Development of clinker substitutes

Globally, the clinker content in cement is in decline, driven by modern cement standards, higher market awareness and potential cost savings by producers. However, cement constituents such as fly ash or blast furnace slag (BFS) are also used directly in concrete and therefore compete as clinker substitutes in cement. This article provides new facts & data about this use and the importance of clinker substitutes, as well as highlighting the latest trends.

1 Introduction

Clinker is the main constituent of the majority of cements [1]. Possible clinker substitutes are gypsum, ground limestone, industrial by-products such as fly ash and ground granulated BFS (GGBFS), natural (volcanic) pozzolans, calcined clay (metakaolin, LC3) and other supplementary cementitious materials (SCM). According to a technology roadmap by the International Energy Agency (IEA) together with the Cement Sustainability Initiative (CSI) of the World Business Council for Sustainable Development (WBCSD), the global clinker content in cement (clinker factor = CF) stood at 65 %...

1 Introduction

Clinker is the main constituent of the majority of cements [1]. Possible clinker substitutes are gypsum, ground limestone, industrial by-products such as fly ash and ground granulated BFS (GGBFS), natural (volcanic) pozzolans, calcined clay (metakaolin, LC3) and other supplementary cementitious materials (SCM). According to a technology roadmap by the International Energy Agency (IEA) together with the Cement Sustainability Initiative (CSI) of the World Business Council for Sustainable Development (WBCSD), the global clinker content in cement (clinker factor = CF) stood at 65 % in 2014 [2]. By 2060 a CF of 60 % will be realized in the 2DS scenario (2DS = 2°C global warming limitation in low-carbon transition of the cement industry). It is projected that this will reduce the cumulative CO2 emissions of the cement industry by 37 %, or 128 % of the current direct CO2 emissions of cement production.

It has to be noted that in the IEA/CSI data the CF vary greatly from region to region, depending on the availability of clinker substitutes, in terms of quantity/quality and its impact on prices, but also regional practises, market awareness and acceptance. Availabilities of the industrial by-products fly ash and BFS are projected to decline already by 2020 according to the IEA and other sources. Cement industry standards vary regionally in terms of accepted cements and their constituents. Distances between available substitutes and cement production locations are a big obstacle, so that international trading has become an issue. China remains the region with the lowest CF of 58 % compared to the highest of 87 %, which was the 2014 average level in Eurasia, according to IEA-terms.

2 Clinker factor development by major

cement producers

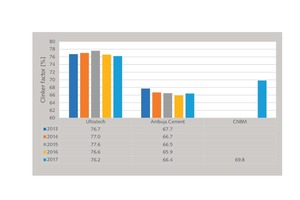

Normally, when taking the IEA projections for the clinker content in cement it has to be assumed that for most cement companies the CF will have declined. However, with some of the largest cement majors, which operate several plants around the world, the opposite is the case. Figure 1 shows the CF development from 2013 to 2017 for selected cement majors. The data are derived from the sustainability reports of the relevant companies. The CF of LafargeHolcim increased by 2 % in the 5 years period. HeidelbergCement’s CF showed a decline by 2.1 % until 2016, but in 2017 the CF increased by 1.6 %, Cemex’s CF increased by 1.5 % in 5 years, CRH had a huge decline up until 2013, but since then their CF has increased by 3.0 %. Finally, Votorantim’s CF had ups and downs, but in 2017 the CF was 0.5 % higher than in 2013.

Looking at other major cement producers in India and China, some more important conclusions can be drawn (Figure 2). In India, Ambuja Cement is at the forefront in the sector. In 2017, a CF of 66.4 % with fly ash utilization of 31.5 % in Portland Pozzolana Cement (PPC) was achieved, after 66.5 % in 2015. Ultratech, India’s largest cement producer is much less advanced and achieved a CF of only 76.2 % in 2017, after 76.7 % in 2013. In 2017, about 8.3 million t (Mt/a) of fly ash were used by Ultratech and only 0.005 Mt/a of slag. For China practically no information on the companies’ clinker to cement ratios are available. The largest producer CNBM, with a cement capacity of 525 Mt/a, achieved a CF of 69.8 % in 2017. This figure is derived from their 257.6 Mt/a cement production, 216.1 Mt/a clinker production and 36.15 Mt/a clinker sales.

It is also very surprising that none of these cement majors achieved such low clinker content rates in cement as outlined by the IEA/CSI average level outside China. CNBM is far away from a CF of 57.5 %, which is said to be the average figure in China. So, it can be assumed that the IEA figures are much too low and cannot be true. Anyhow, the CSI also provides in their GNR-figures (GNR = Get the Numbers Right) data for a weighted average of all GNR participants. The figure stood at a CF of 75 % in 2016, after figures of 83.3 in 1990 and 76 % in 2010. But it has to be noted that the GNR figures cover only 19 % of the cement and clinker production in 2016 and, accordingly, it makes no sense to use these figures for a global extrapolation.

3 Clinker factor development by selected

countries/regions

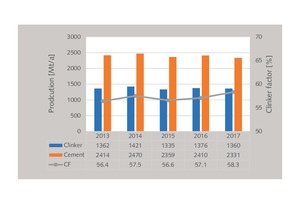

According to Cembureau, the European Cement Association, the CF in the EU 27 was 73.7 % in 2017. India achieved a CF of 71 % in 2017, according to India’s Cement Manufacturers Association (CMA), after 74 % in 2010. Different figures have been reported for China. The Chinese Cement Producers Association stated a clinker to cement ratio of 0.575 for 2014, which was derived from the cement and clinker production in China of 2470 Mt/a and 1421 Mt/a respectively. Figure 3 shows the development of the CF in China, according to official sources. In 2017 and 2018, an increase in the CF can be expected. However, when the figures of CNBM are taken as a benchmark for China, then these figures still appear too low. It is speculated that sourced clinker is not adequately taken into account in these figures.

The figures by the German Cement Association (VDZ) expressively include these amounts of clinker in the German CF values (Figure 4). The CF decreased from 73 % in 2013 to 71 % in 2017. The quantity of clinker was almost stable with 23.127 Mt/a in 2013 to 23.423 Mt/a in 2016, while cement production slightly increased from 31.308 Mt/a to 33.991 Mt/a. It has to be noted that the clinker production does not include clinker imports, while the cement production includes cement from imported clinker and that in the CF the clinker production includes imported clinker but not the clinker exports. It is important to say that, if any other definition is used, then the CF values are not adequately derived.

4 Availability of fly ash and blast furnace slag

4.1 Blast furnace slag (BFS)

For high-grade iron ores of 64-67 % iron content a blast furnace typically will produce about 0.25-0.30 t of slag (BFS) per t of pig iron. For low grade ores of below 60 % the slag amount is higher with typically 0.35-0.50 t/t pig iron. In 2017, about 1180 Mt/a of pig iron were produced globally, compared to 1034 Mt/a in 2010, which results in 325-370 Mt/a of BFS in 2017. Figure 5 shows the 2017 pig iron production by regions and major countries, which is closely followed by the BFS production. The EU28 accounts for 7.9 % (93.2 Mt/a) of the production, North America accounts for 2.8 % (32.9 Mt/a). China alone accounts for 60.2 % (710.8 Mt/a), all Asian producers (incl. the Middle East and Oceania) account for 78.7 % (929 Mt/a). The smallest production, aside from Oceania, is in the Middle East with 0.2 % (2.3 Mt/a) and Africa with 0.4 % (5.1 Mt/a).

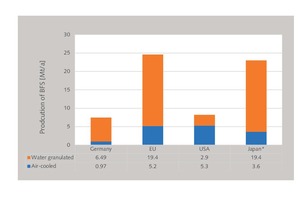

There are two types of BFS cooling, air-cooled and water cooled. The quenching of the liquid (molten) BFS with water forms a glassy and granular product that has to be ground to produce a fine powder for use as clinker substitute. Ground granulated BFS (GGBFS) has cementitious properties similar to those exhibited by Portland cement. The glass content of GGBFS varies depending on the granulation process from 60 % to 100 vol.-%. The practises differ widely from country to country (Figure 6). The highest rates of water granulation are in Germany (87 %) and Japan (84 %, 2017 data), some of the lowest are in the USA (35 %). The granulation rate also is an indicator of how the BFS is used. While GGBFS is used as a clinker substitute in cement, air-cooled BFS is used as a concrete supplement. However, the global pig iron production is projected to increase by 1-2 % annually, despite the growth in scrap recycling.

There are a number of trends in the sector. Firstly, there has been a noticeable increase in the use of GGBFS in some regions, including Asia, the Middle East and Africa, although the quantities used in the Middle East and Africa are still small. But international trading from regions such as Europe and China has increased to supply regions with low availability. Secondly, the increased use of GGBFS has become a factor for saving raw materials, reducing CO2 emissions and improving the cement production cost base. Thirdly, the advantages of slag cements for the concrete performance are now better understood. Prices for GGBFS closely follow the price for clinker. In most cases, a 15-20 % price advantage can still be realized. Slag cements represent about 25 % of cement sales in Europe and 30 % in Japan. Many other countries are now trying to catch up with the European practises.

4.2 Fly ash from hard-coal fired power (PFA)

Fly ash (pulverized fuel ash = PFA) is a by-product from coal-fired power plants. Two types of ash are generated, depending on the coal that is burned. Siliceous (low-calcium) ash is obtained from burning hard-coal (anthracite or bituminous coal), calcareous fly ash is obtained from burning lignite or sub-bituminous coal (brown coal).

Both types of fly ash have pozzolanic properties and are used in blended cement or concrete. According to the IEA, more than 675 Mt/a of fly ash is available globally. Direct use in concrete is allowed if the fly ashes have low CaO and highly reactive SiO2 (>25 %), criteria which are fulfilled by hard-coal fired ash. The total steam coal production declined from 5820 Mt/a in 2015 to 5463 Mt/a in 2016. This was already seen by some analysts as the end of the coal cycle. However, in 2017 steam coal consumption increased by 3.9 %.

Since the year 2000, the world has doubled its coal-fired power capacity to almost 2000 GW. Accordingly, coal-fired power generation remains the largest source of electricity generation worldwide, with a share of around 37 %, and this will continue over the next few years. Currently, China has a total installed capacity of around 900 GW of coal-fired plants. This represents almost half of global coal-fired capacity. Figure 7 illustrates the latest figures for coal-fired (CF) power plants under construction in selected countries in Asia. China has 130 new plants under construction. India 41, Indonesia 20 and Japan 13. The Block 9 of the GKM (Grosskraftwerk Mannheim) power plant (Figure 8) is one of the newest plants starting operation in Europe. It has a capacity of about 900 MW and an efficiency of 46.4 %, which can only be achieved with ultra-supercritical technology. This plant is one of the newest of the so-called HELE plants (High efficiency – Low Emissions).

For the next few years the main trends for the cement industry include an increasing fly ash availability in Asia and a decreasing availability in Europe and the USA, due to CO2 legislation and plant retirements. The efficiency of power plants in Asia is projected to improve from less than 35 % (subcritical technology) to about 42 % (supercritical technology). With increasing efficiency, less coal has to be burned for the same electricity output. This will reduce the fly ash production in Asia per plant but will be more than offset by the growing plant capacity. A major trend are the increasing shipments of fly ash. Last year the USA imported, for example, more than 0.1 Mt/a from India, which traditionally was not the case previously. In Europe, another aspect is that more and more construction projects such as the proposed Fehmarnbelt tunnel (Figure 9) will require the use of fly ash cement or other specialized cements.

5 Calcined clay and alternative clinkers

According to the IEA, the global average cement composition will change significantly from 2014 to 2050. With the reduction of the clinker factor by 5 % from 65 % to 60 %, the other constituents will also change (Figure 10). The large decline in slag and fly ash is, on the one hand, due to a projected shift away from the widely used blast furnace route towards scrap-based electric arc furnaces and, on the other hand, due to the shift from coal-fired power to gas and renewables as a result of the CO2 legislation. However, at the moment and for the next few years this is not yet the case. But the other main important projection by the IEA is the large increase of calcined clay in the cement composition from 1 % to 8 %. With a projected cement production of about 4680 Mt/a by 2050, 8 % calcined clay corresponds to an amount of nearly 375 Mt/a.

The global reserves of the required raw clay are considered practically unlimited when compared to global cement volumes. Hundreds of studies have been undertaken by researchers at universities, cement producers, equipment suppliers, investors and research federations such as LC3, which stands for limestone calcined clay cement. Today, metakaolin is also known as a high purity product for paper, refractory industries and ceramics. It is 3-5 times more expensive than cement. However, clays containing metakaolin which are regarded as wastes or overburden can be used in cement. According to ASTM C618, the US Portland Cement Association (PCA) defines this type of product as “a calcined clay which is produced by low-temperature calcination of kaolin clay, consisting of predominantly silica and alumina”.

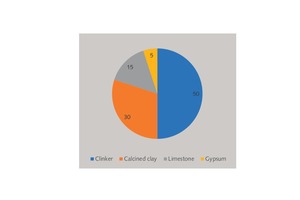

The research has shown that metakaolin for use in the cement industry is calcined by flash or rotary kiln technologies between 600°C and 850°C from low-grade kaolinite clay that is transformed to an amorphous phase, which reacts with the CaOH of cement/or lime reactions. Studies by the LC3 group propose an innovative blended Portland cement that includes the addition of metakaolin (calcined kaolinite clay) and limestone to conventional clinker and gypsum (Figure 11). The strength and performance of this mix is stated to be similar to unblended Portland cement, but provides an even better chloride resistance. Anyhow, LC3 is a family of cements wherein LC3-50 stands for 50 % less clinker and 30 % less CO2 emissions, while LC3-65 stands for 65 % less clinker.

Up to now, LC3 has performed only a small-scale production in two pilot plants in India, producing around 170 t of five different blends of cement. Several other blends have been produced and tested in the laboratory. In Brazil, it is claimed by IEA that since the 1970s there has been a constant production of 2 Mt/a of calcined clay [3]. This is definitely not true. According to Metacaulim they are the first company in Latin America to produce and commercialize metakaolin on an industrial scale with a production capacity of 0.1 Mt/a. The product is mainly used for the onshore and offshore construction of dams, ports and piers. Hoffmann Green Cement Technologies (HGCT) is probably the first company to start commercial production (Figure 12) in Europe. HGCT is completing the construction of a 50 000 t pilot plant in Bournezeau, Vendée/France. The new works will produce cement using flashed metakaolin, reducing CO2 emissions to 200-250 kg/t, according to the company.

Beside metakaolin, a large number of concepts have been developed by several cement producers to substitute a significant portion of ordinary Portland cements by low-carbon clinker/cements [4]. Such new binders include cements based on the carbonation of calcium silicates, pre-hydrated calcium silicates, belite cements, (belite) calcium sulfoaluminate clinker and others. HeidelbergCement (Figure 13) is one of the leading companies in this sector. However, according to cement industry experts, from a mid-term perspective none of the new binding materials have the potential to replace cements based on Portland cement clinker on a larger scale. The new binding materials and systems presented will develop and enter the market for niche products with regional importance, e.g. for repair mortars, quick cements and other cementitious preparations [5].

6 The growing use of by-products in concrete

In Germany and China fly ash is used in considerable amounts in concrete, while in the USA, India, Japan and Australia BFS is also used in considerable amounts in concrete. The practise of by-passing the cement manufacturing process has to do with the different standards and price differences that can be achieved with these industrial by-products in the one or the other application. The result is that a smaller amount of resources will be available for cement production and if these resources are used directly in concrete, cement production will decline. The main question is, which best practises from a specific country are becoming the global practise. In the following, a few important examples of different practises are outlined.

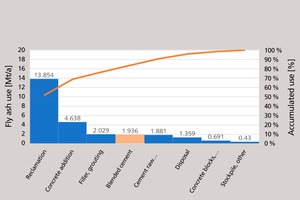

Figure 14 shows the production und utilisation of fly ash in Europe for the year 2016. The majority of the produced fly ash goes into reclamation and restoration projects. Only 42 % is used, of which 1.936 Mt/a or 7.2 % of the production are for blended cements. 4.638 Mt/a or 17.3 % are for the direct use in concrete. In Germany the figures are even more surprising. There is practically no production of Portland fly ash cement (CEM II/V). The main amount of fly ash used, which declined from 313 000 t in 2013 to only 243000 t, is used as raw material in the clinker production. About 86 % of the 3.16 Mt/a of fly ash utilised in Germany, corresponding to 2.72 Mt/a, is directly used in the production of concrete. In other words, this huge amount reduces the cement production with a k-factor of 0.4 by 1.09 Mt/a.

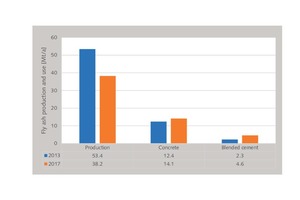

In the USA, due to the retirement of coal-fired power plants, the fly ash production has been in decline for several years (Figure 15). The interesting fact is that despite this more fly ash was used directly in concrete and in blended cement in 2017, with 14.1 and 4.6 Mt/a compared to 12.4 and 2.3 Mt/a in 2013. The percentage of use in concrete (incl. grout) has been increased from 23.2 % to 36.9 %, while the use in blended cements (incl. fly ash as a raw material for clinker) has been increased from 4.2 % to 12.0 %. Figure 16 illustrates the 2016 figures for BFS in the USA. While 32.3 % of air-cooled BFS is used in the concrete industry (mainly asphalt concrete), 99.8 % of water-granulated BFS is used in the cement industry. Accordingly, GGBFS achieves prices which closely follow the prices for clinker.

In Japan, the total amount of BFS declined from 25.271 Mt/a in 2013 to 23.032 Mt/a in 2017 (Figure 17). Granulated slag declined by -6.6 % from 20.811 Mt/a to 19.436 Mt/a, while air-cooled slag declined by 19.4 % from 4.459 Mt/a to 3.596 Mt/a. It is very interesting how the GGBFS is used (Figure 18). The use in blended cements increased from 86.3 % in 2013 to 87.9 % in 2017. The use in concrete and as an aggregate in concrete declined from 9.6 % to 7.3 %, while other uses (roads, civil use and others) is more or less stable at about 4.0-4.5 %. In Japan, the expansion in the use of Portland blast furnace slag cement is one measure included in the plan to achieve the Kyoto Protocol. Japan is also leading with processes to solidify air-cooled BFS so that it can be used as an aggregate in concrete instead of sand/aggregate [6].

7 Outlook

The outlook for clinker substitutes is almost exclusively driven by the discussion about climate change and “Global Warming”. Accordingly, the IEA and other sources also use these global warming scenarios when projecting the future availability of the resources. At first sight this is a very legitimate approach, because the climate debate is also guiding governments and many business leaders. However, in the last few months there has been a growing concern on the part of an increasing number of scientists and researchers that in the next two decades or so temperatures on earth will be increasingly affected by sunspot activity, which can cause a global cooling.

//www.onestone.cons" target="_blank" >www.onestone.cons:www.onestone.consulting

Überschrift Bezahlschranke (EN)

tab ZKG KOMBI EN

This is a trial offer for programming testing only. It does not entitle you to a valid subscription and is intended purely for testing purposes. Please do not follow this process.

This is a trial offer for programming testing only. It does not entitle you to a valid subscription and is intended purely for testing purposes. Please do not follow this process.

tab ZKG KOMBI Study test

This is a trial offer for programming testing only. It does not entitle you to a valid subscription and is intended purely for testing purposes. Please do not follow this process.

This is a trial offer for programming testing only. It does not entitle you to a valid subscription and is intended purely for testing purposes. Please do not follow this process.