asian markets

Figure 12 shows the breakdown of wallboard capacities in the Middle East/Asia. China is the leading market with 53.2 % market share from 3.014 billion m2 capacity and 84 plants. North East Asia, which includes Japan, South Korea and Taiwan, has 21.6 % market share and 27 plants. Next comes the Middle East (incl. Turkey) with 10.2 % market share and 39 plants, before South East Asia with 8.2 % market share and 23 plants and Oceania (Australia and New Zealand) with 5.0 % and 13 plants. Last in the ranking is South Asia (India, Sri Lanka and Pakistan) with only 1.8 % market share from 101 million m2 and 11 plants. However, India and the Middle East are the two fastest growing wallboard markets and are large importers of gypsum to fulfil the local needs.

If we look at the main wallboard manufacturers in this region, this is very much dependent on the individual countries and locations. In China, the company CNBM (China National Building Material Company) owns the two wallboard manufacturers BNBM and Taishan Gypsum, which operate 62 plants in China with about 2.34 billion m2 capacity. In 2018, the group produced 1.865 billion m2 of gypsum board, which leads to 80 % capacity utilisation. CNBN has a market share of 77.6 % of the wallboard capacity in China. Other producers and their market shares include Jason Plasterboard with 4.5 % market share and four plants, Boral with 4.3 % and four plants, Saint Gobain and Knauf with 2.7 % and 2.0 %, respectively and three plants each, as well as 8.9 % by other manufacturers and their 8 plants.

Figure 13 shows the gypsum board production in Japan over the last few years. The production has been nearly stable with around 500 million m2, which corresponds to a capacity utilisation of about 63 %. The market leader in Japan is Yoshino Gypsum with about 80 % market share, followed by the local firm Chiyoda-Ute Co. In South Korea the market leader is the KCC Corporation with 63.5 % of the capacity from two plants, followed by USG Boral with 36.3 % from three plants. In Australia the market is nearly equally split between USG Boral, CSR Gyprock and Knauf. In South East Asia USG Boral is the dominant market player, beside Knauf, Saint Gobain and a few local players.

Turkey is the leading country in the Middle East with 220 million m2 capacity from 13 plants that are operated by a number of local players, such as Dalsan Alci, Aygips and ABS Alci and the international players Knauf and Saint Gobain. Saudi Arabia comes next in the ranking with about 150 million m2 capacity from nine plants of nine different local manufacturers, followed by the UAE with about 95 million m2 capacity from four plants, of which Knauf and Saint Gobian own one each. Oman has only two plants with just 28 million m2 capacity, of which a small 8 million m2 plant is operated by USG Boral. However, Oman has become the largest global gypsum exporter with about 9.5 Mt/a in 2018.

3 Outlook on the availability of synthetic gypsum

According to Smithers Apex, in 2017 the global synthetic gypsum (calcium sulphate) market volume was about 151 Mt/a, of which Europe, the USA and China accounted for over 90 %. FGD gypsum is the largest and most marketable synthetic gypsum by volume. Fluorogypsum is a by-product from the production of hydrofluoric and sulfuric acid. Up to now, all these kinds of gypsum have not been recycled but completely sent to landfills. Citrogypsum is a by-product from the fermentation of sugar. Up to now this product has no commercial applications. Phosphogypsum is a by-product from the production of phosphoric acid. It has some applications in agriculture, the cement industry and in wallboard manufacturing. Titanogypsum is obtained in large quantities from the production of titanium dioxide by the sulphate method, but up to now its uses are limited.

The generation of FGD-Gypsum is linked to the development of coal-fired power (hard coal and lignite), and future scenarios propose that especially in Europe and the USA the production of FGD-gypsum will come to an end, due to the move from conventional power generation to renewable power. According to the IEA (US International Energy Agency), world coal production declined in 2014 for the first time in this century and accelerated in 2016. However, the trend changed in 2017 with 3.1 % increase, or plus 225 Mt/a, mainly because of the increase in the steam coal production in Asia. In the OECD countries, the share of electricity and heat produced from primary coal as a fuel fell in 2017 to a new low of 26.9 %, down from 27.3 % in 2016 and 44.4 % in 1985.

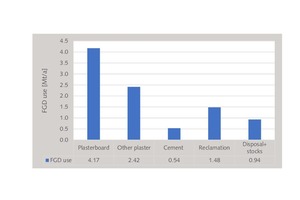

In Europe, about 9.543 Mt/a of FGD-gypsum was generated in the EU15 (ECOBA members) in 2016, after 11.3 Mt/a in 2012, which is a significant decline. However, the volume of FGD-gypsum in the EU28 in 2016 was about 15 Mt/a. Figure 14 shows the utilisation of the EU15 quantity. Plasterboard is the main utilisation with about 43.7 %, followed by other plaster use (self-levelling floor screeds, gypsum blocks, projection plaster) with 25.3 %. Usage in the cement industry as a retarder is still very low and makes up only 5.6 %. 15.6 % are used in the reclamation and restoration of gypsum mines or temporary stockpile, while 9.8 % go to disposal. Germany is the largest FGD-gypsum producer in Europe with about 7 Mt/a in 2015. Projections for Germany by the BMWI in their energy reference prognosis 2014 lead to a volume of only 2.2 Mt/a by 2050 in the best case, while the volumes in the EU are projected to decline from 18 Mt/a in 2012 to 4.6 Mt/a in 2050 [2].

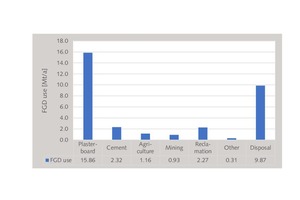

The projections for the USA also show a large decline in FGD-gypsum in the future, but the usage of FGD can still be improved. In 2017, about 32.707 Mt/a were generated and 22.839 Mt/a (69.8 %) were used. Figure 15 shows the FGD-gypsum utilisation for 2017. The majority of 48.5 % is used as a raw material for the production of wallboard and probably other plaster products, 7.1 % are used in the cement industry, 3.5 % in agriculture, 2.8 % in mining and 6.9 % in reclamation (especially in pond closure activities of power plants), while 1 % is for other use and 30.2 % still goes to disposal. In the projection by the IEA in their reference case, coal-fired generating capacity will decline by 101 gigawatts (GW) through 2050, which corresponds to 42 % of existing coal-fired capacity [3].

4 Market outlook

In the gypsum industry the takeover of USG Corporation by Knauf will have a signal effect for other mergers & acquisitions. However, at the moment the full effect is not visible. Some analysts predict that Boral could become independent from the Knauf Group. Boral stated that they may be ready to announce their plans with the USG Boral joint venture in August 2019. According to an Australian newspaper, they are currently conducting due diligence on the joint venture’s operations. Forward options could include the establishment of a new Asian joint-venture with Knauf or buying USG Boral’s gypsum wallboard business in Australia, New Zealand and other countries in Asia.

The competitiveness of gypsum producers in today’s markets depends largely on the use and availability of raw materials, adequate production capacities as well as the specific energy consumption. State-of-the-art technology is a very feasible option to bring the energy use down (Figure 16).

Plant upgrades and expansions require short stand-still times and have to fit smoothly into existing lines (Figure 17). Most producers that use large quantities of synthetic gypsum are in the process of finalising long-term supply contracts with power plants. Other aspects are to optimise the product portfolio to customers’ needs and e.g. to reduce the average weight per sheet of plasterboard products by about 20 %, especially for products that have to fulfil firecodes.

www.onestone.consulting

Überschrift Bezahlschranke (EN)

tab ZKG KOMBI EN

This is a trial offer for programming testing only. It does not entitle you to a valid subscription and is intended purely for testing purposes. Please do not follow this process.

This is a trial offer for programming testing only. It does not entitle you to a valid subscription and is intended purely for testing purposes. Please do not follow this process.

tab ZKG KOMBI Study test

This is a trial offer for programming testing only. It does not entitle you to a valid subscription and is intended purely for testing purposes. Please do not follow this process.

This is a trial offer for programming testing only. It does not entitle you to a valid subscription and is intended purely for testing purposes. Please do not follow this process.