European construction equipment sector is picking up

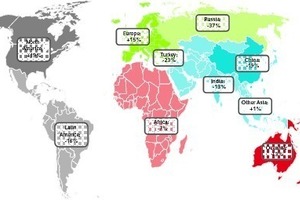

Although some regions of the worldwide construction equipment market are still slowing down – Russia, Turkey, China, South America, India, Africa – the good news is that figures are showing that Europe and North America are picking up. At the Intermat in Paris, CECE published its latest report.

1 Introduction

According to the European Construction Equipment Association (CECE), based in Brussels/Belgium the situation is clear: It’s a mixed market environment but with definite signs of recovery in the European construction industry. Under these signs the Intermat, the international exhibition for construction equipment and building technologies, took place at Villepinte near Paris, France from 20.-25.04.2015. “CECE is proud to see the sector showcasing its excellence at the Paris fair, demonstrating its readiness for new markets and opportunities”, said Eric Lepine, President of CECE at...

1 Introduction

According to the European Construction Equipment Association (CECE), based in Brussels/Belgium the situation is clear: It’s a mixed market environment but with definite signs of recovery in the European construction industry. Under these signs the Intermat, the international exhibition for construction equipment and building technologies, took place at Villepinte near Paris, France from 20.-25.04.2015. “CECE is proud to see the sector showcasing its excellence at the Paris fair, demonstrating its readiness for new markets and opportunities”, said Eric Lepine, President of CECE at the trade show.

2 US-market

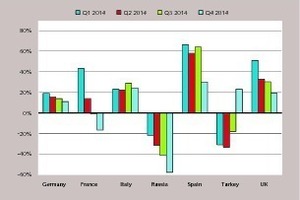

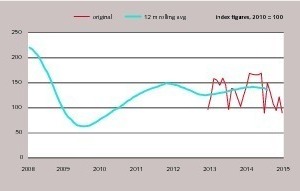

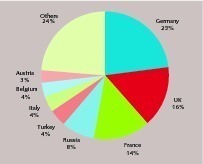

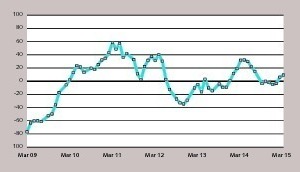

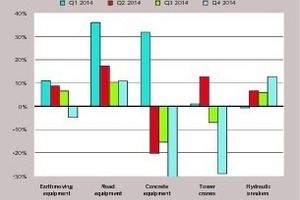

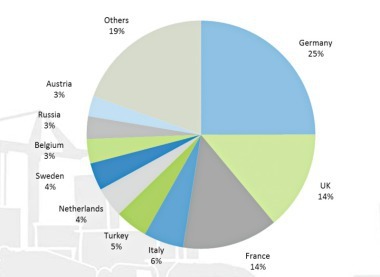

“There are still uncertainties in different regions of the world and particularly in Europe, but the good news is that the figures are showing that Europe is picking up”, Lepine continued (Figures 1-6). In 2014, the European construction equipment industry was already back to significant growth, albeit coming from low levels. For 2015, CECE is forecasting that the level of 2014 is to be maintained as further growth is mainly expected to come from hard-hit markets like Spain, Portugal or Italy whereas matured markets like UK, Germany or the Scandinavian countries which already experienced robust growth in 2014, will likely remain stable.

The outlook for France, one of the biggest construction markets in Europe, is also rather gloomy for 2015. Investments there have almost come to a standstill; rental companies which belong to the industry’s major customer groups, do not show any promising signs of buying activities.

“Looking at the longer term, 2016 should see a continued slow recovery of our industry in Europe”, predicted Eric Lepine. The construction equipment sector is still showing a huge disparity between several European countries, but CECE believes that the gap is not getting bigger”, he said. On global terms, the bright spot for the industry is North America. As Europe is an important supplier to the USA, several companies should benefit from the positive market development.

3 Emissions – Stage V regulation

Eric Lepine emphasized that the construction equipment sector is an important industry for the European economy. To maintain this and to make their contribution in building a competitive and modern Europe, also in terms of technological know-how, the industry needs legislation that works. He referred in particular to the EU emissions legislation’s stage V which is about to come in the near future and will be the strictest exhaust emissions regulation in the world. The respective directive 97/68/EC is still under revision in parliament and council.

However, Lepine pointed out that the industry has delivered significant improvements in the last few years. The construction equipment industry already produces the cleanest and safest machinery in the world and is committed to further support the legislator in this field. In order to do that, the industry needs the support of the legislator. “We need the regulation to be approved by the end of 2015, otherwise our industry will not have the time to implement all the necessary changes in the engine and the machines to comply with these new very stringent emissions standards” he said. Also, an appropriate replacement engines provision should be inserted in the new legislation. Furthermore, CECE is requesting the legislation’s transition period to be extended by six months.

CECE also sees the need for global alignment. An estimated 75 % of the world however, is only at stage IIIA and below. As the global market for highly-regulated products is still quite small, Europe cannot afford to deviate too much from the requirements in other ambitious nations in this field. CECE thus urges the EU to maintain alignment in standards and limits with other regions, notably with the US, and actively promote worldwide alignment.

4 TTIP helps to secure free trade

This is also why CECE sees TTIP, the Transatlantic Trade and Investment Partnership, as a great opportunity for the European economy. “We support TTIP because we are for free trade and we need cooperation and harmonization in all markets”, Lepine pointed out. There are still tariffs that are an obstacle for free trade, like different emissions regulations, international standards like machine safety or labelling, different test procedures or access of companies to public procurement.

Regulatory cooperation is by far the most important point: “When regulations are recognized on both sides we will have harmonization in the end”, the CECE-President said. And, advanced markets should be aligned. If they set common standards together they form a bigger block towards other regions and will set the pace and the standards. Free trade on both sides of the Atlantic would foster competitiveness of the industries on a global scale.

5 Joined forces

A major obstacle for free trade on the European Internal Market remains the problem of non-compliant machines coming to Europe. According to a CECE survey, one out of three companies is facing a loss of sales due to this. “A good market surveillance system enables a shift from unfair price competition between machines that are not complying with same standards to a fair competition based on quality amongst machines that are compliant”, said Lepine. As resources on market surveillance are low in the member states, EU legislation must be enforced and policed.

This is why CECE keeps on calling on the European Commission to keep the issue on the agenda and to improve market surveillance legislation and enforcement. The association works on the market surveillance topic in a rather practical way directly in the construction sector by carrying out inspections at trade shows and auctions or by providing information about dangers and risks when buying non-compliant machines.

CECE has also started an initiative to call on rental companies and operators to form a joint force.

Überschrift Bezahlschranke (EN)

tab ZKG KOMBI EN

This is a trial offer for programming testing only. It does not entitle you to a valid subscription and is intended purely for testing purposes. Please do not follow this process.

This is a trial offer for programming testing only. It does not entitle you to a valid subscription and is intended purely for testing purposes. Please do not follow this process.

tab ZKG KOMBI Study test

This is a trial offer for programming testing only. It does not entitle you to a valid subscription and is intended purely for testing purposes. Please do not follow this process.

This is a trial offer for programming testing only. It does not entitle you to a valid subscription and is intended purely for testing purposes. Please do not follow this process.