Energy efficiency in the German cement industry against the background of more stringent energy policy targets and rising energy costs – Part 2

Increasingly stringent political demands are being imposed on the energy productivity of the industry. In a plant-specific investigation, the savings potential for electrical energy, fuels and CO2 emissions of the German cement industry in the period 2013 to 2035 was studied within an economic framework. Part 2 contains the analyses and evaluations.

Part 1 was published in the third issue of ZKG International 2015 and contains the applied method and initial calculations. In part 2, the sensitivity analysis and the conclusion is presented. This section gives am introductory summary of part 1.

In the introduction, we outlined different policies which set direct and indirect goals for a reduced industrial energy consumption in Europe and Germany. The energy saving potentials are calculated in a bottom-up approach by implementing the investigated energy saving measures at each German cement plant, where possible, individually. The energy...

Part 1 was published in the third issue of ZKG International 2015 and contains the applied method and initial calculations. In part 2, the sensitivity analysis and the conclusion is presented. This section gives am introductory summary of part 1.

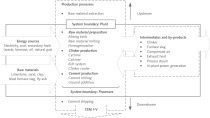

In the introduction, we outlined different policies which set direct and indirect goals for a reduced industrial energy consumption in Europe and Germany. The energy saving potentials are calculated in a bottom-up approach by implementing the investigated energy saving measures at each German cement plant, where possible, individually. The energy saving costs are derived from the net present value which comprise the capital costs and the changes of energy and other operational costs through the adoption of the respective measure. For the calculations, detailed information on the energy savings measures and on the existing German cement plants is required. A synoptic table of the measures was outlined in part 1, the plant data can be found in [4]. For the calculation, we distinct between two different kind of system boundaries (see K1 box). The process boundaries account for the effects of a single energy saving measure on the respective process und is used to assess the cost-effectiveness of measures. The plant boundary includes the interactions of energy saving measures and constitutes the cumulative energy saving potential. The main findings on both system boundaries of part 1 are outlined in the conclusion (see section 5).

4 Sensitivity analysis

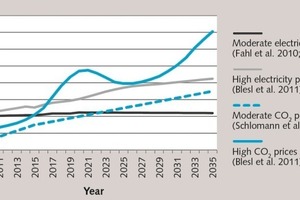

4.1 Sensitivity of the economic savings potential

In the preceding text passages the economic savings potential was presented in a basic scenario relating to fuels, electrical power and CO2 emissions. The cost effectiveness of a measure is strongly dependent on the assumed prices of the energy sources and CO2 certificates. The purpose of the sensitivity analysis is to examine the behaviour of the economic savings potential under the modified price developments shown in Fig. 1. There are three different scenarios that have to be examined: 1) high electricity prices (El), 2) high CO2 certificate prices (CO2) and 3) high CO2 and high electricity prices (CO2El).

In addition to the exogenous, i.e. market- and policy-driven factors, companies’ demands on the cost effectiveness of energy-saving investments represent significant influencing factor for the economic savings potential. The fact that many companies specify a payback time of less than three years as a precondition for such investments – despite the fact that payback time alone is not sufficient for investment decisions – is regarded in the literature as a serious obstacle to the achievement of energy efficiency (cf. Brunke et al. 2014). In order to represent the affinity of the industry for short amortization periods, an interest rate of 30 % (R30) was analysed for the net present value calculation. The interest rate of 15 % (R15) that is normally applied for the industry in the literature (cf. Hasanbeigi et al. 2013b; Fleiter 2012; Beer et al. 2009) was also represented. The 3 % (R3) proposed by the German Federal Environmental Agency was taken into consideration as an extremely low interest rate (cf. Umweltbundesamt 2007). Each of these three interest rate assumptions R3, R15 and R30 represents an individual scenario for analysis. Together with the radical process innovations, there are thus a total of seven scenarios whose effects are summarized in Table 1.

A correlation can be established between these scenarios or parameters and the cumulative savings potential. The highest established correlation (-0.98*) is between the demanded interest rate and the economic CO2 reduction potential and, subsequently, between the interest rate and the fuel savings potential (-0.90). The determined interest rate effects thus verify the demands for less stringent profitability criteria for energy-saving investments. For this to be achieved, the companies would have to accept amortization periods of more than three years or internal rate of returns of less than 30 %. However, a stable and secure policy framework is required so that companies are able to bear the risk of long-term investments. The next-largest correlation (0.67) is to be found on the same level, i.e. between a higher electricity price and the economic power-saving potential, which indicates a higher flexibility of the industry with regard to electricity prices. Simultaneously, due to the dynamic competition between the measures when there are higher electricity prices, there is a slightly reduced effect (-0.17) in the fuel savings. The lowest correlation (0.19) on the same level is that between the CO2 certificate prices and the economic CO2 reduction potential. Viewed in isolation, the idea of the EU ETS to push investments in CO2-reducing measures by providing additional cost incentives shows hardly any effect on the cement production in Germany when judged on the basis of the measures analysed here. At the same time, an increase in the CO2 certificate price leads to a slight decrease (-0.16) in the fuel savings because of the often cited dynamic competition between measures. Even in the highest CO2 price scenario (R15CO2), a specific emission rate of 790 kg CO2 per tonne of clinker is calculated. When this figure is set against the 2030 target of 560 kg CO2 per tonne of clinker, it is obvious that this target will be very difficult to achieve. Without a doubt, one of the main reasons for the cement industry’s inflexibility regarding CO2 emissions is the high proportion of process-determined emissions.

4.2 Consequences for the energy-related production costs

There is hardly any other sector of industry where energy costs make up such a high proportion of the overall production costs as they do in the cement industry. Fuel costs alone make up 30-40 % of the total costs of clinker production, according to the European Integrated Pollution Prevention and Control Bureau (EIPPCB 2010). The EU Commission has also stated that the cement industry occupies an exceptional position and has therefore classified it under the list of industrial sectors that are endangered by “Carbon Leakage”. This is because the cost of CO2 certificates could lead to an increase in production costs amounting to at least 30 % of the gross value added (VDZ 2012a). This section will deal with the extent of this rise in production costs on the basis of different price assumptions. On the production cost side, the analysis focuses purely on the energy-related production costs, which include CO2 certificates in addition to fuels and electricity. At first, reference costs are needed, with which the analysis results can be brought into relation. For this purpose, the specific energy consumption is multiplied by the specific cost assumption models for the year 2013 (Tab. 2).

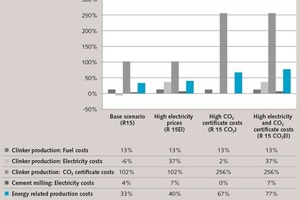

It has to be observed here that even if the precise cost structure of the German cement plants were known and applied, use of the mean values would probably prevent any of the German plants being directly represented by Table 2. Actually, the intended purpose of Table 2 is to provide a starting point for the relative development of energy-related production costs up to the year 2035. This representation of the average production cost changes over the period 2013 to 2035 related to reference costs in the year 2013 (Fig. 2) was selected in order to facilitate transferability of the results to individual plants.

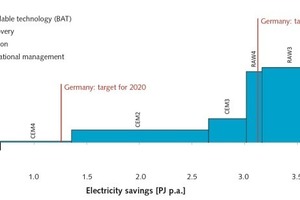

It can be fundamentally determined that in the period 2013 to 2035 all considered scenarios lead to a considerable increase of the average energy-related production costs** amounting to 33 % to 77 % (see Fig. 2). Individual consideration of the modified prices reveals that a rise in electricity prices can be partially compensated by additional economic electricity-saving measures and that, in this study, the energy-related production costs show a comparatively low sensitivity towards this energy carrier. In the basic scenario (R15), a moderate rise in electricity prices of approx. 6 % lead in this study to a slight decrease in the electricity costs for the clinker manufacturing process and to a moderate increase (4%) in the cement grinding process. By contrast, an electricity price increase of more than 50 % (R15El) would mean that there would be hardly any additional economic savings potential in the clinker production process and that its electricity costs would rise by 37 %. However, in the cement grinding process it would be possible to partyl compensate the price increase, mainly by replacing ball mills with vertical mills (CEM2), as this substitution measure would then be cost-effective (Fig. 3), which would restrict the increase in electricity costs to 7 %.

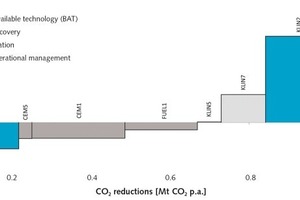

The prices of the 13 investigated fuel types were not directly modified. The average fuel price increase of 16 % can be reduced by economic fuel saving measures to a rise of 13 %. Indirectly, different CO2 certificate price scenarios resulted in additional fuel use expenses. The costs for CO2 certificates increased strongly in some cases during the investigated period of time. In the basic scenario (R15) the cost increase is 107 %, while in the high price scenario (R15CO2) it is as high as 267 %. The marginal cost curves of the CO2 reductions on the plant level (Fig. 4) show that the industry only has limited options for reacting to this cost increase by implementing available reduction measures. In fact, economic CO2 reduction measures, and additional CO2 reduction measures that would become economic, would only be able to limit the cost increase to 256 % (R15CO2 and R15CO2El) or to 102 % (R15) (Fig. 2), respectively.

It is easy to see that the industry is most sensitive to the price of CO2 certificates. With the cost of CO2 certificates taking a 46 % share in the energy-related production costs in the basic scenario (R15) and 57 % in the high-price scenario (R15CO2), a 100 % increase in the price of CO2 certificates in 2013 would lead to an average 36 % rise in energy-related production costs. Even considering economic CO2-reduction measures, the rise in production costs resulting from increasing CO2 certificate prices would in any event amount to at least 30 % of the gross value added. In accordance with the definition of the European Commission, the German cement industry would be in acute “Carbon Leakage” danger during the period 2013 to 2035. This fact must be taken into account for the future handling of the EU ETS.

5 Concluding discussion

Driven by the European emissions trading system (EU ETS), by the Energy Strategy of the German Federal Government, which caps the level of energy and electricity tax under the condition that companies provide evidence that they apply certified energy management systems, or just by the constantly rising prices for energy carriers and increasing competitive pressure: the subject of energy efficiency is bound to assume even more importance for companies in the future. Against this background, the term “energy efficiency” is omnipresent in the media. However, there is an inadequate general understanding of the relationship between energy input and energy output, because saving energy is not necessarily the same as using energy efficiently (see K2 Box). The developed method described here essentially differentiates between two perspectives: the process level and the plant level. The process level is employed to compare the effectiveness of individual savings measures, while the plant level is used for the purpose of considering competing measures – for example measures utilizing the same waste heat stream – in order to enable conclusions to be drawn regarding the total savings potential. It needs to be noted that in any energy system analysis, the system boundary, the calculation method and the data basis needs to be listed in order to understand and interpret the results. It is therefore advised to consult Brunke and Blesl (2014).

By far the most effective means of saving on fuel consumption is the development of new types of cement. However, the effects on the cumulative saving potentials of measures with lacking commercial availability like radical process innovations or other theoretical approaches like those presented in Betz et al. (2014) are deliberately neglected. Of the available measures, the substitution of Lepol kilns with BAT and increasing the proportion of granulated blastfurnace slag proved to be especially cost-effective. The replacement of running rotary or planetary coolers with modern reciprocating grate coolers and the retrofitting of precalciners at the remaining rotary kiln systems are not economic, although they promise large total savings of 5.93 and 3.06 PJ p.a. respectively. The calculated economic fuel saving potential in the basic scenario is 4.00 PJ p.a., which represents 5.2 % of the fuel requirement in 2010 and would result in an annual cost saving of € 12.8 million €2013.

However, the economic savings potential is not high enough to enable attainment of the political objectives. With an assumed uniform distribution of the expenses to all industrial sectors, the forced implementation of the 2020 target of the EU Energy Efficiency Directive would cost the cement industry € 3 million2013 p.a., while attainment of the 2020 target of the Energy Strategy of the German Federal Government would cost it at least € 25.8 million2013 p.a. in additional costs. To achieve electricity savings, two of the most effective measures are state-of-the-art process control systems that continuously measure the chemical composition of the raw material, and an increase in the proportion of fly ash. The greatest potential for reducing power consumption, 2.10 PJ p.a., is offered by the replacement of ball mills with vertical mills for cement grinding, but this measure does not become cost-effective for running mills in the base scenario. The economic power-saving potential is calculated to be 0.68 PJ or around 5 % of the electrical power requirement of 2010. The entire cement industry would thereby save € 2.19 million2013 per year. This saving is offset by the additional costs that are implicit in the objectives of the Energy Strategy, of € 0.33 million2013 p.a. for 2020 and at least € 14 million2013 p.a. for 2050.

In accordance with the stated understanding, the use of secondary fuels (SF) can contribute to an increase in energy efficiency. The EU ETS regulations only classify the use of biogenic fuels that satisfy the sustainability criteria as CO2-neutral. In addition, because of the increasing competition for usage of these fuels, the absolute quantity of biomass was kept constant until 2035. Given an increase in the use of SF from 60 % to 80 %, the calculated CO2 reduction is 180,000 t CO2 p.a. Ultimately, the CO2 reduction potential in the basic scenario is 0.67 million t CO2 p.a. or approx. 3.4 % of the CO2 emission in 2010. On the basis of the assumed CO2 price developments, the cost saving would amount to € 14.54 million2013 p.a., but these would be offset by at least € 25.80 million2013 p.a. in additional costs if the CO2 tax exemption level of 0.766 t CO2/t clinker is to be achieved in all cement plants. Taking all energy sources into consideration and assuming a uniform distribution of the burden over all industrial sectors, attainment of the targets specified in the Energy Strategy for the year 2020 would mean additional costs of € 26.13 million2013 per year.

Fundamentally, the cost effectiveness of a measure strongly depends not only on the demanded cost effectiveness criterion but also on the assumed prices of the energy sources and the CO2 certificates. Variation of these parameters reveals the sensitivity to the economic savings potential and also ultimately the sensitivity to the energy-related production costs. It is hardly surprising that the greatest determined correlation is that between the interest rate and the economic fuel savings potential.

The next-highest correlation is that between the electricity price and the economic power-saving potential, which shows that the industry has a comparatively high flexibility with regard to increasing electricity prices. Simultaneously, due to the dynamic competition between the measures in the case of high electricity prices, there is a slight reduction in fuel savings.

The lowest determined correlation is that between the CO2 certificate prices and the economic CO2 reduction potential. On the basis of the investigated measures, the idea of the EU ETS to push investments in CO2 reduction measures by providing additional cost incentives shows – when viewed in isolation – hardly any effect.

In a final step, the consequences on production costs of changing the price developments were analysed under consideration of the economic savings potential. Taking all the considered scenarios into account, the calculated rise in energy-related production costs is 33 % to 77 % over the period 2013 to 2035. The cement industry shows the highest degree of sensitivity towards CO2 prices, because a 100 % increase in the CO2 price results on average in a 36 % rise in the energy-related production costs. By contrast, the industry shows the lowest sensitivity towards increasing electricity prices, due to the fact that the price increase can be partially compensated by implementing additional measures that have become cost-effective because of the price rise.

In the future, the cement industry will continue to face a high “Carbon Leakage” threat, because the proportion of CO2 reduction costs in the industry’s gross value added is 46 % in the basic scenario and 57 % in the high price scenario, which exceed the 30 % criterion set by the European Commission. The European emissions trading system (EU ETS) is widely considered to be a market-oriented and cost-effective instrument for achieving reductions in CO2 emissions. However, it is not possible for the individual, heterogeneous sectors of industry to be treated equally under the terms of the EU ETS. This investigation has shown that, the cement industry has only a few options with high marginal reduction costs for achieving energy-efficient reduction of its CO2 emissions. Without doubt, one of the main reasons for this is the high proportion of process-determined emissions. The fact that this limits the industry’s room for manoeuvre must be taken into consideration in the specification of political objectives and instruments. The sensitivity analysis showed that companies’ preference for short payback times has a high influence on the cost-effectiveness and can be considered as one major barrier to the adoption of energy efficient technologies. However, one prerequisite for companies to be able to bear the risk of long-term investments is a stable and secure policy framework.

Acknowledgements

This research under the auspices of the Graduate and Research school “Efficient use of Energy” Stuttgart (GREES) was financially supported by the EnBW Energie Baden-Württemberg AG and the University of Stuttgart.

Überschrift Bezahlschranke (EN)

tab ZKG KOMBI EN

This is a trial offer for programming testing only. It does not entitle you to a valid subscription and is intended purely for testing purposes. Please do not follow this process.

This is a trial offer for programming testing only. It does not entitle you to a valid subscription and is intended purely for testing purposes. Please do not follow this process.

tab ZKG KOMBI Study test

This is a trial offer for programming testing only. It does not entitle you to a valid subscription and is intended purely for testing purposes. Please do not follow this process.

This is a trial offer for programming testing only. It does not entitle you to a valid subscription and is intended purely for testing purposes. Please do not follow this process.