Cutting excess capacity in China

China’s cement industry is at a crossroads. The gap between cement demand and supply has widened and production, sales, prices and profits have declined. However, cement producers’ cost control and self-discipline have improved and overseas expansion is increasingly regarded as a way to a better future.

1 China’s economic development

According to China’s National Bureau of Statistics (NBSC) the country’s economy expanded at an annual rate of 6.7 % in the first half of 2017. Property investment grew 8.5 % in the first half. Exports grew by 8.5 %, providing a 7.6 % growth of the manufacturing sector. The strong start in 2017 beat all market expectations and the growth rate is above the 6.5 % goal set by the government for the entire year. Figure 1 comprises the projections in the World Economy Outlook (WEO, April 2017) for China and its peers published by the International Monetary Fund (IMF)....

1 China’s economic development

According to China’s National Bureau of Statistics (NBSC) the country’s economy expanded at an annual rate of 6.7 % in the first half of 2017. Property investment grew 8.5 % in the first half. Exports grew by 8.5 %, providing a 7.6 % growth of the manufacturing sector. The strong start in 2017 beat all market expectations and the growth rate is above the 6.5 % goal set by the government for the entire year. Figure 1 comprises the projections in the World Economy Outlook (WEO, April 2017) for China and its peers published by the International Monetary Fund (IMF). The IMF is expecting the GDP to decline to 5.7 % by 2022 [1]. Nevertheless, China is still well above the projections for the rest of the world.

A market driver for China’s cement industry is the rapid urbanization, which led to a construction boom that lasted for many years. From 2003 to 2014 construction revenue increased from about US$ 109 billion to almost US$ 2570 billion, which corresponds to a compound annual growth rate (CAGR) of 30.1 %. The Government’s urbanization program is an important part of the structural reform in China, which foresees a transition to a more productive and service-based economy. Today, the urbanization rate stands at 56.1 %. The target for 2020 is to achieve a rate of 60 % and to improve the proportion of urban residents, while reducing the proportion of migrant workers.

The 13th Five Year Plan, which started in 2016, will create accelerated growth in China’s construction sector, following a weak 2015.

2 Production, demand and capacities

Since 1985, China’s cement production has been ranked first in the world [2]. The annual output peaked in 2014 at 2480 million t (Mt/a), accounting for almost 60 % of global production. In only three years, China consumed more cement than the USA in the entire 20th century, driven by rapid urbanization and a booming construction sector. However, the numbers given by the NBSC, the China Cement Association (CCA), other local sources and by analysts often seem not only incredible but also questionable. Figure 2 shows the development of the per capita cement consumption (PCC) over the last few years, reaching a peak PCC of 1810 kg. India, the other major territorial country with an almost identically large population, today accounts for a PCC of only 290 kg.

According to data provided by the NBSC, China’s cement production declined by -5.2 % from 2476 Mt/a in 2014 to 2348 Mt/a in 2015 (Figure 3). In 2016 a slight growth of 2.3 % to 2403 Mt/a was again achieved. Interestingly, after the first real decline in 2015, cement production has again increased, showing signs of recovery with significant price increases. Figure 4 shows how cement production in China correlated with clinker production. According to the chart, the clinker factor (clinker to cement ratio) declined from 62.6 % in 2010 to 56.4 % in 2016, with a more or less constant ratio in the last few years. By international standards, the clinker factor of Chinese manufacturers is the lowest of all major countries. Producers in Germany for example achieved a clinker factor of 74 % in 2015.

Figure 5 shows the development of cement and clinker capacities in China. While cement capacities increased from 2405 Mt/a in 2010 to 3330 Mt/a in 2016, representing a CAGR of 5.6 %, clinker capacities increased from 1544 Mt/a to 1987 Mt/a, a CAGR of 4.3 %. The capacity growth rate was higher than the production growth rate in this period (4.3 % for cement production, 2.5 % for clinker production). Accordingly, the capacity utilization rates declined (Figure 6). In 2010, the cement capacity utilization was 77.7 %, but by 2016 it had decreased to 72.2 %, while the clinker capacity declined in the same period from 75.8 % to 68.2 %. This shows that compared to full capacity utilization the present surplus capacity for cement is 927 Mt/a and that for clinker is 631 Mt/a. Some kilns have been stopped or only discontinuously operated to keep costs down.

Development of the NSP kiln technology (NSP = New Suspension Preheater) is illustrated in Figure 7. NSP capacity increased from 1229 Mt/a in 2010 to 1830 Mt/a in 2016, while the non-NSP technology decreased from 315 to 157 Mt/a. During the period the proportion of NSP technology increased to 92.1 %. However, about 160 Mt/a is still obsolete technology and it seems that in the last few years no significant obsolete capacity has been eliminated from the market. Figure 8 shows the new contracted NSP capacities and the number of new kiln lines in China. In 2011, more than 200 Mt/a were still contracted. By 2016 the figure had decreased to 25.8 Mt/a and 20 new kiln lines. Over the last few years, the average kiln size has been nearly stable with an average capacity of 1.3 Mt/a or about 3940 t/d.

3 The major cement producers

The cement industry in China is still very fragmented. In 2016, the TOP 10 cement groups accounted for 43.9 % of cement capacity (Figure 9). The market leader is the China National Building Material Company (CNBM) with a market share of 12.2 % and 406 Mt/a capacity from 4 Divisions (China United, South Cement, North Cement and Southern Cement). In 2016, the company produced 291.2 Mt/a of cement and clinker, which leads to a capacity utilization rate of 71.7 %. In 2016, Sinoma Cement became part of CNBM, bringing in another almost 110 Mt/a of capacity and underlining the status of CNBM as the global No. 1 with a capacity of more than 515 Mt/a. According to the CCA, CNBM has leading market positions in East China, Northeast China, Southwest and Northwest China.

Anhui Conch (Conch) holds 2nd place in the capacity ranking, while the company ranks No. 1 in cement market capitalization in China. Conch (Figure 10) achieved a clinker capacity of 244 Mt/a and a cement capacity of 313 Mt/a, including overseas capacities. In China a total of six new clinker production lines and 18 cement grinding units were installed in 2016, expanding Chinese capacities by 9.2 Mt/a of clinker and 20.9 Mt/a of cement. The Conch Group has shareholdings in a number of other cement manufacturers in China, including Jidong Cement (13.93 %), Xinli Finance (9.0 %) and West China Cement (21.17 %). The state-owned Anhui Conch Holdings is the controlling shareholder of the company. Taiwan Cement Corporation (TCC), JPMorgan Chase & Co., Citigroup and others hold minority shares.

The Beijing Building Materials Group (BBMG) has become the 3rd largest cement manufacturer in China after the strategic restructuring of the Jidong Group. The company’s clinker production capacity increased to 110 Mt/a and its cement capacity rose to about 170 Mt/a with its main capacities in North China. The region however is characterized by a large imbalance in supply and demand, excess capacities and fierce price competition. Places 4 and 5 in the capacity ranking are held by Sinoma Cement and Shandong Shanshui (Sunnsy). Sinoma has been taken over by CNBM. Sunnsy has a cement capacity of 101.8 Mt/a and a clinker capacity of 51 Mt/a. The company’s main capacities are in the Shandong (Figure 11), Northeast China and Shanxi regions. In 2016, its cement sales volume was 43.96 Mt/a after 45.8 Mt/a in 2015. About 64 % was high grade and 36 % was low grade cement.

Huaxin Cement, China Resources Cement (CRC), Honghsi Holding, Taiwan (China) Cement Corporation (TCC) and Tianrui are the other TOP 10 cement groups. Huaxin (Figure 12) achieved a cement and clinker sales volume of 52.7 Mt/a in 2016, which is a plus of 5 % over the previous year. The acquisition of 17 LafargeHolcim cement plants, including 4 grinding plants with about 18 Mt/a cement capacity, has been approved by the shareholders. In 2016, LafargeHolcim held a 41.8 % stake in Huaxin. CRC is one of the fastest growing cement companies in China. In 2016, the company operated 44 integrated lines and 93 grinding plants. During the last year the construction of six new clinker production lines (Figure 13) has been completed. CRC achieved capacity utilization rates of almost 100 %.

Hongshi is the holding enterprise for 22 cement companies in Zhejiang, Jiangxi and ten other provinces, with a combined cement capacity of about 80 Mt/a. The Hongshi Group has also taken the initiative of exploring overseas cement markets. TCC of Taiwan operates 32 integrated plants and 59 grinding mills with a combined clinker capacity of 48.1 Mt/a and cement capacity of 58.6 Mt/a. In 2016, the company produced 53.3 Mt/a of cement. The China Tianriu Group ranks No. 10 with 50.8 Mt/a cement capacity. In 2016, the company operated 18 integrated lines and 52 cement grinding plants, mainly in the Henan and Liaoning Provinces in China.

With LafargeHolcim’s divestment from Huaxin, foreign cement companies no longer play a major role in China’s cement industry. The main foreign investments are by TCC, Asia Cement Company (ACC), Taiheiyo Cement, CRH with their 26 % shareholding in Jilin Yatai, and HeidelbergCement with their shareholding in China Century Cement and Jidong Heidelberg Cement (Figure 14). In total, these companies control about 115 Mt/a of cement capacity, which corresponds to less than 3.5 % of the capacity in China. Of this foreign capacity, TCC has the major share with 51 %, ACC has 30 % and CRH and HeidelbergCement have about 7 % each. Anyhow, a much better picture can be drawn if the regional or provincial capacities and market shares are taken into account.

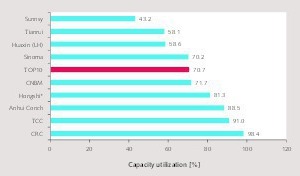

The cement capacity utilization rates of the TOP 10 cement groups in China are illustrated in Figure 15. There is a large span in the utilization rates. The best companies CRC, TCC and Anhui Conch achieved 98.4 %, 91.0 % and 88.5 % respectively, while at the lower end only 43.1 %, 58.1 % and 58.6 % were achieved by Sunnsy, Tianrui and Huaxin. The average utilization rate of the TOP 10 was 70.7 % although this is lower than the average in China, which was stated in Figure 6 as 72.2 % for the year 2016. However, it should also be noted that for some manufacturers (CNBM, Anhui Conch and Huaxin) the utilization rate includes the sale of cement and clinker. The matter of how the smaller companies are able to achieve higher utilization rates is also open to question.

4 Cement industry regulations

In 2016, the Chinese government was demanding a supply-side reform of the cement sector. With the promulgation of the “Guiding Opinions on Promoting Steady Growth, Structural Adjustments and Efficiency Enhancement of the Building Material Industry” (Guo Ban Fa [2016], No. 34), new guidelines were issued by the General Office of the State Council. On the one hand this includes the control of new production capacity, the elimination of backward production, the encouragement of industry consolidation and restructuring, the promotion of off-peak production policy and the self-discipline of manufacturers. On the other hand, with further implementation of the “One Belt and One Road” strategy (Belt and Road Initiative or BRI), it encourages well-established building material companies to accelerate their internationalization and explore overseas markets.

The Ministry of Industry and Information Technology outlined the “Development Plan for the Building Materials Industry (2016-2020)”, which further specifies targets, including the elimination of 10 % of the clinker capacity by 2020, the increase of waste-fuel co-processing from 7 % to 15 % and the reduction of the energy demand from 112 kg/t of coal to 105 kg/t of coal by 2020. In February 2017, various government departments conducted inspections of the cement and glass industries to verify the status of elimination of obsolete capacities. It was announced that the manufacturing license of about 680 cement enterprises had been revoked. Another issue is the phasing-out of low grade cement, which had been announced as early as 2014. It is expected that the long awaited elimination of the 32.5 cement grade will materialize in 2017 and that with a higher clinker content in cement the clinker demand will increase by up to 10 %.

5 Regional and overseas expansion

Figure 16 shows the regional cement development in China over the five years from 2010 to 2015, according to the NBSC. The Northern region had a negative growth of -3.3 %, while the North East region also had a negative growth of -0.8 %. The largest growth was in the Western regions (North West +10.8 %, South West +8.0 %). However, up to now the Western regions have only been responsible for about 26.2 % of the demand in China, while 60.6 % of the demand is in Central South and East China and only 18.7 % is in North East and Northern regions. In 2016, 20 new production lines with a clinker capacity of 28.2 Mt/a were installed. 5.5 Mt/a were installed in the Yunnan and Guizhou provinces of the South West region and 6.8 Mt/a were installed in the Guanxi und Guandong Provinces of the Central South region.

China’s overseas plans date back to the year 2010/2011 [3]. According to the CCA, the overseas expansion of China’s cement industry in line with the BRI initiative is accelerating. By April 2017, about 37 production lines were implemented overseas, of which seven are under construction, comprising 23 Mt/a of clinker capacity and about 40 Mt/a of cement capacity. There are plans for China to invest into 1000 Mt/a of cement capacity overseas. At the moment, the major groups with overseas capacity include Anhui Conch, CNBM, Huaxin and Hongshi. In 2016, Anhui Conch had overseas capacities of 4.8 Mt/a of clinker and 9.35 Mt/a of cement in Indonesia (Figure 17), Myanmar, Cambodia and Laos. By 2020, capacities of 20 Mt/a of clinker and 25 Mt/a of cement are envisaged. The Hongshi Group, which is relatively unknown outside China, has developed five major cement projects in Laos, Nepal, Myanmar and Indonesia.

6 Outlook

With the reduction of excess cement and clinker capacities in China, the consolidation of the sector will continue to achieve scale and market expansion with the impact of tens of thousands job losses. According to the CCA and a China merger database in 2016, a total of 17 mergers & acquisitions (M&A) were recorded in the cement industry, including the major M&A of CNBM/Sinoma, BBMG/Jidong and Huaxin/LafargeHolcim and smaller M&A such as the acquisition of Henan Yongan Cement by Tianrui. Furthermore, the ties between cement companies are getting closer.

Already, numerous joint-ventures, assets transfer and collaboration agreements are in existence. To name a few: In 2016, CRC entered into a strategic agreement with BBMG to jointly explore the Chinese and overseas markets. In another strategic co-operation agreement, Anhui Conch will assist CRC in the technological upgrade of production plants. Also, West China Cement (WCC) entered into a joint-venture with Conch Venture to establish a waste treatment platform.

//www.onestone.eu" target="_blank" >www.onestone.eu:www.onestone.eu

Überschrift Bezahlschranke (EN)

tab ZKG KOMBI EN

This is a trial offer for programming testing only. It does not entitle you to a valid subscription and is intended purely for testing purposes. Please do not follow this process.

This is a trial offer for programming testing only. It does not entitle you to a valid subscription and is intended purely for testing purposes. Please do not follow this process.

tab ZKG KOMBI Study test

This is a trial offer for programming testing only. It does not entitle you to a valid subscription and is intended purely for testing purposes. Please do not follow this process.

This is a trial offer for programming testing only. It does not entitle you to a valid subscription and is intended purely for testing purposes. Please do not follow this process.