Cautious expectations for the year 2009

The German cement industry is sceptical about the prospects for the cement sector during the coming year. However, according to an evaluation by the cement manufacturers, the measures taken so far by the government offer an opportunity to mitigate the business downturn that is emerging as a consequence of the global crisis in the financial markets. “There is potential, in particular for the building trade and the building materials industry. To use this may contribute to coming to grips with the overall economic problems,” said Dr. Martin Schneider (Fig.), General Manager of the Federal...

The German cement industry is sceptical about the prospects for the cement sector during the coming year. However, according to an evaluation by the cement manufacturers, the measures taken so far by the government offer an opportunity to mitigate the business downturn that is emerging as a consequence of the global crisis in the financial markets. “There is potential, in particular for the building trade and the building materials industry. To use this may contribute to coming to grips with the overall economic problems,” said Dr. Martin Schneider (Fig.), General Manager of the Federal German Association of the Cement Industry (BDZ). “We all expect that the intended measures to stimulate business at national and European level are appropriate for the mitigation of the consequences of the global crisis.” However, the strongly increasing costs of energy and the future development of emissions trading worry cement manufacturers. To ensure the competitiveness of the branch, it is of special importance that the position of the federal government should gain acceptance during the negotiations in Brussels. According to this, the cement industry and other CO2-intensive industries would fulfil the criteria to be permanently exempted from the obligation to buy CO2 emissions rights at auction.

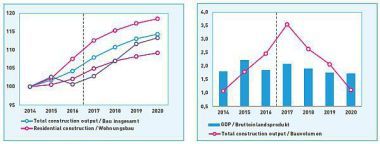

In view of the financial crisis, which was not foreseeable at the beginning of the year, the branch has revised its original prognosis for domestic cement consumption in 2008 from plus 5 % to an increase of only 1 to 2 %. For the next year, however, the cement industry expects a drop in cement consumption by 3 to 4 % compared to this year. Presumably this trend will become established in the second half of 2009.

According to the expectations of the BDZ, developments in the three central building sectors will again differ. For residential construction the industry assumes that the demand for cement will decline further in 2008. After the activities in this sector had already reached a new low in 2007, the permits for private homes in the first nine months of 2008 once again dropped by almost 4 % compared to the figure for the previous year. The reasons for this development are a reduced willingness of potential builder/owners to invest. In addition to this is the fact that during the period from 2000 to 2015, the percentage of the total population in the 26 to 45-year-old age group, which is especially important for home building, will decline from 31 to 25 %, i. e. absolutely by 5.3 million.

On the other hand, the positive trend in non-residential construction, which in the meantime has become the most important demand segment of the cement industry, is encouraging. Almost 40 % of the entire cement consumption is allotted to this market segment, while residential construction has dropped to 25 %. The permits for non-residential construction this year up to and including September with an increase of almost 14 % are clearly above the volume for last year. The developments as regards office and administration buildings deserve particular mention. After extensive reduction of the excess capacities, which existed for many years, the demand has again increased strongly in this sector. However, the development of incoming orders recently remained below the building permits. It is difficult to predict to what extent planned buildings will only be delayed or not carried out at all. Nevertheless, the BDZ expects positive growth effects as regards the demand for cement in the building sector in 2008. According to the current state of affairs, the rather cautious willingness of the companies to invest could lead to a downward trend in demand.

The cement industry expects a positive impetus, in particular from civil engineering to mitigate the downward business trend. Due to the planned increase in capital expenditure by the federal government for the infrastructure for motorways and major roads amounting to 1 billion Euro in 2009 and 2010, numerous developed projects could now be implemented. The BDZ advocates that capital expenditure for the infrastructure should be increased in view of the worsening situation regarding bottlenecks in the road freight transport of goods, in particular during a slowing economy, so as to avoid the logistics location Germany becoming a stumbling block to future economic growth.

Überschrift Bezahlschranke (EN)

tab ZKG KOMBI EN

This is a trial offer for programming testing only. It does not entitle you to a valid subscription and is intended purely for testing purposes. Please do not follow this process.

This is a trial offer for programming testing only. It does not entitle you to a valid subscription and is intended purely for testing purposes. Please do not follow this process.

tab ZKG KOMBI Study test

This is a trial offer for programming testing only. It does not entitle you to a valid subscription and is intended purely for testing purposes. Please do not follow this process.

This is a trial offer for programming testing only. It does not entitle you to a valid subscription and is intended purely for testing purposes. Please do not follow this process.