Development prospects of China’s cement industry CO2 in 2050

Influenced by the current Chinese annual growth rate, which is more than one percent and an urbanization rate of more than 70 %, the demand for cement is at a peak. The CO2 emissions of the cement industry will also identically accompany such a major trend. The author states, how CO2 emissions as well as urbanization will go parallel with the zero growth level of China’s population after 2030.

1 Introduction

China is at the peak of industrialization and urbanization. The urbanization rate was 53.7 % in 2013. Currently, the annual growth rate is more than one percent and the urbanization rate will reach more than 70 % of the stable phase after 2030.

Influenced by industrialization and urbanization, demand for cement and building materials is at a peak. It is estimated that the consumption peak in the cement industry will appear between 2015 and 2020, and then will begin to gradually decline. After 2030, cement and building materials will also be close to saturation. With the completion...

1 Introduction

China is at the peak of industrialization and urbanization. The urbanization rate was 53.7 % in 2013. Currently, the annual growth rate is more than one percent and the urbanization rate will reach more than 70 % of the stable phase after 2030.

Influenced by industrialization and urbanization, demand for cement and building materials is at a peak. It is estimated that the consumption peak in the cement industry will appear between 2015 and 2020, and then will begin to gradually decline. After 2030, cement and building materials will also be close to saturation. With the completion of stable population and urbanization, the construction industry will begin to fall to the lowest point.

CO2 emissions in China’s cement industry will also accompany an identical emissions trajectory according to such a major trend. The total development trend depends on the population, namely cement consumption per capita and accumulative consumption of cement per capita. Finally, CO2 emission will eventually stabilize along with the stabilization of the population and the completion of urbanization.

2 Future population depends

on demand for cement

Cement is mainly used for the construction of housing and infrastructure as a basic building material. According to the development experience of countries, the ultimate demand for cement depends on cement consumption per capita and the accumulative consumption of cement per capita.

As the most populous, developing country in the world, cement consumption per capita in China was close to 1.8 tons in 2013, while the world average was only 0.3 tons. Such a high consumption per capita in China is mainly because China is in the middle stage of industrialization and urbanization, has a lack of forest resources, and main buildings are built with cement-based materials.

Although cement consumption per capita in China is higher, cumulative cement consumption per capita is less than two-thirds of that of similar developed countries. Therefore, there is a certain space in the Chinese cement consumer market. However, it will soon reach its peak within the next few years because of China’s huge annual yield (up to 60 % of the world’s).

If we want to know what the future cement demand will be in China for decades, we must first know what China’s population will be in the future.

2.1 Forecast of China’s future population

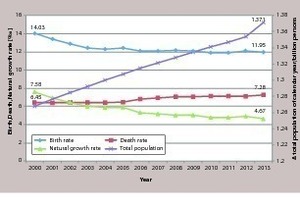

Figure 1 shows the development of China’s population since 2000. As can be seen, China’s population has been growing during the past 10 years, with a more than 7 million annual net increase of population, which is equivalent to the population of a medium-sized country in Europe. In order to maintain employment, housing, and infrastructure, large amounts of cement and building materials are consumed. Therefore, China has the world’s largest cement production.

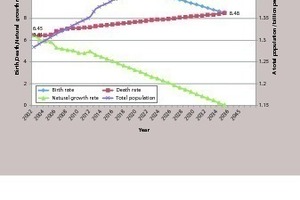

Figure 2 is related to China’s future population forecast. According to the forecast, China’s population will approach zero growth in the years after 2030. With a stable population, China will be the same as the developed countries from 2035 to 2050, entering into the historical stage with low growth in economy and construction. Therefore, the demand per capita and the cumulative amount of cement can be inferred based on the current situation in developed countries.

2.2 Cement consumption per capita after population stabilization

According to our studies of the experiences of developed countries including some emerging economies, annual consumption of cement per capita is generally only in the range of 300-500 kg after population and construction peaks are stable.

We used this as a reference and took into account China’s national conditions to predict the demand for cement in China between the years 2030 and 2050. We set a 400-600 kg cement demand per capita in the Chinese population stabilization period. When the population is 1.45-1.5 billion, the demand for cement is about 0.58-0.87 billion tons or 0.6-0.9 billion tons. By summarizing the above two scenarios, the final consumption of Chinese cement in the stabilization phase is predicted roughly to be 0.6 to 0.9 billion tons. Compared with the current annual output of 2.41 billion tons, at least two-thirds of the production needs to be eliminated.

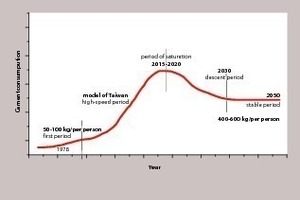

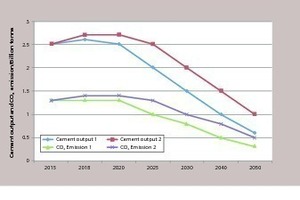

The forecasting model of Chinese cement industry demand in 2050 is shown below (Fig. 3) according to these predictions.

3 Forecast CO2 emissions from the future

of China’s cement demand

According to future cement demand as well as the history and current situation of the cement industry CO2 emissions, the appropriate amount of future carbon dioxide emissions each year could be calculated.Table 1 presents clinker output, heat consumption, and CO2 emissions in China’s cement industry from 1990 to 2010. Total emissions of clinker include emissions from clinker burning with coal and emissions from the process of calcined limestone. These two parts are direct discharges of cement plants.

3.1 CO2 emissions from China’s cement industry since 1990

Besides the direct discharge of clinker burning, material grinding, and cement grinding, process sectors of the cement factories also consume some electricity. This part of emissions generated by power does not happen in the cement plant, but still due to the production of cement, and therefore belong to the indirect emissions of the cement industry. Table 2 includes the indirect emissions of China’s cement industry from 1990 to 2010. The sum of the direct and indirect emissions is the total emissions associated with the cement industry (Also indicated in Table 2).

It can be seen from Table 2 that CO2 emissions in China’s cement industry increased from 208 million tons to 1.119 billion tons from 1990 to 2010. Cement output increased from 229 million tons to 1.868 billion tons. That is a nearly 10-fold increase.

3.2 Estimation of CO2 emissions from China’s cement industry in the past three years

Because of lacking statistical data, emissions data of the cement industry for the recent three years is an estimation, provided in Table 3.

As shown in Table 3, China’s cement output in 2013 reached 2.42 billion tons and the total CO2 emissions reached 1.274 billion tons. Using this as the emission factor of unit cement; one ton cement discharges about 0.53 tons of carbon dioxide. Based on this, the carbon dioxide emissions in the future can be calculated.

3.3 Forecast of CO2 emission before 2050

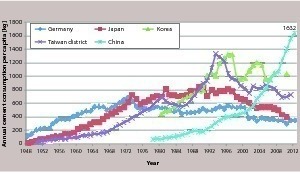

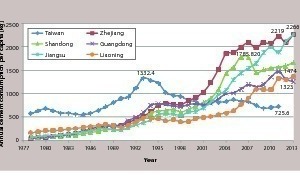

The essence of the forecast for CO2 emissions of the cement industry in the next few decades is still the forecast for cement demand. As stated earlier, the future population and demand determines the yield of China’s cement. Forecast according to population as well as the historical development and cement consumption data of developed countries, newly industrialized countries, and regions (Fig. 4 and Fig. 5) plus the Chinese coastal areas (Fig. 6), we predict China’s cement demand data and trends up to the year 2050 with models (refer to Table 4 and Fig. 3).

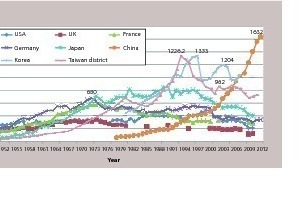

It can be seen from Figure 4, in typical developed countries such as Germany and Japan, cement consumption per capita reached a peak in the late 1970s and early 1980s, at approximately 700-800 kg per capita. In newly industrialized countries and regions, such as South Korea and Taiwan, consumption per capita reached a peak of about 1.22 and 1.33 tons per capita between 1993 and 1997.

Considering that developed and emerging countries and regions are not comparable, we chose a few developed provinces in China as reference for the forecast. Figure 6 is data chosen from a few of the developed provinces as a reference criterion. It can be seen that the consumption per capita of Liaoning, Guangdong, Shandong and Zhejiang respectively peaked between 2007 and 2012. The highest consumption of cement per capita is between 1.3 and 2.2 tons. China reached its national average of 1.8 tons in 2013. Because China’s cement output is still growing, we forecast the maximum consumption range of Chinese cement demand will reach the apex of consumption per capita of 1.8-2.2 tons between the years 2015-2020 (see Fig. 3).

According to future demand for cement consumption in China, the corresponding CO2 emissions data (Table 4, Fig. 7) is calculated in accordance with the current emission factor (0.53) of specific cement. The current emission factor of cement may not accurately reflect changes in the future, but it can serve as general reference data.

It can be roughly seen from the predicted data that the cement industry in China will reach its peak production between 2015 and 2020. During this period, the highest cement production will be between 2.5 and 2.7 billion tons, while the highest CO2 emissions between 1.3 and 1.4 billion tons. From 2020 to 2030, cement production and CO2 will go through a slow process of decline. After 2035, along with zero growth of China’s population and gradual completion of urbanization, the cement production will fall to its lowest point. This will be maintained for a long time until 2050. If there are no other major changes to this situation, the amount would be between 0.6 and 1.0 billion tons, and CO2 can be extrapolated based on current emission factor to only 0.3-0.5 billion tons. At present, the capacity of the Chinese cement industry is 3.2 billion tons, and the output is more than 2.4 billion tons. After the cement demand is saturated, two-thirds of the cement capacity will gradually be eliminated, and 1/2 - 2/3 of the output will no longer be needed. Although this is a matter that will take place in 20-30 years, we should begin preparations for it now.

Überschrift Bezahlschranke (EN)

tab ZKG KOMBI EN

This is a trial offer for programming testing only. It does not entitle you to a valid subscription and is intended purely for testing purposes. Please do not follow this process.

This is a trial offer for programming testing only. It does not entitle you to a valid subscription and is intended purely for testing purposes. Please do not follow this process.

tab ZKG KOMBI Study test

This is a trial offer for programming testing only. It does not entitle you to a valid subscription and is intended purely for testing purposes. Please do not follow this process.

This is a trial offer for programming testing only. It does not entitle you to a valid subscription and is intended purely for testing purposes. Please do not follow this process.